Explorer

RBI MPC Wrapup: A Look At Key Announcements From The Meeting - In PICS

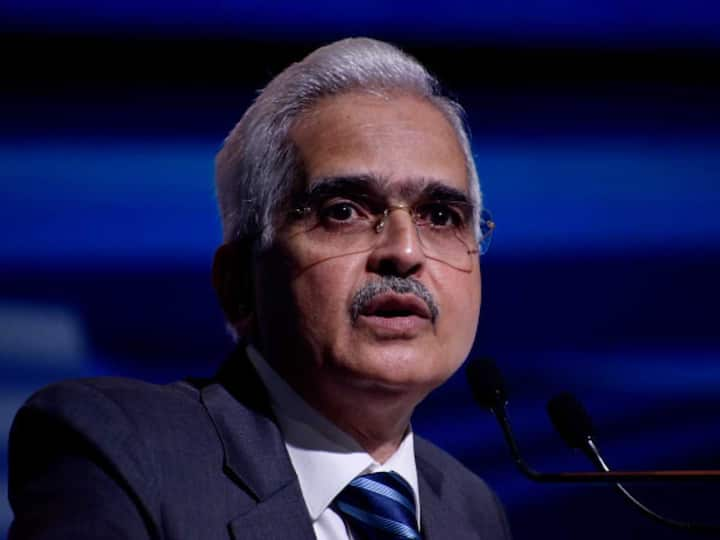

RBI's Monetary Policy Committee (MPC) concluded its bi-monthly review meeting, chaired by Governor Shaktikanta Das today and made some key announcements.

RBI's Monetary Policy Committee (MPC) concluded its bi-monthly review meeting, chaired by Governor Shaktikanta Das today and made some key announcements.

1/7

Das revealed that the regulator has decided to keep the repo rate unchanged at 6.5 per cent. Getty

2/7

The central bank estimated that the Consumer Price Index (CPI) based retail inflation will remain at 5.4 per cent in the current fiscal year. Getty

3/7

The regulator upgraded its GDP growth rate projection for FY24 to 7 per cent from 6.5 per cent, given earlier. Getty

4/7

The Governor informed that the cap for e-mandates for recurring payments has been increased to Rs 1 lakh, from the earlier limit of Rs 15,000. Getty

5/7

The RBI enhanced the UPI payment limit for healthcare and educational facilities to Rs 5 lakh. Getty

6/7

The bank noted that it plans to establish a FinTech Repository to help create a better understanding of developments in the fintech ecosystem in the country and facilitate the sector. Getty

7/7

Regarding the financial sector in India, Das noted that the regulator is working towards developing a cloud facility for the industry, which will be rolled out in the medium-term. Getty

Published at : 08 Dec 2023 05:36 PM (IST)

View More

Advertisement

Trending News

Advertisement