Micron Investment Fuels Modi Govt's Semiconductor Ambition. What Are The Obstacles Ahead

Will the investment by the fifth largest semiconductors manufacturing firm give India the push it needs to break into the chip ecosystem?

New Delhi: Micron Technology's announcement regarding the establishment of a cutting-edge semiconductor assembly, testing, and packaging plant in Sanand, Gujarat, has reignited fresh hope for India's aspirations to become a global semiconductor supply chain hub. A string of announcements have been made since Micron’s plan came out. On Monday, notably, Union Minister for Electronics, IT and Telecom, Ashwini Vaishnaw expressed confidence that India's first made-in-India semiconductor chip would roll off the production line within just 18 months — by December 2024. He said the upcoming Micron plant would contribute to the expansion of the semiconductor ecosystem in India.

Now, the pressing question arises, does this announcement truly signify the long-awaited breakthrough that India has been yearning for in the realm of chip manufacturing?

Plans Unveiled During PM Modi’s US Visits

During Prime Minister Narendra Modi's recent state visit, several significant announcements were made for the semiconductor sector in India. Micron Technology plans to invest $825 million in a new semiconductor assembly and test facility, aiming to create thousands of job opportunities. Lam Research aims to train 60,000 Indian engineers through its virtual fabrication platform, contributing to India's semiconductor education goals. Applied Materials intends to establish a Semiconductor Centre for Commercialisation and Innovation with a $400 million investment. Additionally, India and the US have signed an MoU to promote collaboration in the semiconductor supply chain and innovation, fostering commercial opportunities and skill development.

Potential Of These Proposals

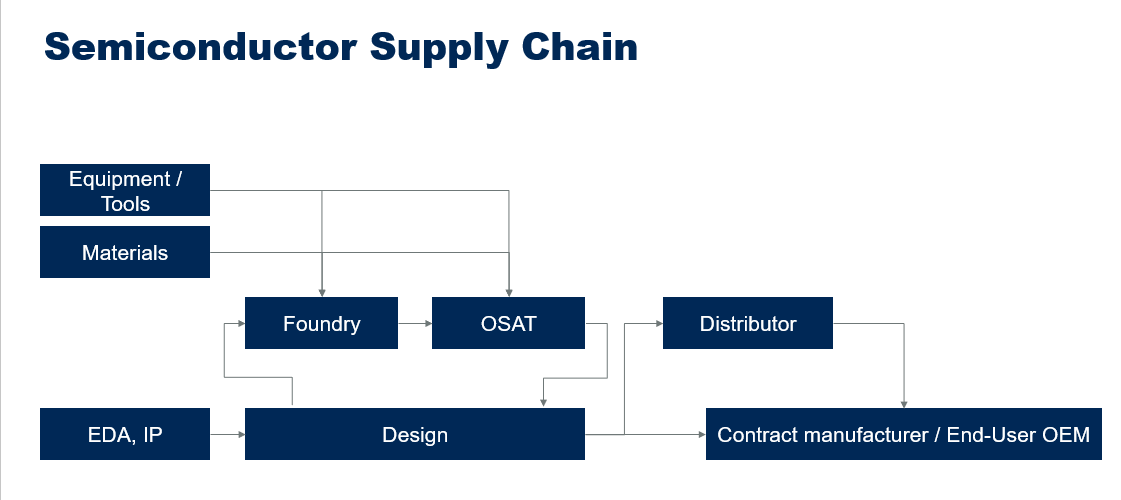

To understand Micron's plan, one needs to look at how the Semiconductor ecosystem works. From mining to manufacturing, the industry involves multiple sectors in its ecosystem.

"Semiconductor manufacturing involves various stages and each of these stages may involve a completely different category of vendor," says Kanishka Chauhan, Senior Principal Analyst at management consulting company Gartner.

"It starts with chip design, and depending on whether the vendor has manufacturing capability or not (fabless or IDM) they may work with foundries for chip production. Once these chips are produced they have to be assembled, tested, marked and packaged (ATMP) before being shipped to a distributor or an end user," he tells ABP Live.

Micron setting up an ATMP plant is a fair starting point for India’s semiconductor journey as this process is not as complex as actual chip fabrication. According to Chauhan, these plants require lesser investments and do not require extremely high levels of technical capabilities as compared with full-fledged fabrication facilities. There are other companies as well that have shown interest in ATMP such as Tata and Sahasra and this could prove to be a good start.

"While this certainly does not make India a semiconductor hub, this is indeed the direction that we want to move to," says Chauhan, who has been covering the semiconductor and electronics industry for over a decade.

