Apple Leads Global Tablet Market With Nearly Double Shipment Than Samsung, Huawei Sees 70% Annual Growth: Canalys

Apple maintained its lead with 12 million iPad shipments, compared to Samsung's 6.8 million.

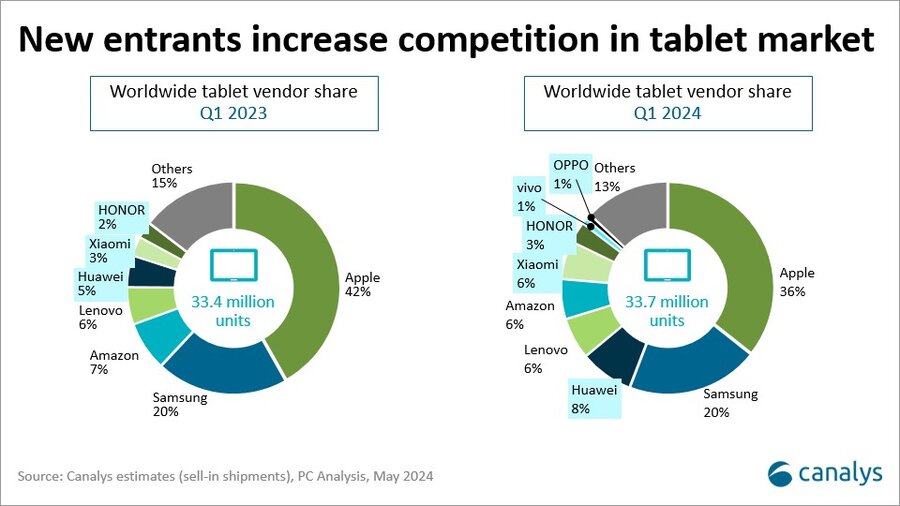

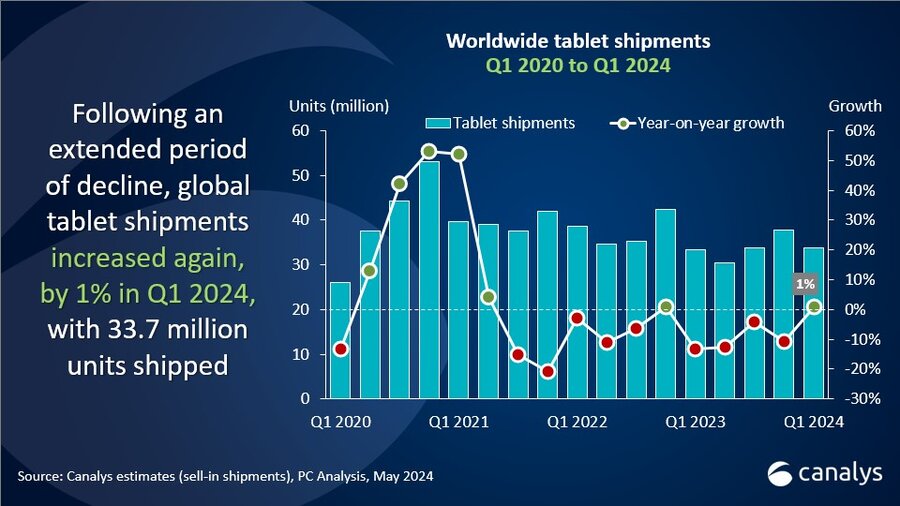

The global tablet market saw a modest uptick in the first quarter of 2024 with shipments increasing by 1 per cent to reach 33.7 million units, as reported by Canalys data. This growth comes after a year marked by consecutive declines, indicating a revival in consumer spending and the stabilization of economies worldwide. The news comes a day before Apple is expected to launch its latest iPad Air and iPad Pro models at its virtual 'Let Loose' event.

Apple Leads

In terms of market share, Apple maintained its lead in the first quarter of 2024, shipping 12 million iPads and commanding a 36 per cent share.

Samsung followed in second place, experiencing a modest 1 per cent growth with 6.8 million units shipped.

| Worldwide tablet shipments (market share and annual growth) | |||||

| Vendor (company) | Q1 2024 | Q1 2024 | Q1 2023 | Q1 2023 | Annual |

| Apple | 12,012 | 35.6% | 13,954 | 41.8% | -13.9% |

| Samsung | 6,801 | 20.2% | 6,721 | 20.1% | 1.2% |

| Huawei | 2,735 | 8.1% | 1,607 | 4.8% | 70.2% |

| Lenovo | 2,135 | 6.3% | 1,892 | 5.7% | 12.9% |

| Amazon | 2,045 | 6.1% | 2,502 | 7.5% | -18.2% |

| Others | 7,969 | 23.6% | 6,689 | 20.0% | 19.1% |

| Total | 33,698 | 100% | 33,365 | 100% | 1.0% |

|

|

|

|

| ||

| Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2024 | |||||

Huawei secured third place for the consecutive quarter, shipping 2.7 million units and boasting a robust annual growth of 70 per cent, driven primarily by demand in China and the Asia Pacific region.

Lenovo and Amazon rounded out the top five, each shipping over 2 million tablets.

New Players On The Block

Canalys Research Manager, Himani Mukka, expressed optimism about the industry's performance, stating that the tablet industry has had a positive start to 2024, and the outlook for the rest of the year is promising following a challenging 2023. Mukka noted that despite cautious consumer spending, manufacturers remained ambitious, with new market players investing in the category and established brands focusing on innovation to attract customers and explore new use cases.

The tablet market's resurgence is projected to exceed pre-pandemic levels, driven by the gradual recovery of various sectors and the expansion of 5G infrastructure in untapped markets, which will stimulate demand for tablet refreshes.

2024 To Bring In New Form Factors

A significant development in the market is Apple's plan to integrate OLED screens into the iPad Pros, signalling a shift in display technology preferences among leading tablet vendors. Furthermore, 2024 is expected to witness the introduction of new tablet form factors and features, including foldable designs and 3D content viewing without the need for eyewear.