Crypto Tax Across The Globe: How Tax Rates Compare Between Different Countries

Calculating crypto tax is up to users who can choose to calculate crypto by either FIFO or LIFO method.

Cryptocurrency has gained immense popularity in recent years across the world. With increasing mainstream adoption, countries have started applying tax brackets on digital assets in order to regulate them and treat them similarly to existing financial assets. In this article, we will take a look at how various nations have approached crypto taxation.

Here are a few examples of how some countries approach crypto taxes:

Key points to keep in mind when reporting cryptocurrency taxes:

Capital gains and losses: Any time you sell, trade, or exchange your cryptocurrency, you will have a capital gain or loss. These gains or losses must be reported on your tax return.

Cost basis: Your cost basis is the original value of the cryptocurrency when you acquired it. This is used to calculate your capital gains or losses.

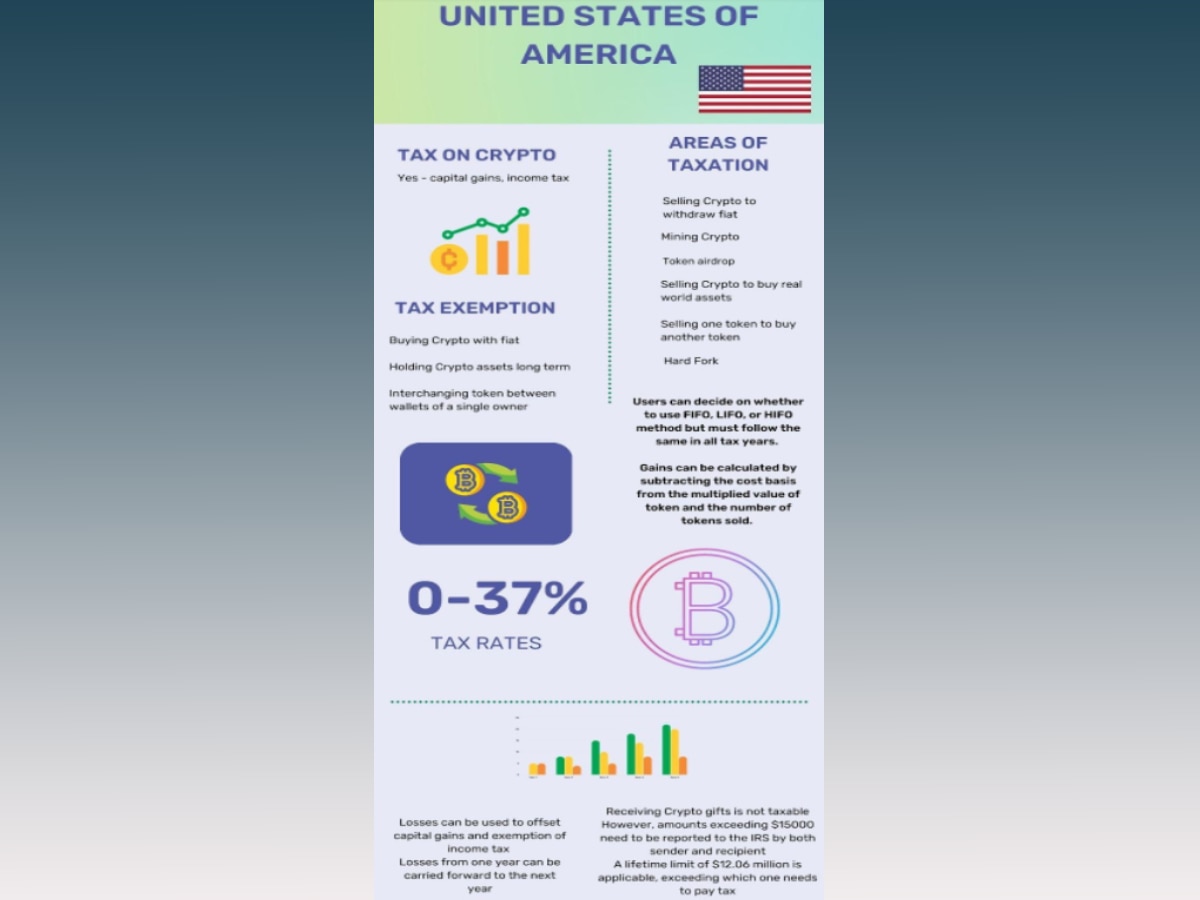

United States of America

In the US, cryptocurrencies are considered property for tax purposes. Any transactions involving cryptocurrencies must be reported on tax returns.

Selling crypto for fiat, token airdrops, mining or staking crypto, buying one token with another are all taxable in the US. The rates vary between 0-37 percent for capital gains and income tax.

Calculating crypto tax is up to users who can choose to calculate crypto by either FIFO or LIFO method.

