When Will The New Income Tax Rates Come Into Effect?

Under the new tax regime, the government has also introduced new tax slabs, lowering the tax burden on middle-income earners.

Finance Minister Nirmala Sitharaman announced a major income tax relief in her Budget 2025 speech on Saturday, stating that no tax will be payable on annual incomes up to Rs 12 lakh under the New Tax Regime. With the standard deduction of Rs 75,000, this effectively raises the tax-free income threshold to Rs 12.75 lakh for salaried individuals. The announcement comes at a time when India’s middle class is facing economic uncertainties and inflation, making this a welcome move aimed at boosting consumer spending and economic growth.

ALSO ON ABP LIVE | What Changes For You With New Income Tax Slabs?

Under the new tax regime, the government has also introduced new tax slabs, lowering the tax burden on salaried-income earners.

Revised Tax Slabs Under New Regime

- Up to Rs 4 lakh – No tax

- Rs 4 lakh – Rs 8 lakh – 5%

- Rs 8 lakh – Rs 12 lakh – 10%

- Rs 12 lakh – Rs 16 lakh – 15%

- Rs 16 lakh – Rs 20 lakh – 20%

- Rs 20 lakh – Rs 24 lakh – 25%

- Above Rs 24 lakh – 30%

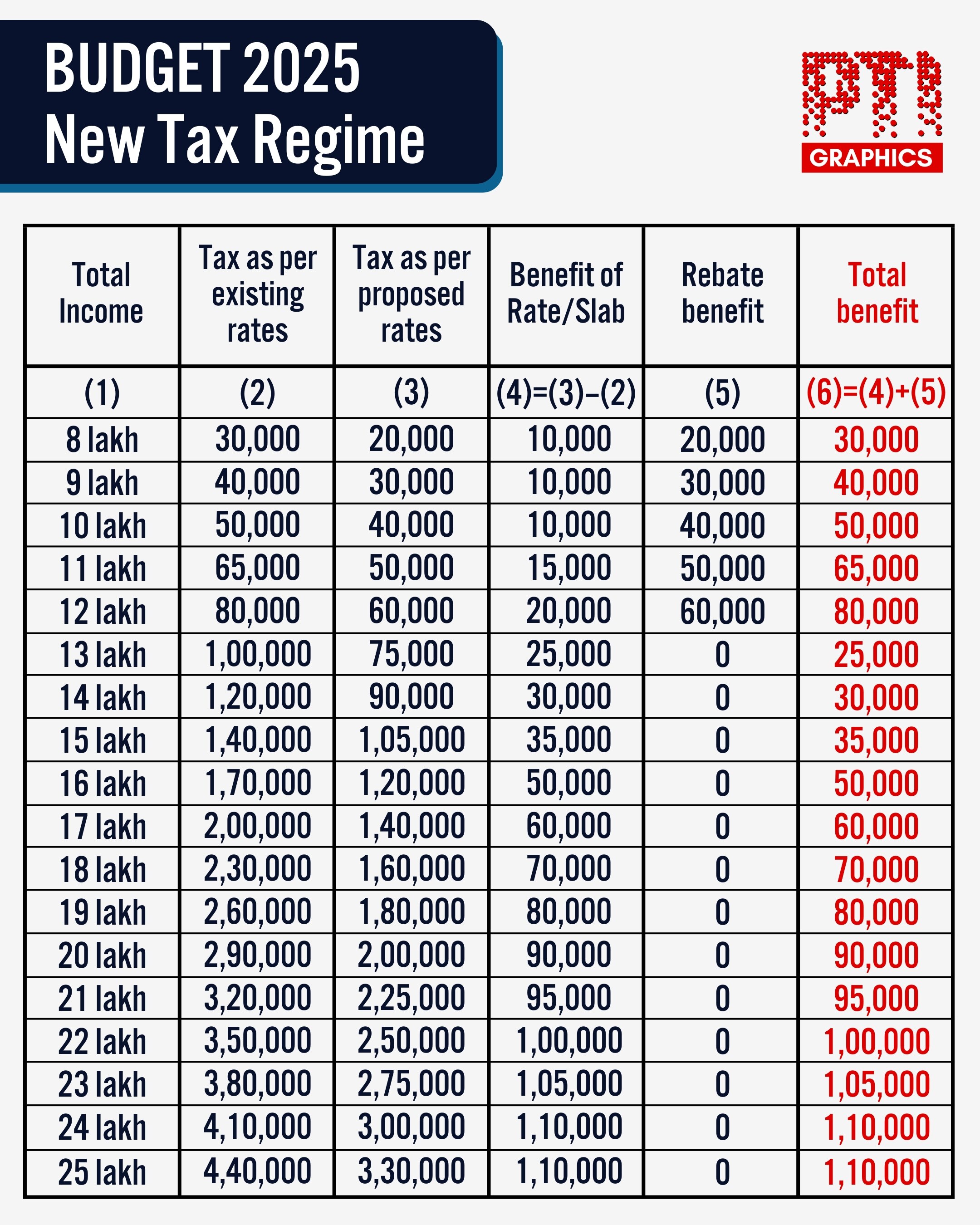

Tax Savings For Different Income Brackets

FM Sitharaman in her speech also highlighted how individuals will save significantly on taxes under the new structure:

- Rs 12 lakh income – Rs 80,000 saved (100% tax reduction from existing rates)

- Rs 18 lakh income – Rs 70,000 saved (30% tax reduction)

- Rs 25 lakh income – Rs 1,10,000 saved (25% tax reduction)

Opinion | Budget 2025 Doesn’t Mention Capital But Has Delhi Polls Written All Over It

When Will The New Tax Rates Apply?

The revised tax slabs will come into effect from April 1, 2025, marking the beginning of the financial year 2025-26, pending Parliamentary approval.

The move is expected to provide relief to millions of taxpayers, encourage higher disposable incomes, and support domestic consumption-led growth, aligning with the government’s vision for a more prosperous middle class.

READ MORE | Happy With Income Tax Announcements In Budget 2025? Here's How Much It Will Cost Centre