Samsung, Vivo, Apple Lead In Value Share Even As India Smartphone Market Falls In Q2

India's smartphone market witnessed a decline, with shipments decreasing by 2 per cent in the second quarter (Q2) of 2024, compared to the same period last year.

Share India's smartphone market witnessed a slight decline, with shipments decreasing by 2 per cent in the second quarter (Q2) of 2024, compared to the same period last year, a new report said on Wednesday. According to Counterpoint Research, the fall in smartphone shipments can be attributed to several factors, including unusually high temperatures, typical seasonal fluctuations, and a slowdown in consumer demand following the first quarter (Q1).

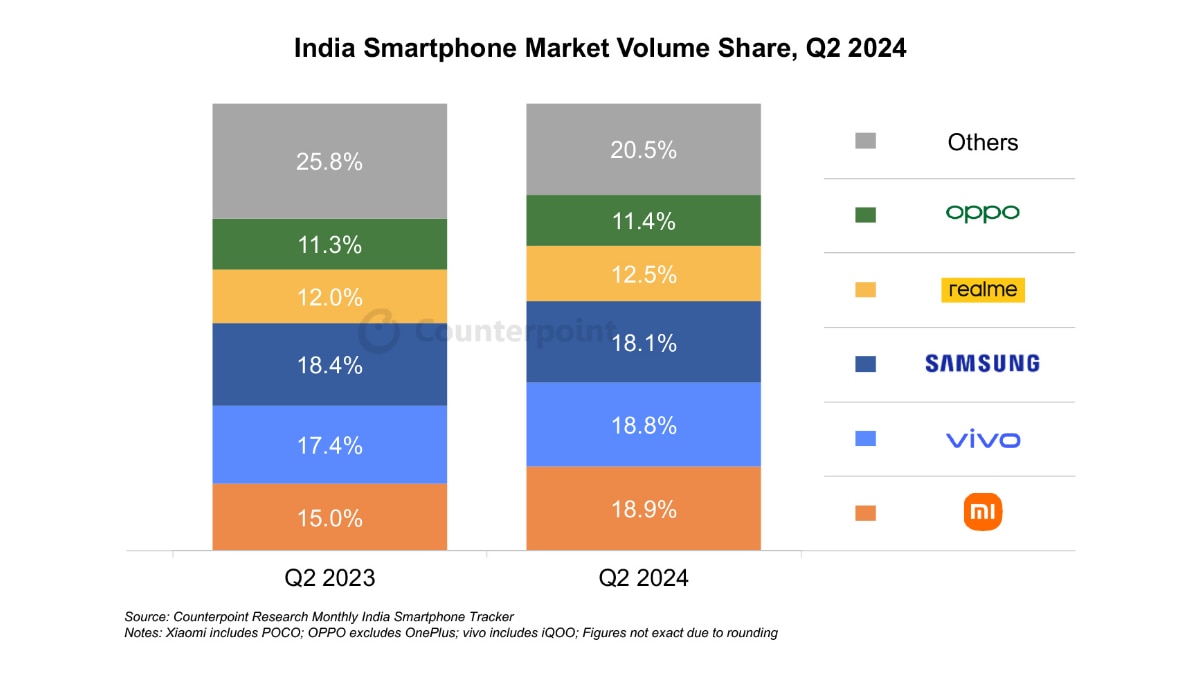

To address excess inventory, smartphone manufacturers organised promotional events during this period. However, these efforts resulted in reduced shipments to retailers and a temporary market decline. During the quarter, Xiaomi reclaimed the top spot with a 23 per cent YoY growth in its shipments, driven by a streamlined and focused portfolio that spans from the entry-level to affordable premium segments.

Also read: LG Joins As Supplier For Apple iPhone SE 4 Display

Samsung Gets Over 25% Market Share In Terms Of Value; Vivo, Apple Follow

Samsung maintained its leading position in terms of market value for the second quarter in a row, capturing more than 25 per cent of the market share. The company's Galaxy Fold 6 series is anticipated to help maintain this dominance. Samsung's focus on higher-value products has paid off, with its ultra-premium segment (devices priced above Rs 45,000) seeing nearly double the growth compared to the previous year.

Also read: Realme 13 Pro+ Vs Motorola Edge 50 Pro: Comparison Of Specs, Camera, Display, More

“Heatwave conditions in various regions led to lower footfalls in offline channels and delayed smartphone purchases as consumers prioritised appliances like air conditioners and refrigerators. This reduced demand caused an inventory build-up. However, summer sales at online channels, good harvest and aggressive promotions towards the end of the quarter provided relief to OEMs, helping close the quarter on a better note than at the beginning," Shilpi Jain, Senior Research Analyst, Counterpoint, said in a statement.

The second spot in terms of value was claimed by Vivo, largely due to the success of its more expensive models, such as the V30 series, which boasts improved camera capabilities, followed by Apple, which secured the third position in terms of value. However, analysts predict a potential upturn for the tech giant in the coming quarter, largely due to recent price reductions across its iPhone lineup.

“In Q2 2024, India’s smartphone market achieved its highest ever Q2 value, driven by the ongoing trend of premiumisation. Consumers continued to upgrade to higher-value smartphones, supported by better trade-in values and easy financing schemes. This resulted in a 24 per cent YoY growth in the ultra-premium (>Rs 45,000) segment, said Shubham Singh, Research Analyst, Counterpoint.