Trump's Trade War Hits Wallets: See How Your Currency Is Faring Against The US Dollar

Over 90 countries impacted by fresh US tariffs; INR weakens marginally while Brazil, Serbia see sharper declines.

US President Donald Trump’s latest wave of import tariffs, targeting over 90 countries, has officially taken effect today, sending ripples through global trade corridors. Importers now face a steep cost for bringing foreign goods into the United States, and economists warn that American consumers could eventually foot the bill as businesses pass on the additional expenses.

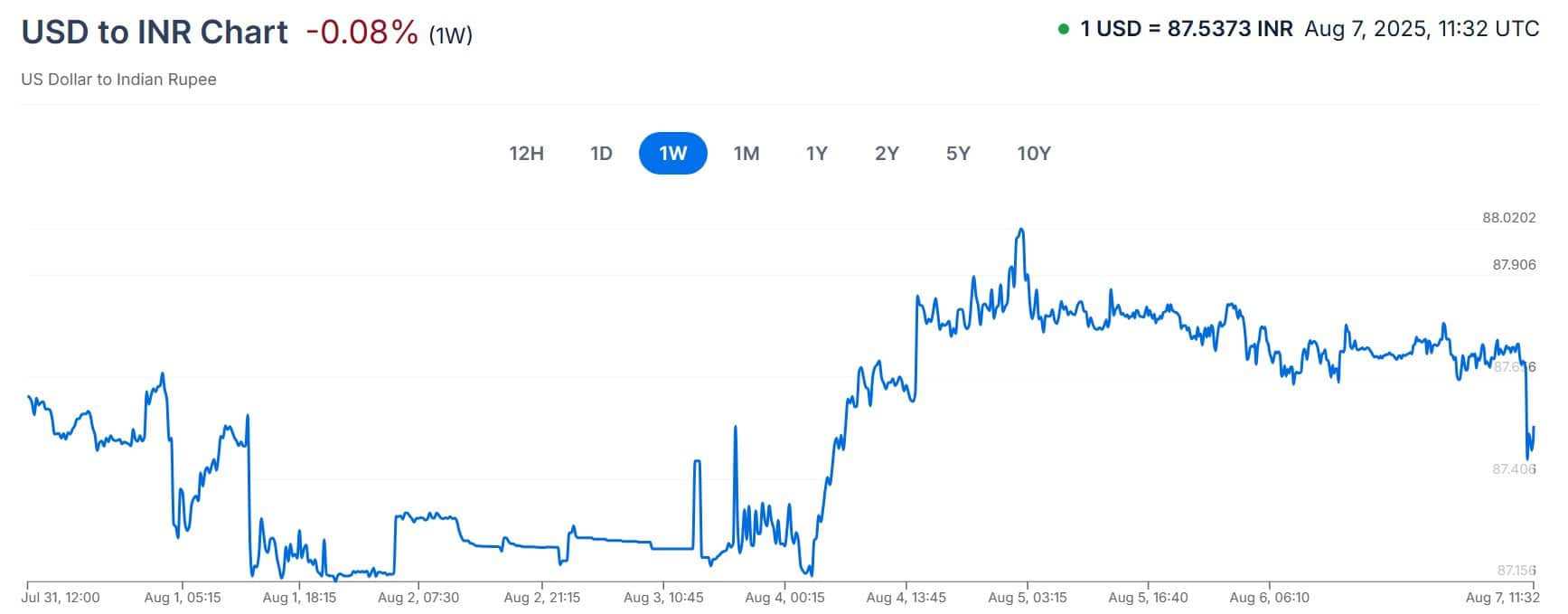

Among the nations impacted is India, which is preparing for a significant 50 per cent tariff rate, set to kick in from August 27. While these new duties have yet to touch Indian shores, market tremors are already visible. The Indian rupee, for instance, has been losing ground against the US dollar, trading at Rs 87.51 per dollar as of August 7.

Currency data from Xe reveals a 4.26 per cent year-on-year rise in USD to INR conversion.

Source: Xe

However, the movement in August alone has shown a marginal decline of 0.14 per cent, suggesting early market caution even before the tariffs hit.

Source: Xe

Tariff Leaders: Brazil & Syria Top Charts

Among the countries currently facing the brunt of the Trump tariffs, Brazil stands out with a massive 50 per cent duty slapped on most of its goods, the highest globally (until India's tariffs come into effect).

Syria follows in a close second, facing a 41 per cent tariff. Laos and Myanmar share the third rank with 40 per cent, while Switzerland ranks fourth with a 39 per cent rate. Several others, including Canada, Iraq, and Serbia, are contending with a 35 per cent levy.