FIFO (first in, first out) method means the total profits are calculated based on tokens which are bought first.

LIFO (last in, first out) method means the total profits are determined based on the last tokens bought at the time of selling.

ALSO READ: How ChatGPT-Like AI Tools Can Revolutionize Crypto Industry

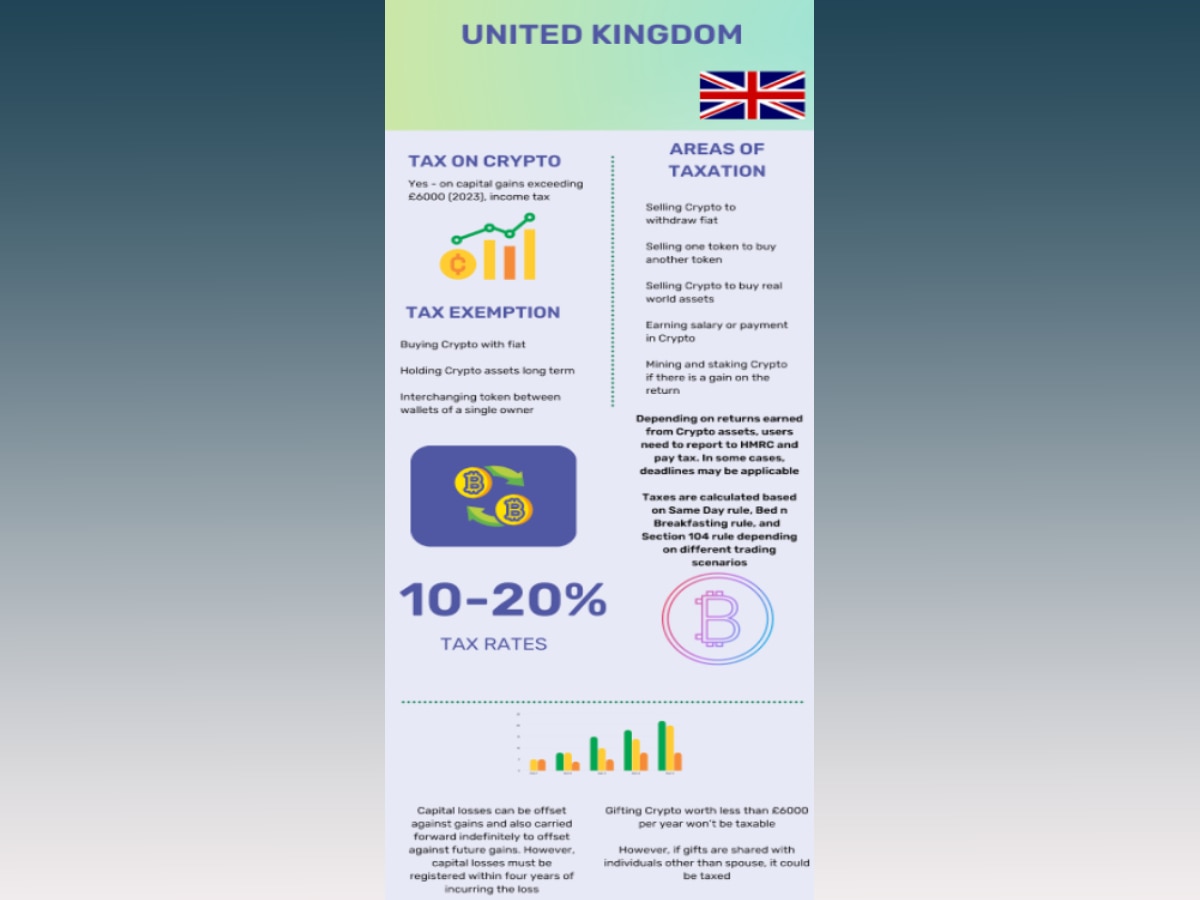

United Kingdom

In the UK, taxes are accrued on Income in Crypto or Capital gains. Tax rates applied are between 10-20 percent.

Selling crypto to withdraw fiat, trading one token for another, using crypto to pay for real-world assets, and earning compensation in crypto are all taxable.

There are 3 ways of calculating taxes on crypto:

- Calculating gains/losses on Crypto traded on the same day

- Calculating gains/losses on Crypto traded within a month

- Calculating an average of all the assets divided by the number of tokens

Italy

In Italy, cryptocurrency is considered a financial instrument and is subject to capital gains tax. If the value of the portfolio exceeds EUR 2,000, 26 percent capital gains tax is applicable.

Selling crypto to withdraw fiat, trading one token for another, etc., using crypto to pay for real-world assets, and earning compensation in crypto are all taxable.

LIFO method is applied to calculate capital gains tax.

Individuals are required to report the value of their cryptocurrency holdings at the end of the tax year, including gains or losses from the previous year.

