Explorer

Paytm Chief hits back at Kejriwal for attacking PM & Paytm

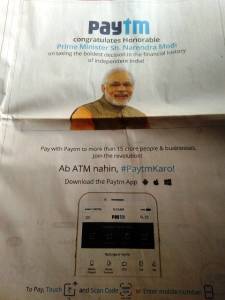

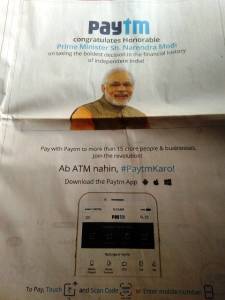

New Delhi: Founder of Paytm, Vijay Shekhar in a befitting reply to Arvind Kejriwal's recent tweet came forward in support of what can be called as Modi government's biggest move against corruption. The Delhi Chief Minister who has had a record of attacking Prime Minister Narendra Modi, in a series of tweets, alleged on Thursday that Paytm, a mobile payment entity and commerce platform, has become the biggest beneficiary of PM Modi’s announcement.  Paytm Ad Even as citizens across the country went into a panic mode following the announcement, Paytm — that has a current user base of 150 million — jumped at the idea and issued full page advertisements asking people to go “cash free”. It added that its platform saw a whopping 435 per cent increase in overall traffic, 200 per cent hike in number of app downloads and 250 per cent surge in number of overall transactions and transaction value — all within hours of the decision being made public. According to industry estimates, cash still accounts for over 78 per cent of all consumer payments done in India. While the government has been taking steps to move towards a digital economy, the current move is expected to accelerate the transition. Another player MobiKwik said it has witnessed over 40 per cent increase in download of its within less than 18 hours of the announcement, while user traffic and merchant queries went up by 200 per cent among its over 35 million users. This has prompted the company to revise its business targets to now achieving a GMV of USD 10 billion by 2017. Oxigen Wallet said it had witnessed significant increase in the load money transactions by upto 40-45 per cent during the first half of the day. “The average ticket size is also expected to jump by 50 per cent going forward. All this because people will become more comfortable to adopt digital wallets for their cashless transactions,” Oxigen Services India Deputy Managing Director Sunil Kulkarni said. Industry watchers said mobile wallet companies are also expected to benefit further from transactions on e-commerce platforms. Amazon and Paytm has halted cash on delivery transactions on its platform, while players like Flipkart and Snapdeal have limited the CoD transaction to Rs 1,000 and Rs 2,000, respectively. Taxi aggregator Uber has advised its users to switch to digital payment options like credit/debit cards or mobile wallet to pay for rides as their driver-partners may not accept Rs 500 or Rs 1,000 notes for cash trips. (With additional information from PTI)

Paytm Ad Even as citizens across the country went into a panic mode following the announcement, Paytm — that has a current user base of 150 million — jumped at the idea and issued full page advertisements asking people to go “cash free”. It added that its platform saw a whopping 435 per cent increase in overall traffic, 200 per cent hike in number of app downloads and 250 per cent surge in number of overall transactions and transaction value — all within hours of the decision being made public. According to industry estimates, cash still accounts for over 78 per cent of all consumer payments done in India. While the government has been taking steps to move towards a digital economy, the current move is expected to accelerate the transition. Another player MobiKwik said it has witnessed over 40 per cent increase in download of its within less than 18 hours of the announcement, while user traffic and merchant queries went up by 200 per cent among its over 35 million users. This has prompted the company to revise its business targets to now achieving a GMV of USD 10 billion by 2017. Oxigen Wallet said it had witnessed significant increase in the load money transactions by upto 40-45 per cent during the first half of the day. “The average ticket size is also expected to jump by 50 per cent going forward. All this because people will become more comfortable to adopt digital wallets for their cashless transactions,” Oxigen Services India Deputy Managing Director Sunil Kulkarni said. Industry watchers said mobile wallet companies are also expected to benefit further from transactions on e-commerce platforms. Amazon and Paytm has halted cash on delivery transactions on its platform, while players like Flipkart and Snapdeal have limited the CoD transaction to Rs 1,000 and Rs 2,000, respectively. Taxi aggregator Uber has advised its users to switch to digital payment options like credit/debit cards or mobile wallet to pay for rides as their driver-partners may not accept Rs 500 or Rs 1,000 notes for cash trips. (With additional information from PTI)

