Benner Cycle Has Been Making 'Accurate' Market Prophecy For Over 100 Years. Here's How It Works

It has been claimed that the Benner cycle accurately predicted the ups and downs of the market for more than 100 plus years. Is it true? Let's find out.

Investors, however small or big, are always looking for the perfect asset, the perfect opportunity, and the perfect time to make a profit. However, in the current scenario where one crisis after another is grappling the market, it is hard to predict any of the recent movements. While some rely on analysts or investment gurus, others tend to pray.

There is another category of traders who use business cycles to make a prediction for a good time to invest in equity or other markets. One of those cycles is the ‘Benner Cycle’. It has been claimed that the Benner cycle accurately predicted the ups and downs of the market for more than 100 plus years. Even forecasting the great depression, WW2, the dot com bubble, and the COVID-19 pandemic market crash.

What Is Benner Cycle?

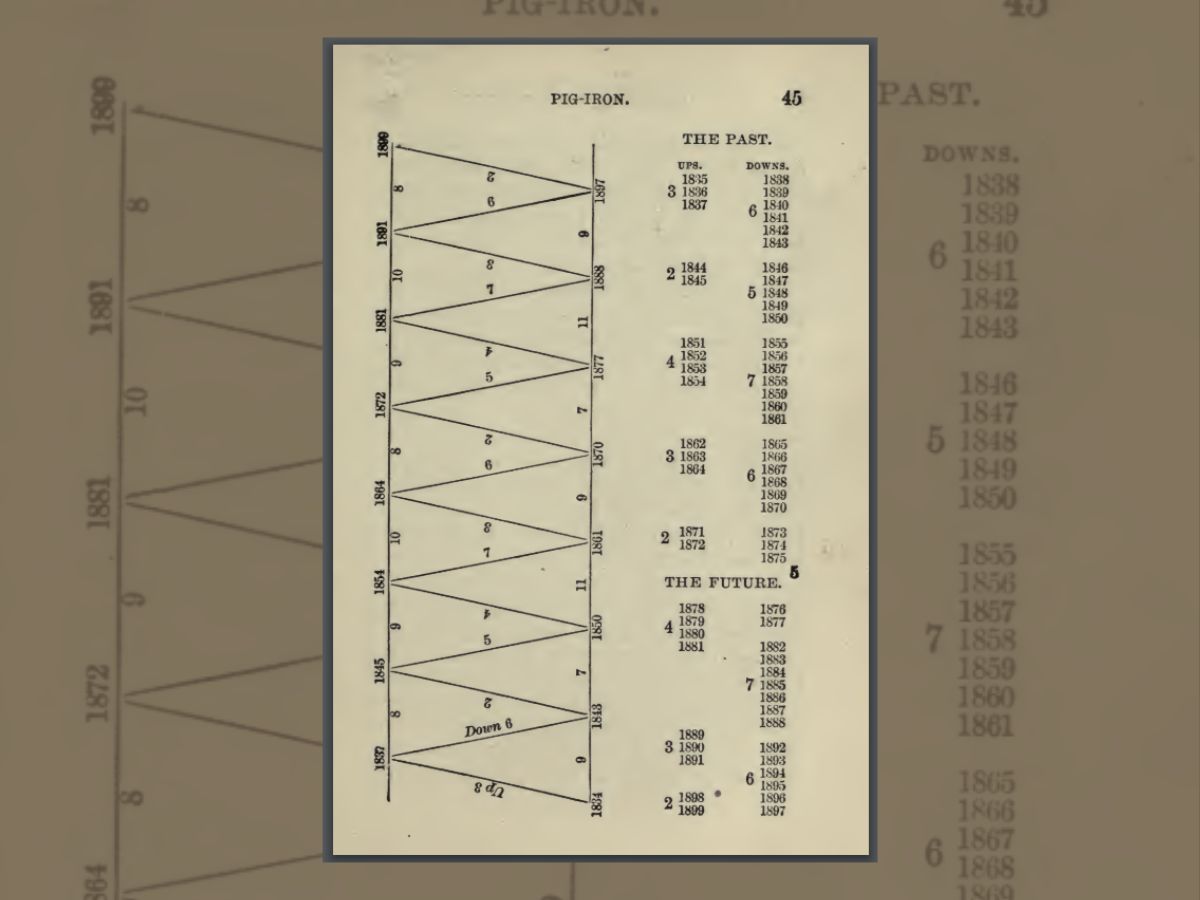

In 1875, Samuel Benner, an Ohio farmer, published a book called "Benners Prophecies: Future Ups And Down In Prices". The book had charts of prices of pig iron, corn, hogs, and cotton. As Benner said it was to inform others on how to make “money on pig iron, corn, hogs, and cotton.” Benner’s book had cycles making business and commodity price forecasts for 1876 -1904. It is said that Samuel Benner was a wealthy farmer who was wiped out financially by the 1873 panic. He discovered a high degree of cyclicality in his search for the reasons behind market changes.

Benner's three cycles consisted of:

- Corn and pig prices follow an 11-year cycle with peaks occurring every five and six years alternately.

- Cotton prices fluctuated in cycles with 11-year peaks.

- A 27-year cycle in the price of pig iron, with low points occurring every 11 and 9 years and peaks occurring every 8 and 10 years.