In case users don’t want to calculate the capital gains or fail to do so, they can pay a flat tax of 14 percent on their portfolio value.

Germany

In Germany, cryptocurrencies are private assets and are subject to Income Tax. Capital gains tax does not usually apply to individuals but to businesses. An individual’s profits are tax-free as long as they are under EUR 600.

Mining and staking income may be taxed as business income. Token airdrops, NFTs, using crypto to buy fiat, other tokens or real-world assets, earning compensation in Crypto, DeFi lending are all taxable.

Germany requires users to report all transactions regardless of their value. Germany’s tax law states that private assets incur income tax. The tax rates are 0-45 percent.

Germany prefers calculating crypto taxes with the FIFO method.

ALSO READ: Key To Crypto Control: Traditional Vs Self-Custody Wallets

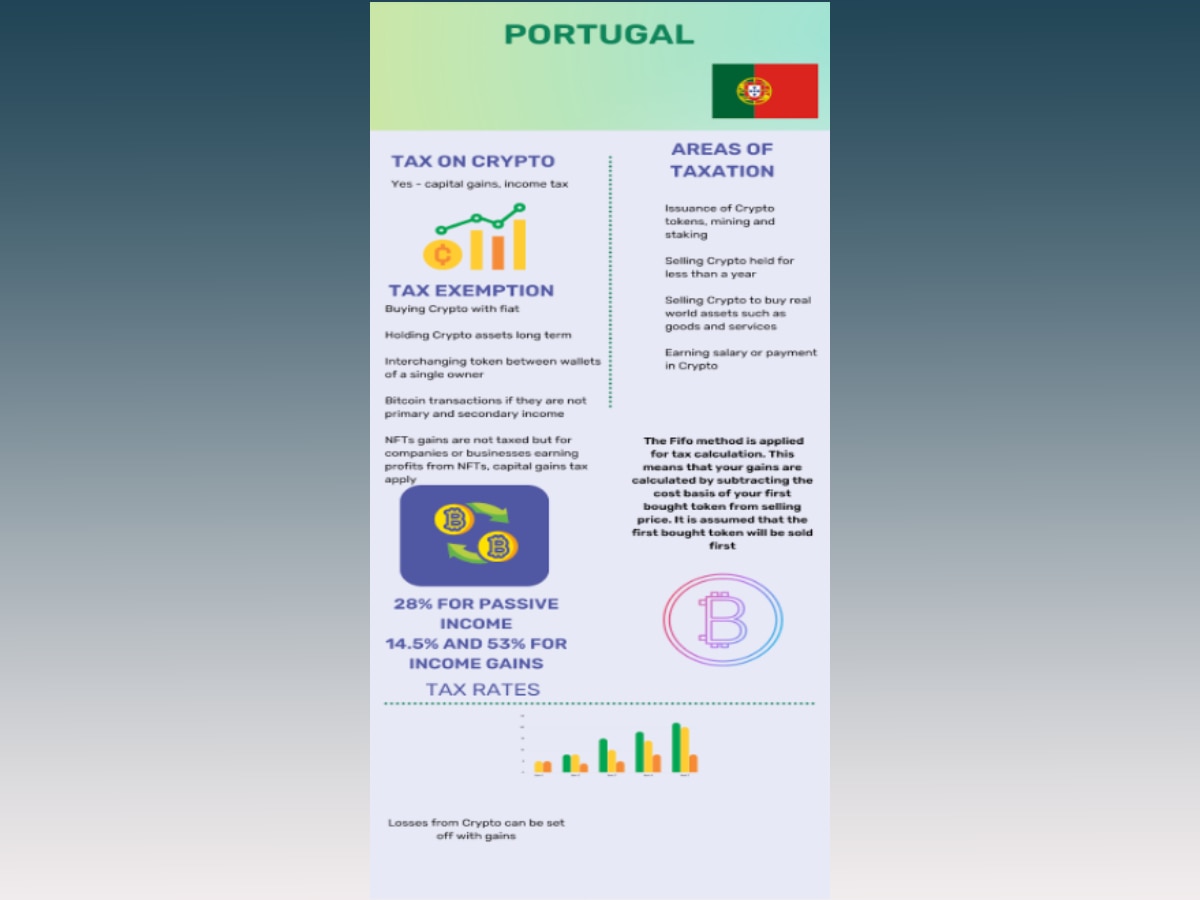

Portugal

In Portugal, cryptocurrency qualifies as capital income or self-employment income.

Passive income from crypto is taxed at 28 percent. Crypto mining, validation, and issuance of tokens will be taxed between 14.5-53 percent.

Portuguese crypto users calculate taxes with the FIFO method.

Individuals and businesses that buy, sell, or hold cryptocurrencies in Portugal must report their transactions, including any gains or losses from cryptocurrency transactions.

