India Stack: As India Promotes Digital Economy At 2022 G20, Here’s Everything You Need To Know About World’s Largest Open API

India Stack is “revolutionising access to finance”, as per the International Monetary Fund (IMF).

The 2022 G20 summit is underway in Bali with this year’s theme: ‘Recover Together, Recover Stronger’. Under this umbrella, leaders from member nations are discussing three main priorities: sustainable energy transformations, global health architecture, and digital transformations. As part of the last topic, India is looking to promote its ambitious unified software project, referred to as India Stack. Owing to the nearly 140-crore population of the country, India Stack is easily the largest open application programming interface (API) in the world. In this article, we will try and understand what India Stack is, and its current status.

What is API?

Before we dive into India Stack, let’s first try and understand what an API is.

To put it simply, an API is a process that helps two or more apps (computer programs) communicate with each other.

Let’s simplify this further. When you are using an app, like Facebook or Instagram, or even your personal banking app, you are interacting with a user interface which is connecting you, a human, to a computer program.

An API, on the other hand, connects apps or software to each other. There is no human interaction involved here, except for the programmer writing the codes or maintaining operations. An API is a set of requirements that define how one app can communicate with another.

ALSO READ: Crypto Regulation To Be A Priority For India At G20 Summit: What To Expect

How do APIs matter to you?

Let’s take a real-life use case to understand this.

Suppose you want to check the current weather in Mumbai on your phone. To do this, you will go to your weather app and look up “Mumbai, Maharashtra” and the current weather conditions will be displayed to you. While you do this, a lot of processes are taking place in the backend. These involve taking your data input and sending it to an online server, which then retrieves the data, interprets it, and does whatever is necessary to send the requested information back to your phone — all in the blink of an eye. API handles all these.

An open API is made publicly available to software developers for easy access, implementation, and further development.

What is India Stack?

As per the official website of India Stack, it “is the moniker for a set of open APIs and digital public goods that aim to unlock the economic primitives of identity, data, and payments at population scale.”

Designed to help promote financial and social inclusion — and prepare India for the “Internet Age” — India Stack can be applied to any nation.

Why is it called ‘India Stack’?

While the ‘India’ part of the moniker is self-explanatory, the ‘Stack’ bit is quite interesting.

