Paytm Q3 Results: Revenue Surges To Rs 2062 Crore, Firm Meets Operating Profitability Target

Paytm also said it has narrowed its consolidated net loss to Rs 392 crore in the third quarter ending December 2022.

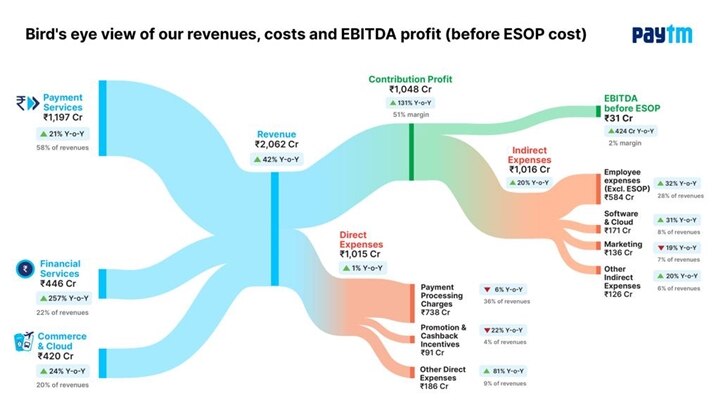

One97 Communications (OCL), the parent entity of mobile payments and financial services company Paytm, said on Friday its revenue from operations jumped about 42 per cent to Rs 2,062.2 crore in the third quarter ending December 2022. Its revenue jumped from Rs 1,456.1 crore in the year-ago period.

Paytm also said it has narrowed its consolidated net loss to Rs 392 crore in the third quarter ending December 2022. The company had posted a net loss of Rs 778.4 crore in the same period a year ago.

The company said it had achieved its operating profitability with EBITDA, excluding ESOP cost at Rs 31 crore, much ahead of its September 2023 timeline.

Paytm founder and CEO Vijay Shekhar Sharma wrote a letter to shareholders announcing the achievement.

"I wrote to you on April 6, 2022, and set a target for EBITDA before ESOP cost breakeven by the September 2023 quarter. I am very happy to share that our company has achieved this milestone of EBITDA before ESOP cost profitability in the December 2022 quarter itself. This is three quarters ahead of our guidance," said Vijay Shekhar Sharma.

"This has been made possible due to the relentlessly focused execution by our team. The team was asked to focus on growth with quality revenues that contribute to the bottom line. We have achieved this milestone without losing sight on growth opportunities and keeping all compliances as well as risk factors under a strict watch," Sharma further said.

Sharma said the next key milestone for Paytm was free cash flow generation. "With our focus on growth and keeping a tight vigil on operational risk and compliances, I am very confident that we will soon achieve our next milestone of becoming a free cash flow generating company," he added.

Shares of the company closed 3.83 per cent down at Rs 524.9 apiece on BSE. The financial result of the company came after market hours.

Top Headlines

Trending News