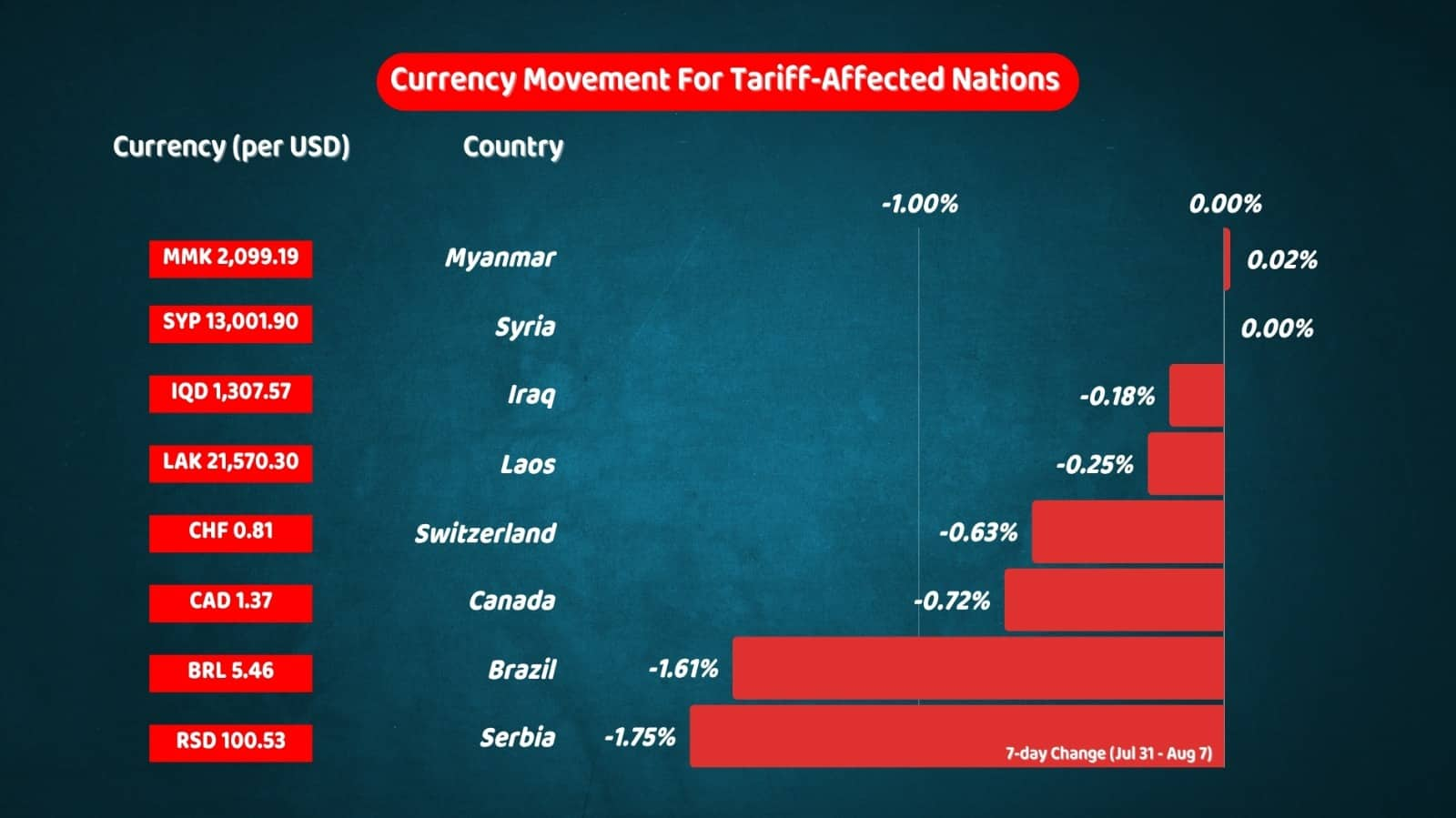

Here’s a closer look at how currencies from countries facing at least 35 per cent tariffs have fared in the past week:

Graphic: ABP Live

Currency Movement For Tariff-Affected Nations (Quick Snapshot)

| Country | Currency (per USD) | 7-day Change (Jul 31 - Aug 7) |

|---|---|---|

| Brazil | BRL 5.46 | -1.61% |

| Syria | SYP 13,001.90 | 0.00% |

| Laos | LAK 21,570.30 | -0.25% |

| Myanmar | MMK 2,099.19 | +0.02% |

| Switzerland | CHF 0.81 | -0.63% |

| Serbia | RSD 100.53 | -1.75% |

| Iraq | IQD 1,307.57 | -0.18% |

| Canada | CAD 1.37 | -0.72% |

Interestingly, while countries like Switzerland and Canada hold stronger currencies, they too are witnessing declines against the dollar, further reflecting global currency pressures under the new trade regime.