In addition to capital gains tax, individuals and businesses may also be subject to value-added tax (VAT) on their cryptocurrency transactions.

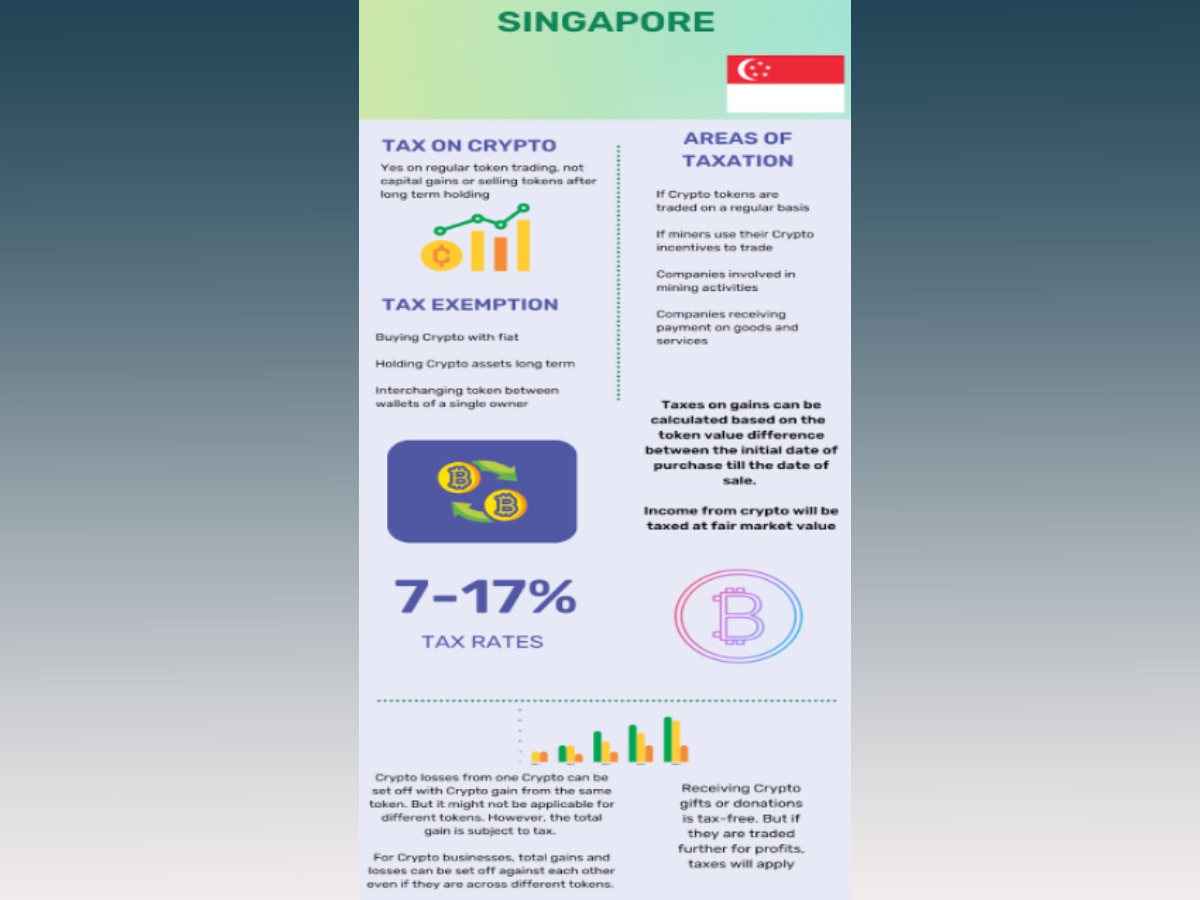

Singapore

In Singapore, cryptocurrency is treated as goods and is subject to goods and services tax (GST) when used to purchase goods and services. Capital gains of cryptocurrency are not currently taxed.

In Singapore, cryptocurrency transactions are subject to tax similar to other forms of income.

Trading crypto, mining crypto, and buying goods and services with crypto are taxable. Income tax is applied at fair market value while capital gains are taxed by subtracting the cost basis of tokens from the selling price.

In conclusion, clear regulations and efficient taxation systems for the cryptocurrency sector in India can help establish a stable and secure investment environment. This will attract more investors and businesses to the sector, leading to the growth of the industry and creating new job opportunities. Additionally, proper tax collection from the crypto sector can also help the government generate revenue and support the country's economy.

It's worth noting that these are general guidelines and tax laws may change over time in the respective countries. Hence it is recommended to consult a tax professional for more specific tax advice.

(The author is the Vice President of crypto investment platform WazirX)

Disclaimer: The opinions, beliefs, and views expressed by the various authors and forum participants on this website are personal and do not reflect the opinions, beliefs, and views of ABP Network Pvt Ltd. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.