According to a 2021 report by the Boston Consulting Group and the Semiconductor Industry Association, China is the leader in this segment with a 38 per cent share, followed by Taiwan at 27 per cent and then nearly 16 per cent share of Japan and South Korea.

Govts Incentives And Yields So Far

In December 2021, the government launched the Semicon India Programme with an outlay of Rs 76,000 crore (approximately $10 billion) to develop the semiconductor and display manufacturing ecosystem. Under the modified programme, the government introduced four schemes to support semiconductor and display manufacturing. These schemes aim to attract investments and provide financial assistance for setting up semiconductor fabs, display fabs, compound semiconductors/silicon photonics/sensors fab/discrete semiconductors fabs, and semiconductor assembly, testing, marking, and packaging (ATMP)/OSAT facilities (under which Micron's proposal has been approved). The schemes offer 50 per cent financial support on a pari passu basis for project costs and capital expenditure.

The government's semiconductor programme initially received applications from consortiums like ISMC, Vedanta-Foxconn joint venture, and IGSS Ventures. However, the evaluation process faced delays due to complexities and changes in ownership. Ultimately, only the Vedanta-Foxconn joint venture remained in the field, as ISMC's partner was acquired by Intel, and IGSS Ventures' proposal did not meet the government's standards.

Unfortunately, as multiple reports suggest, the Vedanta-Foxconn joint venture faced challenges in finding a technology licensing partner for manufacturing 28-nanometer chips, resulting in the government incentives not materialising.

Last month, the government announced the invitation for new applications for setting up Semiconductor Fabs and Display Fabs in India under the Modified Semicon India Programme, starting from June 01, 2023. On June 27, Vedanta-Foxconn JV said that they have resubmitted their application for consideration, this time reportedly focusing on 40-nanometer (nm) node technology.

"The key takeaway here is that strong political will is indispensable! While we cannot become a semiconductor superpower overnight, with the right policies, I am sure we can make some progress," says Kanishka Chauhan from Gartner.

Also Read: Gujarat Inks Deal With US Chip Maker Micron To Set Up India's First Semiconductor Unit

Obstacles Waiting For India's Chip Aspirations

"Large semiconductor companies move in a very planned manner," says Chauhan, "If you want to motivate them to venture into unknown territory, the financial benefits should be very strong. When compared with the US CHIPS Act or the proposed EU Chips Act, the financial benefits may appear weak."

Just two months after India announced its semiconductor scheme, in February 2022, the European Union (EU) announced its own initiative, mobilising €43 billion in incentives to bolster its chip industry. Following suit, in August 2022, the United States, the global leader in chip manufacturing, revealed a subsidy plan amounting to approximately $52 billion.

With such stiff competition, it can be understandable why India's semiconductor mission did not attract applications from major fabs like TSMC, Intel, and Micron in the initial round.

India also faces challenges in its supply chain due to the dominance of various countries. The United States leads in microchip manufacturing with companies like Intel, GlobalFoundries, Qualcomm, AMD, and NVIDIA. Taiwan, particularly TSMC, dominates the outsourcing segment. China holds a significant position in Rare Earth Elements mining, producing 85 per cent of the world's supply of valuable semiconductor materials. Additionally, Japan and Korea play vital roles in the supply chain.

Global players are strengthening their positions to counterbalance China's growing influence in the semiconductor sector. The Biden administration has imposed restrictions on chip sales and manufacturing equipment to hinder China's advancements.

Need For A Proactive Policy

Analysts emphasise the importance of developing a proactive policy for the semiconductors sector.

According to Chauhan, there is an urgent need to simplify the process and clarify policies around tax structure. Availability and support for land, electricity, and water should be communicated more effectively.

"Setting up a semiconductor fab facility is a very high CAPEX venture requiring significant upfront investment in infrastructure and machinery. The future attractiveness and subsistence of the industry shall be dependent on achieving sustainable operations by overcoming the challenges that lie ahead," says Chetan Barapatre, Manager of Growth Advisory at Aranca, a business management consultant firm.

According to Barapatre, there are a few key factors that need to be considered. Firstly, the manufacturing process requires a significant amount of ultra-pure water. Secondly, the supply chain for specialised raw materials is in its early stages in India. Third, skilled manpower specific to semiconductor manufacturing is limited. Lastly, while government financial incentives alleviate initial capital expenditure burdens, long-term subsidies and extended support on taxes and electricity are necessary to further support investors in overcoming these challenges.

"Solutions to these challenges shall define the overall attractiveness of the sector and might take a few years, post which the Indian semiconductor manufacturing industry would be truly ready for take-off," he adds.