Income Tax Return 2019 Alert! ITR Filing Last Date Extended To August 31; Here's Step-By-Step Guide

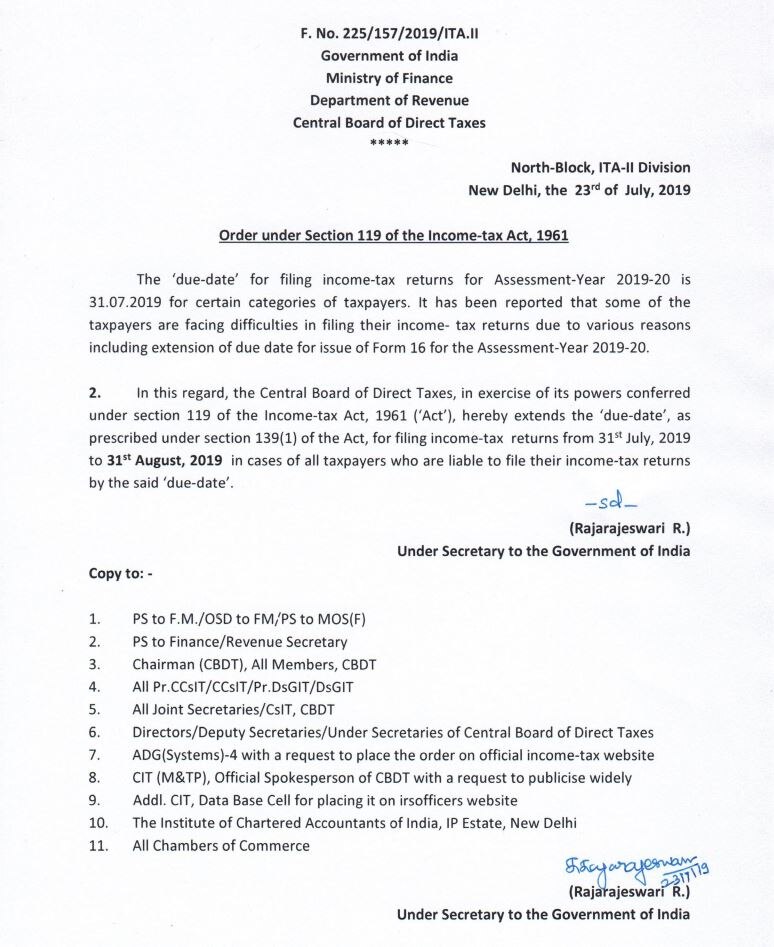

The finance ministry in a statement said, "The Central Board of Direct Taxes (CBDT) extends the 'due date' for filing of Income Tax Returns from July 31, 2019 to August 31, 2019 in respect of the said categories of taxpayers."

There have been demands for an extension in filing ITR date since issuance of tax deducted at source (TDS) statement for 2018-19 fiscal was delayed. Income Tax department had last month extended the deadline for employers to issue Form 16 TDS certificate for financial year 2018-19 to its employees by 25 days till July 10. This left the salaried taxpayers with a limited time-frame of just 20 days to file their income tax returns.The Central Board of Direct Taxes (CBDT) extends the ‘due date’ for filing of Income Tax Returns from 31st July, 2019 to 31st August, 2019 in respect of certain categories of taxpayers who were liable to file their Returns by 31.07.2019.

— Income Tax India (@IncomeTaxIndia) July 23, 2019

Now with the due date for filing ITR, the taxpayers have less time left with them. To ensure a hassle-free tax filing, you may go through the points to learn when and how to file income tax return, else you may have to incur a penalty.

Now with the due date for filing ITR, the taxpayers have less time left with them. To ensure a hassle-free tax filing, you may go through the points to learn when and how to file income tax return, else you may have to incur a penalty. How to file ITR

Step 1) Log on to the incometaxindiaefiling.gov.in Step 2) Register on the website Step 3) Fill the registration form with details like name and DOB, PAN, and choose a password. PAN is your user ID. Step 4) Click on the relevant ITR Form Step 5) Choose the Financial Year Step 6) Download the applicable ITR Form Step 7) Open Excel Utility and fill up the Form by entering details using Form 16 Step 8) Click on ‘calculate tax’ tab and check the tax payable Step 9) Confirm data by validating the ‘validate’ tab Step 10) Generate XML File and save it on your desktop Step 11) Upload the saved XML File on ‘upload return’ on the portal’s panel Step 12) A pop-up will be displayed asking you to digitally sign the filePrecautions while preparing Income Tax Return

• Taxpayer has to first fill ‘Part A General’ (Personal Information) correctly. Rest of the utility will function based on information provided in Part A General. For example, the field 80 TTB will be enabled only for Senior citizens based on the Date of birth and Residential status as per Part A General.

• All relevant schedules to be filled for proper calculation and auto population of relevant fields. For example, if you have donations paid details u/s 80G then 80G schedule to be filled first so that the final value from that schedule will flow to respective field in Chapter VI-A.

Related Video

Union Budget 2025: Arvind Kejriwal lists the shortcomings of the Modi government's budget | ABP News | AAP