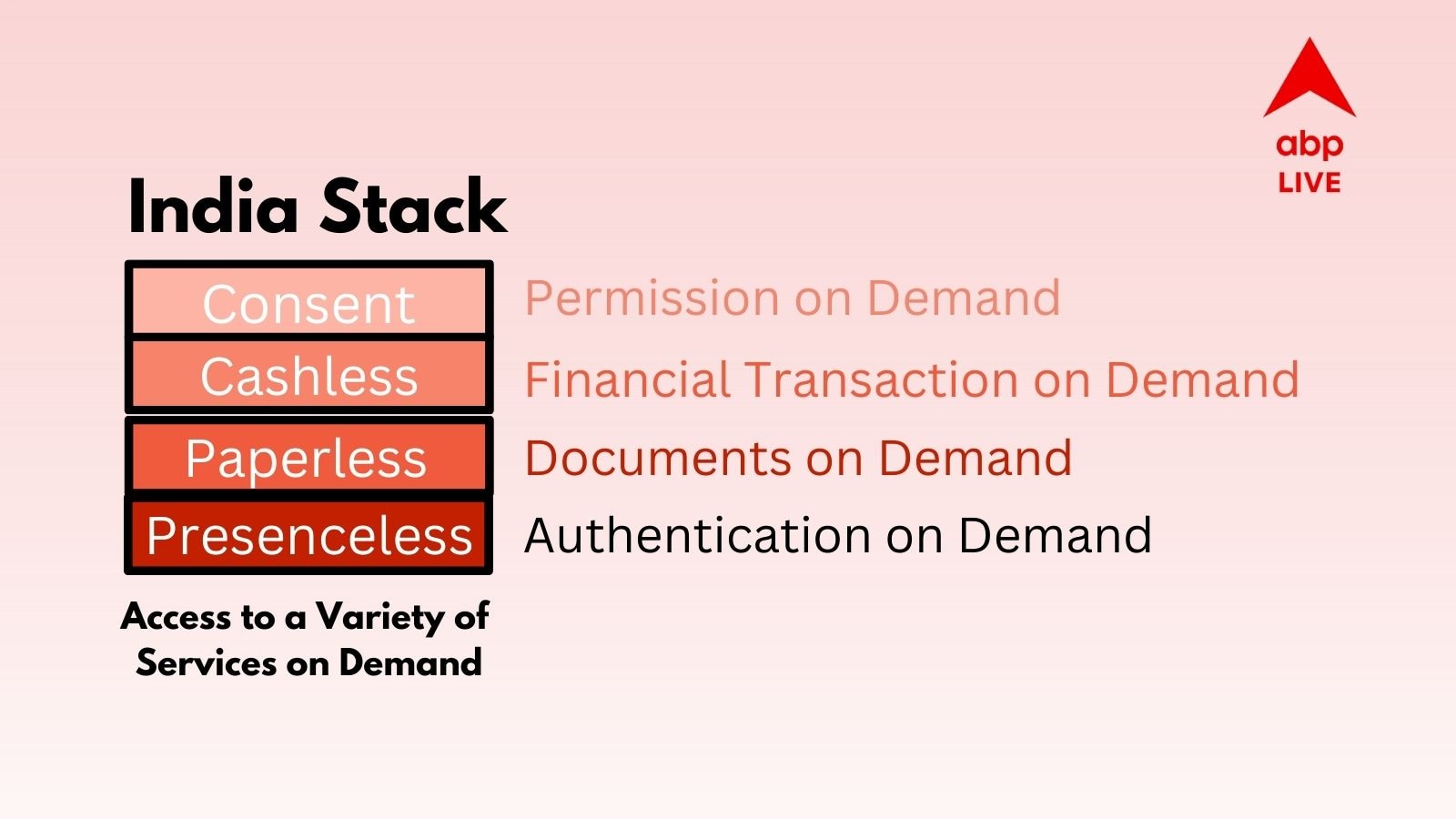

The open API project is divided into four layers — Presenceless, Paperless, Cashless, and Consent — stacked on top of one another from the bottom.

The Presenceless layer offers users the ability to be authenticated from anywhere. India’s unique ID — Aadhaar — is an example. Your Aadhaar ID enables you to provide ID proof anywhere, anytime, without having the need to carry physical documentation with you all the time. Since this involves storing biometric data, its safety and being prone to digital hacks (and eventual fraudulent use) is a primary concern.

The Paperless layer refers to reliance on digital records. Aadhaar, eKYC, and DigiLocker are part of this layer. This layer helps in the quick authentication of digital documents anytime, anywhere.

The Cashless layer, as the name suggests, helps universalise the access and usage of digital payments. The Unified Payments Interface (UPI), handled by the National Payments Corporation of India (NPCI), saw a boost in usage during and after the Covid-induced pandemic. As per an NPCI newsletter, “The objective of this layer is to move things into the digital age, payments, and financial transactions need to go cashless, enabling transparency and ease of use Unified Payment Interface plays a key role in this layer with it API-enabled ecosystem.” The recently launched Digital Rupee pilot by the Reserve Bank of India (RBI) is expected to fortify this layer and its functionality.

ALSO SEE: Digital Rupee: RBI Commences e₹ Pilot. Here Are All Your CBDC FAQs Answered

Finally, the Consent layer is understandably the most important, as it helps users authenticate their own data to be moved between APIs as needed. “The electronic consent architecture enables user-controlled data sharing, data flow, and data retention. This layer allows data to move freely and securely to democratise the market for data,” the NPCI newsletter explained.

When was India Stack first implemented?

The first instance of India Stack’s implementation can be traced back to 2009 when India first formed the Unique ID Authority of India (UIDAI) and issued the first Aadhaar Card in 2010. It was then followed up in later years with the implementation of eKYC, eSignature, UPI, and DigiLocker.

What’s the current status of India Stack? What can other countries learn from this?

As per the official India Stack website, a total of 67 billion digital identity verifications have been made so far. A total value of Rs 5.47 trillion has been transacted in monthly real-time mobile payments, with a total volume of 2.8 billion.

As of 2021, UPI monthly transaction volume has crossed 4 billion, and the Account Aggregator framework has gone live with eight banks.

The International Monetary Fund (IMF) said that India Stack is “revolutionising access to finance”. “The India Stack is widening access to financial services in an economy where retail transactions are heavily cash-based,” the IMF wrote in a paper. “The expansion of digital payments, facilitated by the stack, is an important driver of economic development in India and has helped stabilize incomes in rural areas and boost sales for firms in the informal sector. Other emerging markets and developing economies could learn from the experience.”