RBI MPC Highlights: Repo Rate Remains Unchanged; Here Are The Other Key Announcements

The Committee, made up of three RBI members and three external members, convened from August 5 to 7. With a decision ratio of 4:2, they chose to keep the repo rate unchanged this time as well

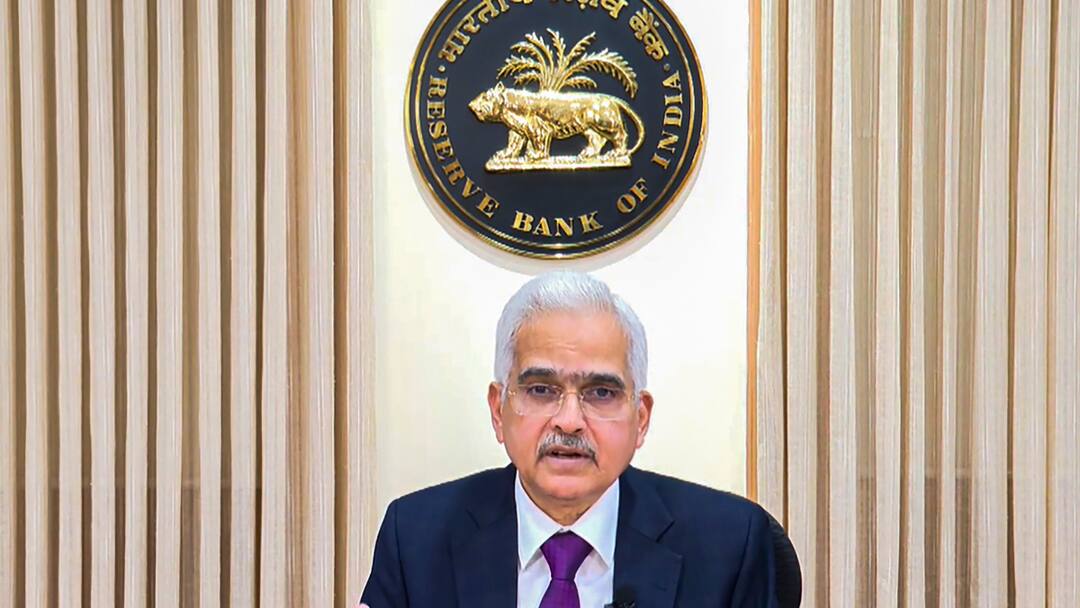

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC), chaired by RBI Governor Shaktikanta Das, concluded its three-day review meeting on Thursday. The committee decided to keep the repo rate unchanged at 6.5 per cent, marking the ninth consecutive meeting. "MPC judged that it is important for monetary policy to stay the course while maintaining close vigil on risks," Das said while announcing the policy decision.

The Committee, made up of three RBI members and three external members, convened from August 5 to 7. With a decision ratio of 4:2, they chose to keep the repo rate unchanged this time as well. This session was the third monetary policy meeting for the fiscal year 2024-25. A total of six MPC meetings are planned for the current fiscal year, with the next one scheduled to take place from October 7 to 9, 2024.

Here Are The Major Announcements From RBI MPC

- The MPC maintained its stance on the repo rate at 6.50 per cent, with the Standing Deposit Facility (SDF) rate remaining at 6.25 per cent and the Marginal Standing Facility (MSF) rate and the Bank Rate staying at 6.75 per cent.

- The committee decided to continue its 'withdrawal of accommodation' stance.

- Governor Shaktikanta Das stated that the MPC's focus will remain on inflation and supporting price stability to promote growth.

- The real GDP forecast for FY25 was kept at 7.2 per cent, with slight adjustments: Q1 at 7.2 per cent, Q2 at 7.2 per cent, Q3 at 7.3 per cent, and Q4 at 7.2 per cent.

- The forecast for real GDP growth for Q1FY26 is projected at 7.2 per cent.

- The RBI’s inflation forecast for FY25 remains at 4.5 per cent, while the forecast for FY26 is kept at 4.4 per cent. For FY25, the Q2 inflation projection has been raised to 4.4 per cent from 3.8 per cent, Q3 to 4.7 per cent from 4.6 per cent, and Q4 eased to 4.3 per cent from 4.5 per cent.

- The MPC remains committed to sustainably aligning inflation with the 4 per cent target.

- Das noted that relief is anticipated due to healthy kharif sowing and a strengthening southwest monsoon.

- RBI Governor highlighted the need to monitor mobile tariffs and milk prices carefully.

- The RBI will continue to be agile and flexible in managing liquidity.

- Das expressed concerns over rising disbursals of top-up home loans and has urged lenders to take corrective measures.

- India's forex reserves reached a record high of $675 billion as of August 2.

- The RBI governor voiced concerns about third-party outsourcing of technological services for banks and financial institutions following the recent global Microsoft outage. He urged financial sector stakeholders to work towards preventing future cyber outages.

- RBI proposed to create a public repository of digital lending apps to prevent unauthorised lenders.

- RBI proposed an increase in the UPI tax payment limit from Rs 1 lakh to Rs 5 lakh per transaction.

- RBI plans to introduce continuous cheque clearing to expedite cheque clearance to a few hours.

Also Read: RBI August 2024 MPC Meeting: Repo Rate Unchanged At 6.5%, FY25 GDP Growth Projection At 7.2%