Mutuum Finance Price Forecast: Why This Cheap Crypto At $0.04 Could Deliver 70x Returns Before 2028

Mutuum Finance (MUTM) at $0.04 is gaining attention as analysts forecast up to 70x returns by 2028, driven by stablecoin fees, buybacks, and DeFi utility.

Projecting extraordinary returns in the cryptocurrency market requires identifying assets that merge acute scarcity with robust, revenue-generating utility. Mutuum Finance (MUTM), at a mere $0.04 in its presale, presents a compelling case for multi-bagger returns, with a forecasted potential to deliver 70x gains before 2028. This prediction is grounded not in hype but in the protocol's capacity to create and circulate value directly to its token holders.

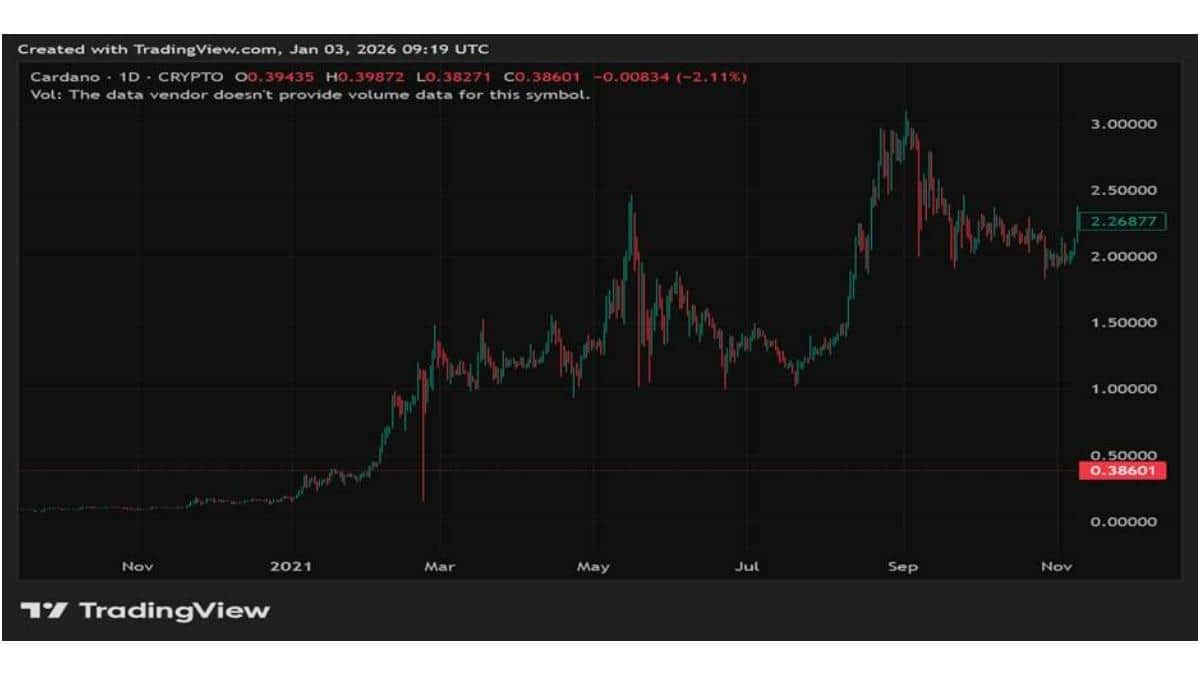

Historical cycles offer a blueprint; Cardano (ADA), for example, ascended from its 2020 low of approximately $0.02 to an all-time high near $3.10 in September 2021, a monumental 15,400% return in roughly 18 months. This surge was propelled by the gradual rollout of its smart contract functionality and staking ecosystem, which drove sustained demand. Mutuum Finance is positioned similarly at the precipice of its launch, with intrinsic features designed to catalyze and sustain demand, making a 70x climb to around $2.80 a reasoned trajectory for early entrants in this cheap crypto

Stablecoin Issuance and Fee Generation

A primary growth driver will be Mutuum's native, overcollateralized stablecoin. Users can mint stablecoins by depositing approved collateral, generating fees for the protocol. For example, if the stablecoin TVL reaches $50 million, it could generate $250,000 in annual fees. A portion of these fees is allocated to buy back and distribute MUTM tokens. As stablecoin adoption grows, this buyback & distribute compounds, creating a powerful, demand-side pull on this best crypto to invest in.

Mutuum Finance Presale: The Strategic Entry Point

Running parallel to these robust protocol features is the Mutuum Finance presale. Currently in Phase 7, MUTM tokens are available at $0.04. This price represents a 300% increase from the Phase 1 price of $0.01, demonstrating the structured appreciation that rewards those who act fast.

Phase 7 is selling out rapidly, making this the final window to acquire tokens before the price rises by nearly 20% to $0.045 in Phase 8. For an investor, committing $500 at the current price secures 12,500 tokens. When contrasted with the post-launch analyst projections that hinge on the protocol's utility, this presale position offers a low-risk basis for potentially monumental returns, with analyst projections pointing to a 70x ROI.

Liquidity Mining Incentives and User Growth

To bootstrap its ecosystem, Mutuum Finance will deploy aggressive liquidity mining incentives. Users who provide liquidity can earn high yield, paid in MUTM tokens. For instance, providing $10,000 in liquidity at a 15% APY could yield $1,500 in MUTM rewards annually. These incentives are designed to rapidly attract capital and users. The resulting network effect and increased platform activity can appreciate the token's underlying value, directly benefiting every holder, consequently making MUTM the best crypto to invest in.

Reserve Factor Mechanism and Investor Protection

The protocol's reserve factor mechanism allocates a percentage of all interest earned (e.g., 10%) to a dedicated safety reserve. This builds a buffer to cover shortfalls during high volatility, ensuring yield payouts remain reliable. For a lender with a $5,000 position, this means their projected $750 annual yield is protected even if some borrowers default. This enhanced security and reliability make the platform more attractive to users, increasing overall TVL and the protocol's fee base, which again fuels the buyback & distribute mechanism, rewarding stakers.

Peer-to-Peer (P2P) Model and High-Yield Niches

Complementing its pooled lending, Mutuum's P2P model allows for customized, high-yield agreements on volatile assets like Shiba Inu. A lender could negotiate a direct loan of $4,000 at a 25% APY, earning $1,000 in interest in one year, isolated from pool volatility. This flexibility opens lucrative niches, attracting more capital to the project.

The Path to Exponential Growth

The forecast for 70x returns synthesizes these mechanics: a stablecoin generating reliable fees, liquidity mining driving viral adoption, a reserve fund ensuring sustainable yields, and a P2P model capturing high-margin niches. Together, they create a powerful economic engine where platform growth directly increases token demand through buybacks and staking rewards.

Similar to how Cardano's staged utility unlock led to parabolic growth, Mutuum Finance’s phased feature rollout positions it for a similar demand explosion. At $0.04, the token represents a high-valuation discount to its potential future utility and cash flow. For investors, this is a calculated entry into a project whose design intentionally facilitates substantial capital appreciation, making a 70x return a viable outcome within the current market cycle for this cheap crypto.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored article. ABP Network Pvt. Ltd. and/or ABP Live do not endorse/subscribe to its contents and/or views expressed herein. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.