Still Calculating Your Tax Under New Slabs? Three Questions About New Tax Regime Answered

The relief applies only to those who have opted for the new tax regime, it has sparked numerous questions about its real benefits. Here's a layman's explanation to help understand the changes.

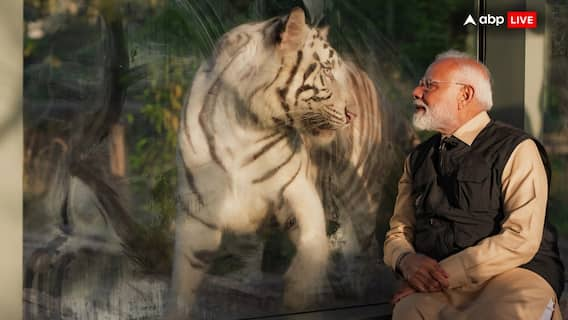

In her 8th consecutive Budget speech, Finance Minister Nirmala Sitharaman introduced significant changes to the Income Tax slabs, especially benefiting salaried individuals. As she announced that individuals with an income of up to Rs 12 lakh would not have to pay income tax under the new tax regime, the treasury side of Parliament erupted with chants of "Modi, Modi..." in support of the decision.

"This Government, under the leadership of Prime Minister Modi, has always believed in the admirable energy and ability of the middle class in nation-building. In recognition of their contribution, we have periodically reduced their tax burden," FM Sitharaman said, highlighting the government's commitment to easing the financial pressure on the middle class.

ALSO ON ABP LIVE | What Changes For You With New Income Tax Slabs? Check The Revised Rates In Budget 2025

While the relief applies only to those who have opted for the new tax regime, it has sparked numerous questions about its real benefits and how it will impact taxpayers. One can always consult a professional, a Chartered Accountant, to understand the tax liability but here's a layman's explanation of how it will help salaried individuals.

Question 1: Do I have to pay tax if my income is Rs 12 lakh and one rupee, and I am part of the new tax regime?

Answer 1: Yes, but not really! Let me explain. If your income exceeds Rs 12 lakh, even by a single rupee, you will fall under the income tax slab. The new revised tax slabs are as follows:

|

0-4 lakh rupees |

Nil |

|

4-8 lakh rupees |

5 per cent |

|

8-12 lakh rupees |

10 per cent |

|

12-16 lakh rupees |

15 per cent |

|

16-20 lakh rupees |

20 per cent |

|

20- 24 lakh rupees |

25 per cent |

|

Above 24 lakh rupees |

30 per cent |

If you earn Rs 12,00,001, your income will be taxed in the following manner:

- 5% on Rs 4,00,001 to Rs 8,00,000

- 10% on Rs 8,00,001 to Rs 12,00,000

- 15% on Rs 12,00,001

This would result in a tax liability of Rs 71,500. However, since you can claim a standard deduction of Rs 75,000, your tax liability would effectively become zero.

There's one more scenario to be considered for the above example that Finance Minister Sitharaman also mentioned in her Budget 2025 speech: "Marginal relief as provided earlier under the new tax regime is also applicable for income marginally higher than Rs 12,00,000."

Question 2: I am earning Rs 30 lakh per annum. How will this new tax regime help me? Am I getting any benefit?

Answer 2: Absolutely! The new tax regime introduces several new tax brackets that will lower your tax liability compared to the previous structure. In FY 2024-25, the highest tax rate of 30% applied to anyone earning above Rs 15 lakh. Now, the introduction of additional tax slabs will lower the tax burden, especially for higher-income groups.

|

Tax Slab FY 2024-25 |

Tax Rate |

|

Up to Rs 3 lakh |

NIL |

|

Rs 3 lakh - Rs 7 lakh |

5% |

|

Rs 7 lakh - Rs 10 lakh |

10% |

|

Rs 10 lakh - Rs 12 lakh |

15% |

|

Rs 12 lakh - Rs 15 lakh |

20% |

|

Above Rs 15 lakh |

30% |

The changes in the new tax regime will allow more people, especially those in the Rs 15 lakh-plus income group, to benefit from reduced rates and more tax-saving opportunities.

Question 3: I am earning Rs 20 lakh per annum, what benefit will I get?

Answer 3: You are in luck! Previously, individuals earning above Rs 15 lakh were subject to the highest 30% tax bracket, but under the new tax regime, you are now placed in the 20% tax bracket with significant relief on your tax liability. This provides you with more breaks and lowers the effective rate you pay compared to the previous structure.

While these changes offer considerable benefits, it's important to remember that for a more accurate and detailed tax computation, it's always advisable to consult a professional Chartered Accountant.

Trending News

Top Headlines