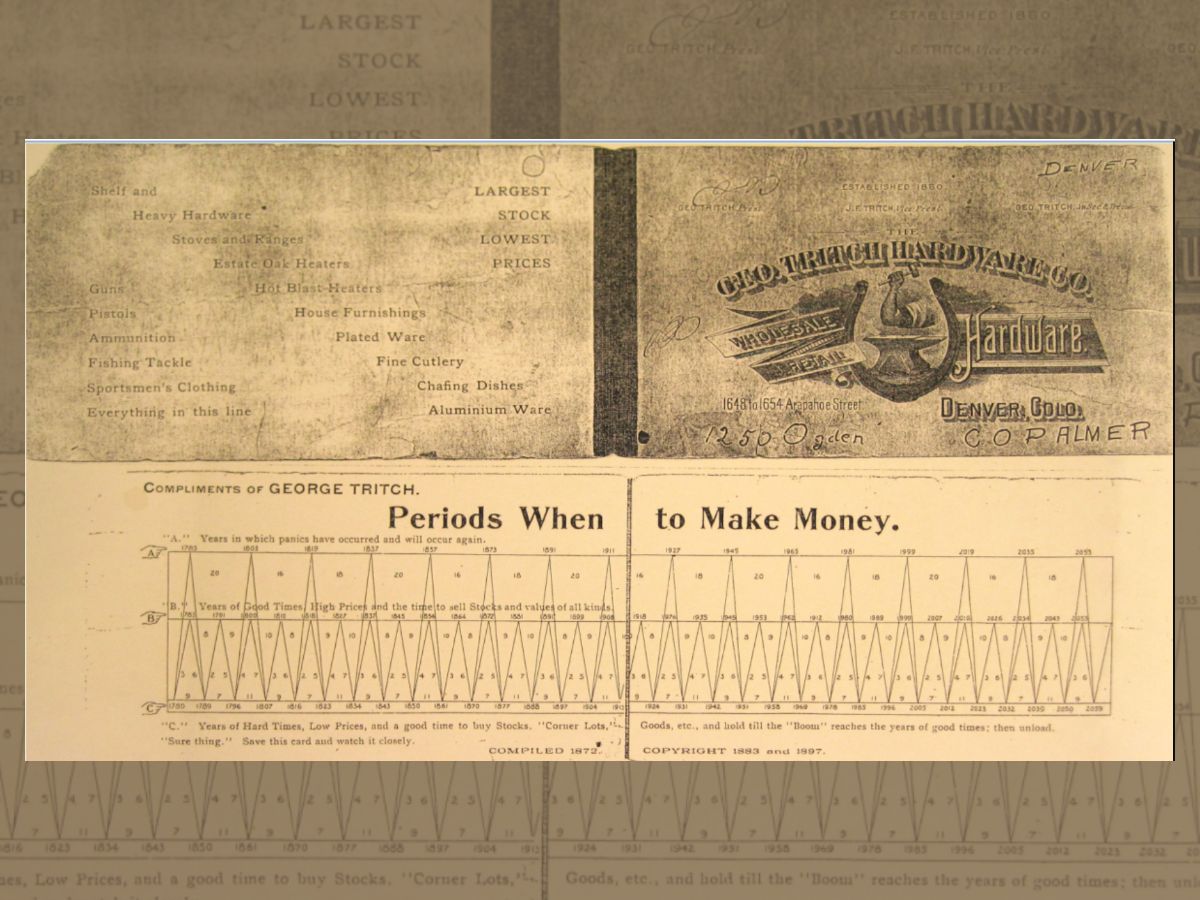

However, it is not clear how made this cycle first. According to a paper by David Mcminn, whose work centred around financial trends, the Benner cycle was first published by Tritch on a business card in 1872 and later publicised by Benner.

Mcminn in his paper shares an image cited to be the card by Tritch.

The chart in the image shows when the years of panic, years of good times, and years of hard times. In panic years, the market either buys or sells a stock irrationally until its price skyrockets or plummets. In good times, prices are high and the best time to trade stocks, commodities, and other assets. In challenging years, purchased stocks, products, and assets are held until the "boom" years of prosperous times, at which point they should be sold.

As can be seen in the image, 2023 is marked as hard time. Some may say, the cycle is accurate with the current volatility in the domestic and global stock markets, with crises like banking failers, forecasted economic slowdowns, and tech layoffs.

Is The Benner Cycle Reliable?

In short, the answer is: No. Why? It is due to the science or logic behind the cycle. In his book, Samuel Benner says, “The cause producing the periodicity and length of these cycles may be found in our solar system…It may be a meteorological fact that Jupiter is the ruling element in our price cycles of natural productions; while also it may be suggested that Saturn exerts an influence regulating the cycles in manufacture and trade.”

He further adds, “When certain combinations are ascertained which produce one legitimate invariable manifestation from an analysis of the operations of the combined solar system, we may be enabled to discover the cause producing our price cycles and the length of their duration.”

However, there was no definite evidence of such a planetary influence on financial activities, unless one believes in astrology.

