Why MUTM Is the Best Cheap Crypto to Buy Over DOGE and XRP

MUTM emerges as the top cheap crypto pick over DOGE and XRP, backed by real utility, lending features, stablecoin integration, buybacks, and a fast-selling presale entering its next phase.

The crypto market is entering a phase where retail rotation and late-cycle bargain hunting are creating unique opportunities. Investors are searching for cheap tokens that offer asymmetric upside. Mutuum Finance (MUTM) is emerging as a standout choice. Unlike Dogecoin (DOGE) and XRP, which rely on social momentum or payment rails, MUTM delivers real product utility. Its lending and borrowing platform, stablecoin mechanism, buyback program, and staking rewards make it a token with built-in demand. For those seeking value and growth in affordable cryptocurrencies, MUTM presents a compelling case.

With the presale in full swing, early adopters are seeing momentum that few other cheap cryptos can match. MUTM combines utility with a clear growth trajectory. This article highlights why it is a better buy than DOGE and XRP, backed by presale data, platform features, and numerical examples.

Dogecoin (DOGE)

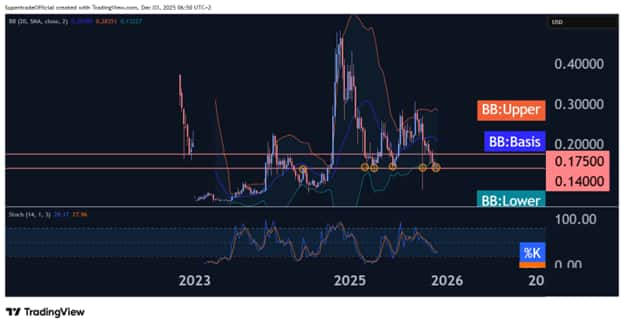

DOGE is well-known for its retail-driven hype and liquidity. It enjoys a strong social presence and active trading volumes. However, DOGE lacks native lending primitives, stablecoin integration, and protocol-driven transaction demand. Its value largely comes from community engagement rather than recurring on-chain activity. Holder distribution and the absence of systematic buybacks limit structural demand, making DOGE less efficient for long-term utility compared to MUTM. Additionally these are mixed analyses regarding DOGE and most of the analysts are currently bearish for DOGE in the daily timeframes.

XRP

XRP focuses on payment rails, settlement speed, and institutional use. While it offers fast transaction capabilities and has navigated regulatory hurdles, its utility is mostly tied to off-chain integrations and specific financial applications. XRP’s demand depends on adoption by financial institutions and legal outcomes, whereas MUTM drives repeated, protocol-based transactions that create a sustainable ecosystem for investors.

This is a reactive structural classification of XRP based on the weekly chart as of this timestamp. Price conditions are evaluated as they stand — nothing here is predictive or forward-assumptive.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is gaining rapid attention. The total planned supply is 4B tokens, with about $19.30 million raised across all presale phases. The current price stands at $0.035, with over 18,400 holders already participating from all phases. Phase 6 is almost complete, with 97% of the 170M tokens sold. The next phase will see a 15% price jump to $0.040. For investors assistance Card purchases are now enabled with no limits, making it easier for investors to join. Phase 6 at $0.035 is nearly gone — last chance before a 15% jump.

Mutuum Finance (MUTM) is a lending and borrowing protocol built for real utility. Users deposit assets and receive mtTokens, which grow with interest and can act as collateral. Borrowers take loans using overcollateralized positions. The V1 of the protocol is expected to launch on the Sepolia Testnet in Q4 2025, initially supporting ETH and USDT as lending, borrowing and collateral purposes. This early version will activate the platform’s foundational components, including the liquidity pool, the mtToken and debt token systems, and an automated liquidator bot built to protect collateral and maintain protocol stability.

The platform will operate with dual lending models. P2C, or Peer-to-Contract, allows lenders to pool stablecoins and popular coins into audited smart contracts. Interest rates adjust based on pool utilization, and mtTokens grow as the pool earns interest. P2P, or Peer-to-Peer, focuses on riskier or less liquid tokens like PEPE, and DOGE. Lenders and borrowers negotiate terms directly, isolating core liquidity from volatile assets while offering higher returns.

Mutuum Finance (MUTM) implements overcollateralization to protect lenders. Stable-rate borrowing starts at a higher rate, with rebalancing if variable rates increase. Stable assets support higher Loan-to-Value ratios, allowing borrowers flexibility while maintaining system safety. This model combines predictable returns for lenders with secure borrowing options for users.

Core Features and Growth Drivers

$1 pegged stablecoin’s innovation anchors the ecosystem. The platform mints and burns tokens tied to loans. Issuers are permissioned and limited, and governance controls interest rates to keep the peg near $1. Overcollateralization and arbitrage maintain stability, making the stablecoin a reliable part of the system. Secondly, MUTMs buy-and-distribute mechanism drives recurring demand. Platform revenue buys MUTM tokens on the market and redistributes them to mtToken stakers. This creates ongoing incentives for users to hold and stake tokens while reinforcing the token’s value.

Expected simultaneous launch and listing provide immediate traction. The platform and token launch together, attracting exchanges with live utility. This strategy encourages on-chain activity from day one, giving MUTM a competitive advantage over tokens that launch before their product is functional.

Security is a top priority. Mutuum Finance (MUTM) contracts now undergo Halborn audits, while CertiK metrics highlight Token Scan and Skynet scores. A 50,000 USDT bug bounty rewards developers for finding issues, with tiered payouts for critical, major, medium, and low-severity bugs. Community engagement is strong as well, with an ongoing $100K giveaway, and daily $500 rewards for top-ranked users.

Consider an investor, who invested $8,000 in Phase 3 at $0.02, acquiring 400,000 MUTM tokens. The current price of $0.035 raises the portfolio value to $14,000, a 1.75× increase. With the token projected to reach $0.35, the same holdings would rise to $140,000, a 17.5× return from the original investment. These numbers illustrate the asymmetric upside that MUTM provides in the cheap crypto segment, far exceeding typical gains from DOGE or XRP over the same period.

MUTM’s advantage lies in its utility, product design, and recurring demand. Stablecoin mechanisms, buybacks, and staking generate continuous on-chain activity. DOGE relies on social momentum, and XRP depends on payment adoption. MUTM’s approach creates protocol-driven demand, offering consistent utility that reinforces token value. For retail and strategic investors, this makes MUTM a superior cheap crypto for both short-term gains and long-term participation.

Phase 6 of Mutuum Finance (MUTM) is 97% sold, with the next phase price rising to $0.040. The platform’s upcoming lending and borrowing utility, stablecoin integration, and buyback programs will provide real transaction demand, unlike DOGE or XRP. Early participation gives investors the advantage of acquiring tokens before the next price increase.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored article. ABP Network Pvt. Ltd. and/or ABP Live do not endorse/subscribe to its contents and/or views expressed herein. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.