‘Adani Or Ambani?’, ‘Credibility Lost’: Hindenburg Tweet Has Kept Social Media Abuzz

US-based short-seller Hindenburg Research's cryptic social media post has stirred up speculation in India. Accused of misleading investors, the firm's announcement follows its previous controversial report on the Adani Group.

In a cryptic post on the social media platform X, US-based short-seller Hindenburg Research hinted at "something big soon India," prompting a wave of responses that criticised the firm for potentially misleading investors. The post has ignited widespread speculation, with many questioning whether the short-seller is once again aiming to disrupt the Indian market.

Hindenburg Research is known for its sensational style of reporting, which contrasts with the more traditional analyses conducted by other research bodies. Last year, the firm released a controversial report accusing the Adani Group of orchestrating "the largest con in corporate history." This led to a massive selloff, wiping out over $100 billion in the group's market value and pushing Gautam Adani out of the top ten richest individuals globally.

Reacting to the latest tweet, X user Devansh Gupta criticised Hindenburg, stating, "[Hindenburg’s] credibility is out of the window. India won’t care."

Credibility is out of the window. India won't care

— Devansh gupta (@devgupta1351) August 10, 2024

In a more humorous response, Tharavadikal urged the short-seller to wait for two weeks so they could close their current market positions before shorting the market.

@HindenburgRes can u plse wait for 2 more weeks . Need to close my positions and need to short market. It will be great help 💰 🤑 💸

— Tharavadikal (@JoeDavi52353628) August 10, 2024

CA Manish Savalkar called on investors to demonstrate that the power of Domestic Institutional Investors (DIIs) outweighs that of Foreign Institutional Investors (FIIs) in the Indian market. He also suggested that the short-seller's actions are part of a broader strategy targeting India's neighbouring countries.

All Indian neighbours country targeted .. now they are aiming us.. be strong and show the power of DII much higher than FII

— CA Manish Savalkar (@Manish10496683) August 10, 2024

X user Madhusudhan opined, "Adani done.. Ambani next? The Indian investors have become lil smarter though since the earlier takedown of Adani. Less likely to react impulsively without a well substantiated research."

Adani done.. Ambani next?

— Madhusudhan ML (@ml_madhusudhan) August 10, 2024

The Indian investors have become lil smarter though since the earlier takedown of Adani. Less likely to react impulsively without a well substantiated research.

Another netizen quipped, "Ab iski report mat niklana ki Ambani ki shadi me 5000 cr kaha kharch huie Aur rahul gandhi pizza kyu kha rahe the? (Now don't publish reports on where Rs 5,000 crore were spent on Ambani's wedding and why Rahul Gandhi was eating pizza?)"

Ab iski report mat niklana ki Ambani ki shadi me 5000 cr kaha kharch huie

— Taksh Diyora (@taksh_diyora) August 10, 2024

Aur rahul gandhi pizza kyu kha rahe the? https://t.co/VPrV4Vk8VQ

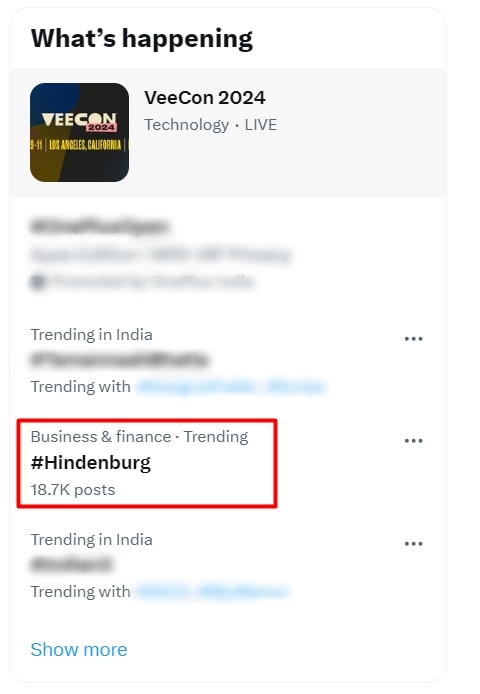

The #Hindenburg hashtag on X has got over 18 thousand posts enabling it to feature in the trending section. The tweet alone has attracted over 7.4 million views.

As the chatter grows, CA Vinay Sharma on LinkedIn accused the short-seller of doing a "hitman" type of job and said that the post tries to create panic but won't be able to inflict damage this time. He posted, "The latest tweet by Hindenburg looks more like a "contract killing/ hitman" type of job than a research institute. No credible research institute would ever try to create panic among the investors. Clearly some ulterior motives trying to create panic and take profits. Fortunately this time most of the people are aware about its dirty game and Indian markets have become stronger. Hence not much damage is expected."

ALSO READ | SEBI Issues 'Show Cause' Notice To Hindenburg Research For Report On Adani Group, Short-Seller Responds

Hindenburg-Adani Row

Hindenburg's previous report on the Adani Group had far-reaching consequences, including the cancellation of the company's flagship Rs 20,000 crore follow-on public offer. The Adani Group has consistently denied the allegations, and a Supreme Court-backed report from SEBI (Securities and Exchange Board of India) found no evidence of wrongdoing. However, Hindenburg recently criticised SEBI, accusing it of protecting Kotak Mahindra Bank group entity, Kotak Mahindra Investments, which allegedly set up an offshore trading account used by US-based businessman Mark Kingdon to maintain a short position against Adani Group shares.

As social media buzzes with speculation, it remains to be seen whether Hindenburg's latest teaser will have a similar impact on the Indian market.