Samsung Dethrones Apple, Becomes Top Smartphone Maker Globally: IDC

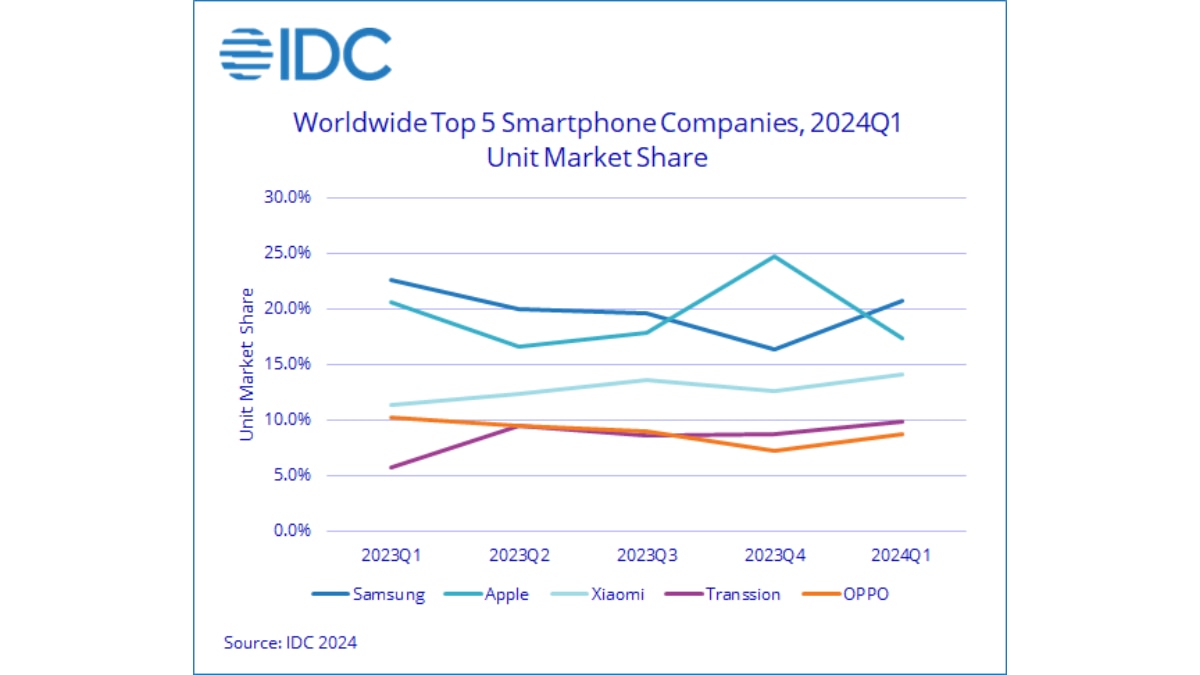

Samsung Electronics has surpassed Apple to claim the top spot as the leading smartphone maker in the first quarter (Q1) of 2024, preliminary data from IDC said.

Samsung Electronics has surpassed Apple to claim the top spot as the leading smartphone maker in the first quarter (Q1) of 2024, preliminary data from the research firm International Data Corporation (IDC) revealed on Monday. Additionally, Chinese handset companies have expanded their presence, capturing a larger portion of the global market share.

IDC further predicted that these two companies will continue dominating the high-end smartphone market. However, the resurgence of tech behemoth Huawei in China, along with significant advancements from Transsion, Oppo/OnePlus, Vivo and Xiaomi will prompt both Samsung and Apple to seek opportunities for expansion and diversification.

Samsung captured 20.8 per cent market share while Apple settled at 17.3 per cent share in Q1 of this year, IDC's preliminary data showed.

"As expected, smartphone recovery continues to move forward with market optimism slowly building among the top brands," Ryan Reith, group vice president, IDC's Worldwide Mobility and Consumer Device Trackers, said in a statement.

"As expected, smartphone recovery continues to move forward with market optimism slowly building among the top brands," Ryan Reith, group vice president, IDC's Worldwide Mobility and Consumer Device Trackers, said in a statement.

"While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter. While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and vivo will likely have both OEMs looking for areas to expand and diversify. As the recovery progresses, we're likely to see the top companies gain share as the smaller brands struggle for positioning," Reith added.

Transsion Sees Remarkable Growth

Transsion experienced remarkable growth, with shipments soaring by an impressive 84.5 per cent. The Chinese major shipped 28.5 million units, securing a market share just shy of 10 per cent.

As the smartphone industry's recovery unfolds, we can expect the leading companies to gain market share while smaller brands face challenges in positioning themselves.

"The smartphone market is emerging from the turbulence of the last two years both stronger and changed," said Nabila Popal, research director with IDC's Worldwide Tracker team.

"Firstly, we continue to see growth in value and average selling prices (ASPs) as consumers opt for more expensive devices knowing they will hold onto their devices longer. Secondly, there is a shift in power among the Top 5 companies, which will likely continue as market players adjust their strategies in a post-recovery world. Xiaomi is coming back strong from the large declines experienced over the past two years and Transsion is becoming a stable presence in the Top 5 with aggressive growth in international markets. In contrast, while the Top 2 players both saw negative growth in the first quarter, it seems Samsung is in a stronger position overall than they were in recent quarters," noted Popal.