Reacting to Kejriwal's tweet, the Paytm founder CEO said that the fact that a recent government scheme benefits several companies cannot be seen as an indication of corruption. Paytm is only a tech startup that aims to solve financial inclusion.Paytm biggest beneficiary of PM's announcement. Next day PM appears in its ads. Whats the deal, Mr PM? https://t.co/lfP0PrQICQ

— Arvind Kejriwal (@ArvindKejriwal) November 10, 2016

Dear Sir, The biggest beneficiary is our country. We are just a tech startup, trying to solve financial inclusion & make India proud. #???????? https://t.co/3rI8r6W0EZ — Vijay Shekhar (@vijayshekhar) November 10, 2016The government’s decision to demonetise Rs 500 and Rs 1,000 notes has come as a shot in arm for mobile wallet companies like Paytm, Freecharge and Mobikwik that now expect to see a strong pick up in userbase as well as transaction sizes. Apparently, all this started ever since there have been Paytm ads on front pages of national newspapers which have thanked PM Modi “on taking the boldest decision in the financial history of independent India!”

Paytm Ad Even as citizens across the country went into a panic mode following the announcement, Paytm — that has a current user base of 150 million — jumped at the idea and issued full page advertisements asking people to go “cash free”. It added that its platform saw a whopping 435 per cent increase in overall traffic, 200 per cent hike in number of app downloads and 250 per cent surge in number of overall transactions and transaction value — all within hours of the decision being made public. According to industry estimates, cash still accounts for over 78 per cent of all consumer payments done in India. While the government has been taking steps to move towards a digital economy, the current move is expected to accelerate the transition. Another player MobiKwik said it has witnessed over 40 per cent increase in download of its within less than 18 hours of the announcement, while user traffic and merchant queries went up by 200 per cent among its over 35 million users. This has prompted the company to revise its business targets to now achieving a GMV of USD 10 billion by 2017. Oxigen Wallet said it had witnessed significant increase in the load money transactions by upto 40-45 per cent during the first half of the day. “The average ticket size is also expected to jump by 50 per cent going forward. All this because people will become more comfortable to adopt digital wallets for their cashless transactions,” Oxigen Services India Deputy Managing Director Sunil Kulkarni said. Industry watchers said mobile wallet companies are also expected to benefit further from transactions on e-commerce platforms. Amazon and Paytm has halted cash on delivery transactions on its platform, while players like Flipkart and Snapdeal have limited the CoD transaction to Rs 1,000 and Rs 2,000, respectively. Taxi aggregator Uber has advised its users to switch to digital payment options like credit/debit cards or mobile wallet to pay for rides as their driver-partners may not accept Rs 500 or Rs 1,000 notes for cash trips. (With additional information from PTI)

Paytm Ad Even as citizens across the country went into a panic mode following the announcement, Paytm — that has a current user base of 150 million — jumped at the idea and issued full page advertisements asking people to go “cash free”. It added that its platform saw a whopping 435 per cent increase in overall traffic, 200 per cent hike in number of app downloads and 250 per cent surge in number of overall transactions and transaction value — all within hours of the decision being made public. According to industry estimates, cash still accounts for over 78 per cent of all consumer payments done in India. While the government has been taking steps to move towards a digital economy, the current move is expected to accelerate the transition. Another player MobiKwik said it has witnessed over 40 per cent increase in download of its within less than 18 hours of the announcement, while user traffic and merchant queries went up by 200 per cent among its over 35 million users. This has prompted the company to revise its business targets to now achieving a GMV of USD 10 billion by 2017. Oxigen Wallet said it had witnessed significant increase in the load money transactions by upto 40-45 per cent during the first half of the day. “The average ticket size is also expected to jump by 50 per cent going forward. All this because people will become more comfortable to adopt digital wallets for their cashless transactions,” Oxigen Services India Deputy Managing Director Sunil Kulkarni said. Industry watchers said mobile wallet companies are also expected to benefit further from transactions on e-commerce platforms. Amazon and Paytm has halted cash on delivery transactions on its platform, while players like Flipkart and Snapdeal have limited the CoD transaction to Rs 1,000 and Rs 2,000, respectively. Taxi aggregator Uber has advised its users to switch to digital payment options like credit/debit cards or mobile wallet to pay for rides as their driver-partners may not accept Rs 500 or Rs 1,000 notes for cash trips. (With additional information from PTI) Related Video

Breaking News: Israel Intensifies Strikes on Iran’s Missile Launchers

Ashutosh Kumar Thakur

Opinion