Samsung Dethrones Xiaomi To Grab Top Position In India Smartphone Market After 20 Quarters: Canalys

Samsung pipped Xiaomi in India after 20 quarters to capture the top spot in the India smartphone market in Q4 of 2022 even as India’s overall smartphone shipments fell to 151.6 million units.

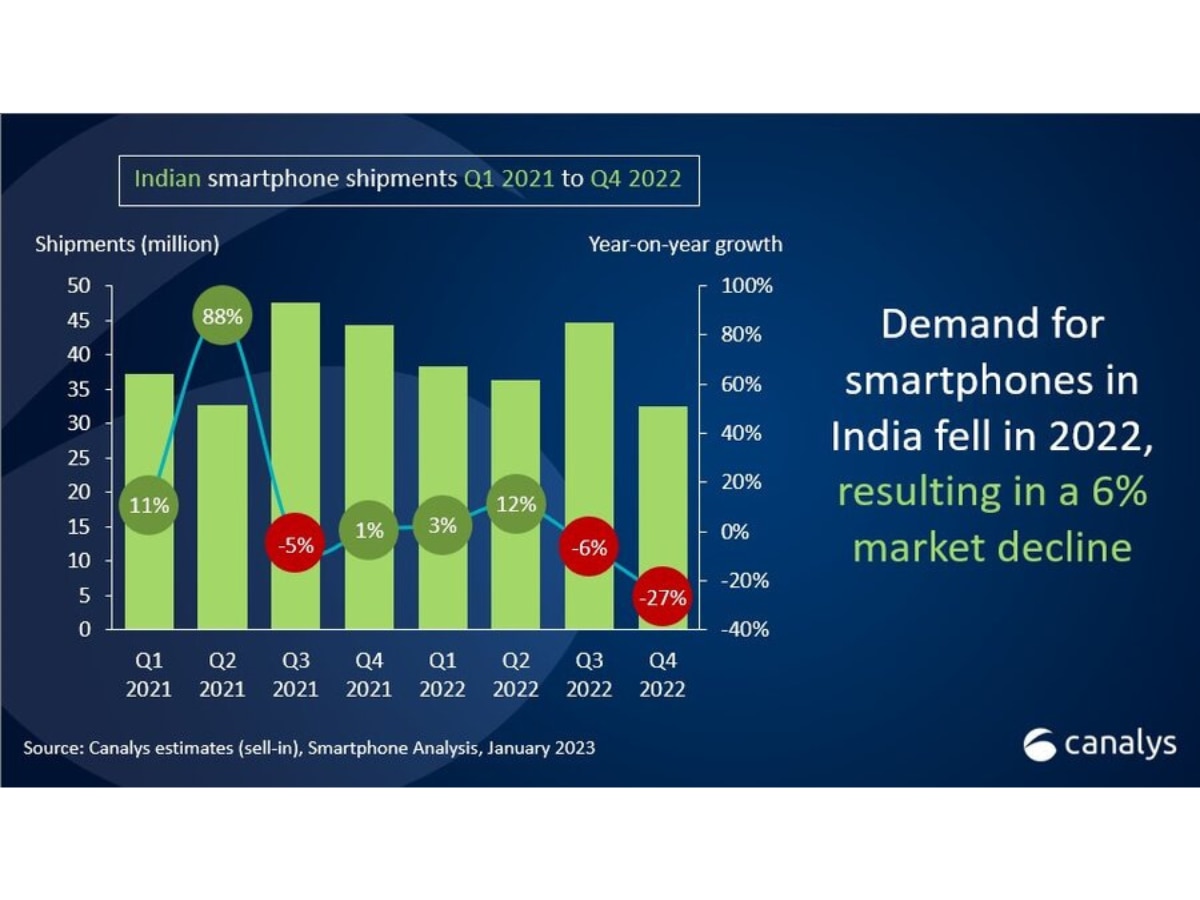

Samsung pipped Xiaomi in India after 20 quarters to capture the top spot in the India smartphone market in the fourth quarter (Q4) of 2022 even as India’s overall smartphone shipments fell to 151.6 million units in 2022, declining by 6 per cent compared with 2021, a report by market research firm Canalys said on Thursday.

Samsung grabbed the top spot in Q4 for the first time since Q3 2017 with a shipment of 6.7 million units and a market share of 21 per cent. After 20 quarters, Xiaomi lost its leadership position to Samsung and fell to third place with shipments of 5.5 million units. However, for a full-year, Xiaomi was still the number one smartphone player.

Also read: Twitter Blue Subscription Prices Discounted For These Countries. Check Details

Last year began with intermittent supply issues and low demand in the wake of the global macroeconomic headwinds. India’s smartphone market suffered its first-ever drop in shipments in the fourth-quarter holiday period, falling by 27 per cent to 32.4 million.

Also read: iPhone 15 Ultra's Price Leaked: Everything You Should Know

“India was better positioned to weather the global downturn than other markets. But domestic consumer spending cooled in the last few months of 2022,” Sanyam Chaurasia, Analyst at Canalys, said in a statement.

“Even during the festive season, the domestic market suffered a fall in transactions, retail spending and electronic imports. In 2022, consumers already had up-to-date technology that they had bought during the pandemic, thereby delaying further purchases. This led to smartphone brands struggling with inventory management because demand was subdued. Vendor channel management strategies became more important than ever. The mid-to-high-end segment performed well this year, which will further catalyse the upgrade cycle.”

Chinese handset maker Vivo got the second spot, which shipped 6.4 million units, mainly via offline channels, followed by Oppo in the fourth spot with a shipment of 5.4 million units.

Related Video

Apple creates a new record in iPhone sales after launch of iPhone 16 | ABP Paisa Live