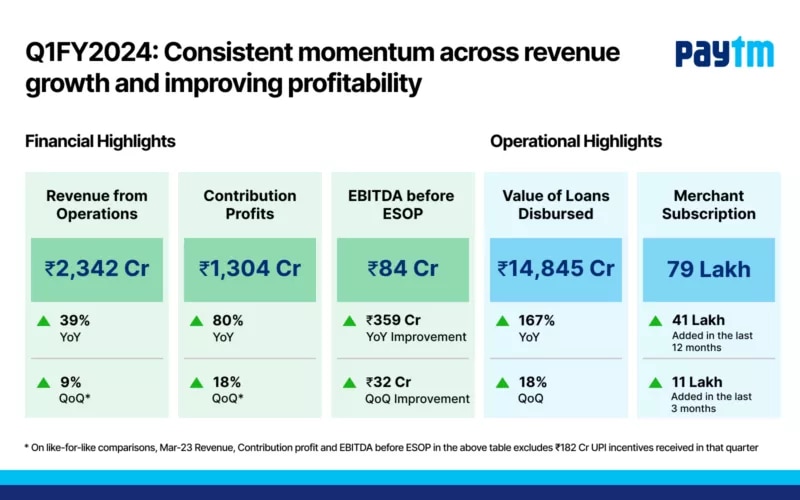

Paytm Reports Robust 39% YoY Revenue Growth In Q1FY24, EBITDA Before ESOP Surges To Rs 84 Crore

The company’s revenue from operations rose 39% YoY to ₹2,342 Cr crore driven by growth in loan disbursements, an increase in merchant subscription revenue, and a significant jump in GMV.

- - Payments revenue increased 31% YoY to ₹1,414 Cr, with an increase in revenue from financial services by 93% YoY to ₹522 Cr

- - EBITDA before ESOP cost grows to ₹84 Cr against ₹52 Cr in Q4FY23 (excluding UPI incentives)

- - Nearly doubles merchant subscriber base to 79 lakh, with devices like Soundbox and Card Machine

Paytm, India's leading mobile payments and financial services company and the pioneer of QR and mobile payments, on Friday, reported its Q1FY24 results announcing a resounding revenue growth momentum. The company’s revenue from operations rose 39% YoY to ₹2,342 Cr crore driven by growth in loan disbursements, an increase in merchant subscription revenue, and a significant jump in GMV.

The company’s operating profit, measured by EBITDA before ESOP cost, stands at ₹84 Cr as compared to ₹52 Cr in Q4FY23 (excluding UPI incentive). On a yearly basis, the company posted a massive improvement of ₹359 Cr in EBITDA before ESOP costs. Driven by the rise in contribution margin and consistent improvement in profitability, EBITDA before ESOP margin also improved to 4%.

Paytm's payments revenue grew by 31% YoY to ₹1,414 Cr crore in Q1FY24 while payments profitability further improved with net payment margin expanding 69% YoY to ₹648 Cr. Paytm achieved its operating profitability milestone in Q1 due to the consistently improved pace in profitability, strong revenue growth, increase in contribution margin and higher operating leverage.

Our Q1FY24 results are here! Led by payments and loan distribution business growth, our revenue jumped 39% YoY to ₹2342 Cr and EBITDA before ESOP grew to ₹84 crore https://t.co/XZmCXZXdeU #Paytm #PaytmKaro #PaytmQ1FY24 pic.twitter.com/yRhuNyJf6b

— Paytm (@Paytm) July 21, 2023

Driven by increased net payment margin, continued improvement in payments profitability and growth in high-margin businesses like credit distribution, Paytm’s contribution profit of ₹1,304 Cr rose to 80% YoY while the contribution margin improved to 56% from 43% in Q4FY23.

The platform’s user engagement continues to grow, with average Monthly Transacting Users (MTU) for Q1FY24 increasing by 23% YoY to 9.2 crores, indicating a strong adoption growth of digital payments by consumers and merchants in India. The company's Gross Merchandise Value (GMV) increased by 37% YoY to reach ₹4.05 lakh crore for FY24.

Paytm continues to scale its credit business with revenue for financial services and others reporting a growth of 93% YoY to ₹522 Cr in Q1FY24 with an increase by 49 lakh of the total number of unique borrowers who have taken a loan through its platform to 1.06 Cr in FY24. Paytm's loan distribution business, in partnership with marquee lenders and Shriram Finance as new lending partners, has continued to scale, with the total number of loans distributed from the platform growing to 1.28 crore in Q1FY24, up by 51% YoY, and the total value of loans amounting to ₹14,845 Cr crore, registering a growth of 167% YoY.

As the merchant payment leader, Paytm's subscription revenues continue to grow, with 79 lakh merchants paying for device subscriptions, both Soundbox and Paytm Card Machines, indicating an increase of 41 Lakh YoY with 11 Lakh new subscriptions QoQ. In the last year, Paytm’s merchant base has grown to 3.6 Cr.

The company's focus on creating additional payment monetization through Paytm app traffic continues to pay off with its growth in Commerce & Cloud revenue up by 22% YoY to ₹405 Cr due to an increase in net payments margin and growth in loan distribution revenues.