Additionally, David McMinn, in his paper says that the Benner cycle became less accurate after predicting the crises of 1819, 1837, 1857, and 1873. McMinn says, “Benner assumed a panic cycle of 54 years rather than the superior alternative of 56 years…the Benner Cycle gave false predictions in 1965 and 1999. In 2019, a sharp, deep recession occurred a little later than expected commencing in early 2020.”

Other Market Prediction Cycles

However inaccurate, some investors bet on these cycles to make investments. There are other cycles that are used in financial market analysis. Like the Gann cycle, a theory developed by the legendary trader W.D. Gann. According to Gann financial markets move in predictable cycles and patterns that can be analysed and used to make trading decisions. He believed that these cycles were related to natural phenomena such as the seasons and planetary movements.

Another one is the Elliott wave cycle, developed by Ralph Nelson Elliott in the 1930s and is based on the idea that market movements follow predictable patterns. According to Elliott's theory, financial markets move in a series of waves that alternate between "impulsive" and "corrective" phases.

The Fibonacci cycle is a concept derived from the Fibonacci sequence, which is a sequence of numbers in which each number is the sum of the two preceding numbers. This sequence is named after the mathematician Leonardo Fibonacci, who introduced it to the Western world in his book "Liber Abaci" in 1202.

There are others like the Kondratiev wave, Juglar cycle, Kitchin cycle, Presidential cycle, and Head and shoulders pattern used by traders to predict market ups and downs.

Word Of Caution

It's important to note that these cycles are not a foolproof method of analysing financial markets. When used at all, they should be in conjunction with other technical and fundamental indicators to make trading decisions.