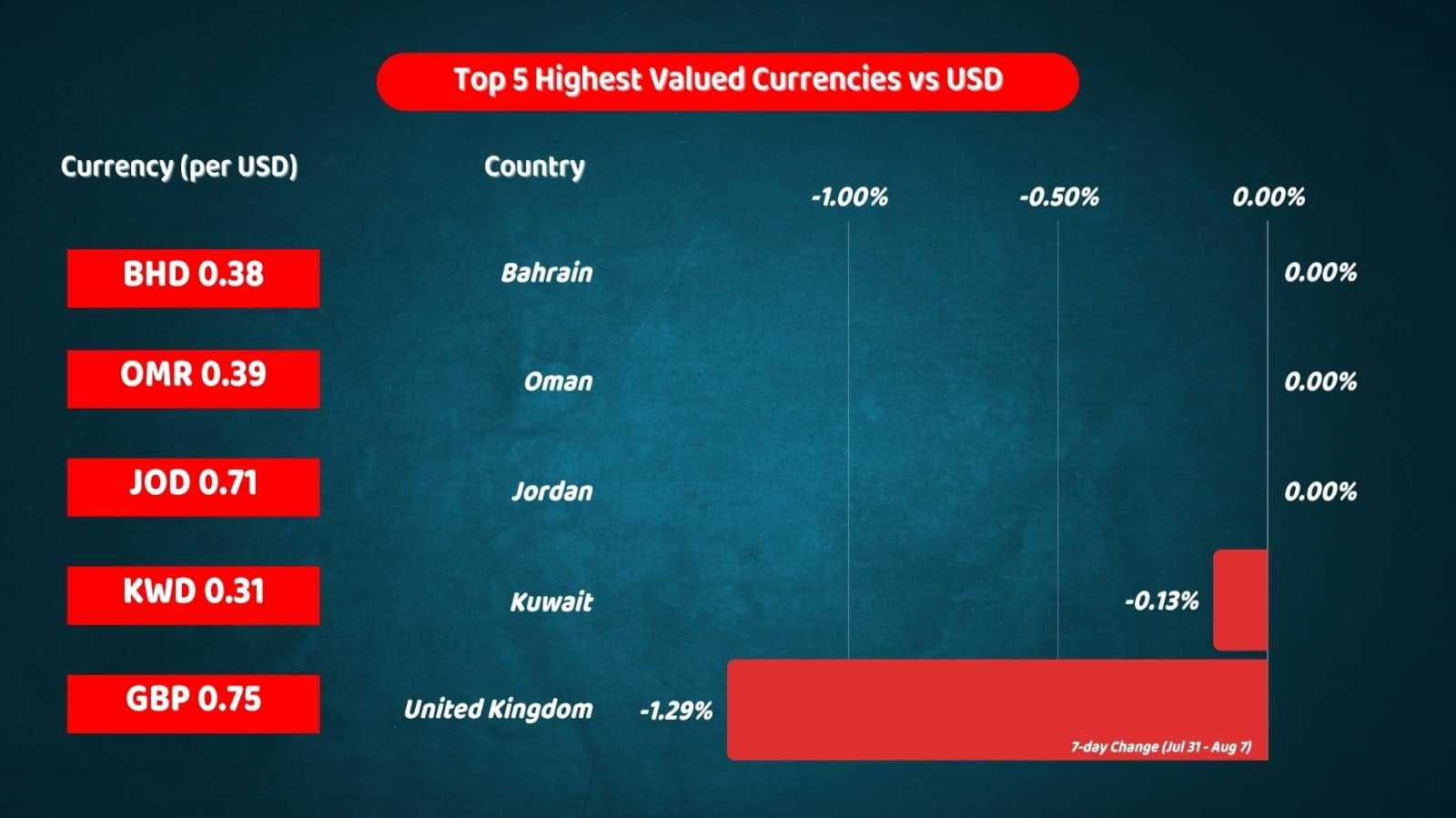

High-Value Currencies Stay Resilient

While several developing and mid-tier economies are experiencing currency turbulence, the world’s most powerful currencies have shown relative stability. Kuwait, Bahrain, and Oman, with the highest purchasing power currencies, have maintained a steady exchange rate in the past week, with zero or minimal movement.

Graphic: ABP Live

Top 5 Highest Valued Currencies vs USD (Quick Snapshot)

| Country | Currency (per USD) | 7-day Change (Jul 31 - Aug 7) |

|---|---|---|

| Kuwait | KWD 0.31 | -0.13% |

| Bahrain | BHD 0.38 | 0.00% |

| Oman | OMR 0.39 | 0.00% |

| Jordan | JOD 0.71 | 0.00% |

| United Kingdom | GBP 0.75 | -1.29% |

Despite the brewing trade turbulence, these high-value currencies seem unfazed, at least for now. But if global trade tensions escalate, even these could see volatility ahead.

Trade Talks Still Simmering

While India’s tariffs are locked in for August 27, some countries are still in a negotiation limbo. China’s 30 per cent tariff has been paused as talks with the US continue, with both sides agreeing to delay further tariffs until August 12.

Mexico, too, has dodged a harsher penalty for now, with existing tariffs held at 25 per cent for 90 more days. Meanwhile, Canada, despite a 35 per cent tariff, enjoys partial exemptions under the US-Mexico-Canada Agreement.

As Washington flexes its tariff muscle, the world watches closely and recalibrates.

Related Video

Union Budget 2025: Arvind Kejriwal lists the shortcomings of the Modi government's budget | ABP News | AAP