Budget 2023: Where Does Government Spend Money, Understanding Expenditure

The expenditure part of the Budget can be understood from two main sections of the Budget – Revenue Expenditure and Capital Expenditure

In less than a month Union Finance Minister Nirmala Sitharaman is expected to present Union Budget 2023. The Budget for the financial year 2023-24 will be the last full Budget for this government before the 2024 general elections. There is a constitutional requirement in India to present a statement of estimated receipts and expenditures of the government before Parliament in respect of every financial year which runs from April 1 to March 31.

Last week, ABP Live explained how the government earns income. We took a dive into the Revenue Budget of the government. In this part, we decode how the government spends that money.

How the government spends?

The expenditure part of the Budget can be understood from two main sections of the Budget – Revenue Expenditure and Capital Expenditure. We briefly discussed the Revenue Expenditure in Revenue Budget. Here we will try to decode it further.

Revenue expenditure is defined as spending for purposes other than the creation of physical or financial assets for the central government. It refers to the costs for the day-to-day operation of government departments and various services, interest payments on debt incurred by the government, and grants given to state governments and other parties.

Budget documents classify total expenditures into plan and non-plan expenditures. According to this classification, plan revenue expenditure relates to the central government's plans and central assistance for state and union territory plans. Non-plan expenditure covers a vast range of general, economic, and social services of the government. The main items of non-plan expenditure are interest payments, defence services, subsidies, salaries, and pensions.

Capital expenditures are expenditures of the government that result in the creation of physical or financial assets or a reduction in financial liabilities. This includes expenditure on the acquisition of land, buildings, machinery, equipment, investment in shares, and loans and advances by the central government to state and union territory governments, PSUs, and other parties.

Capital expenditure is also divided into plan and non-plan in the Budget documents. Plan capital expenditure relates to the central government’s plan and central assistance for state and union territory plans. Non-plan capital expenditure covers various general, social, and economic services provided by the government.

Where does government spend the most?

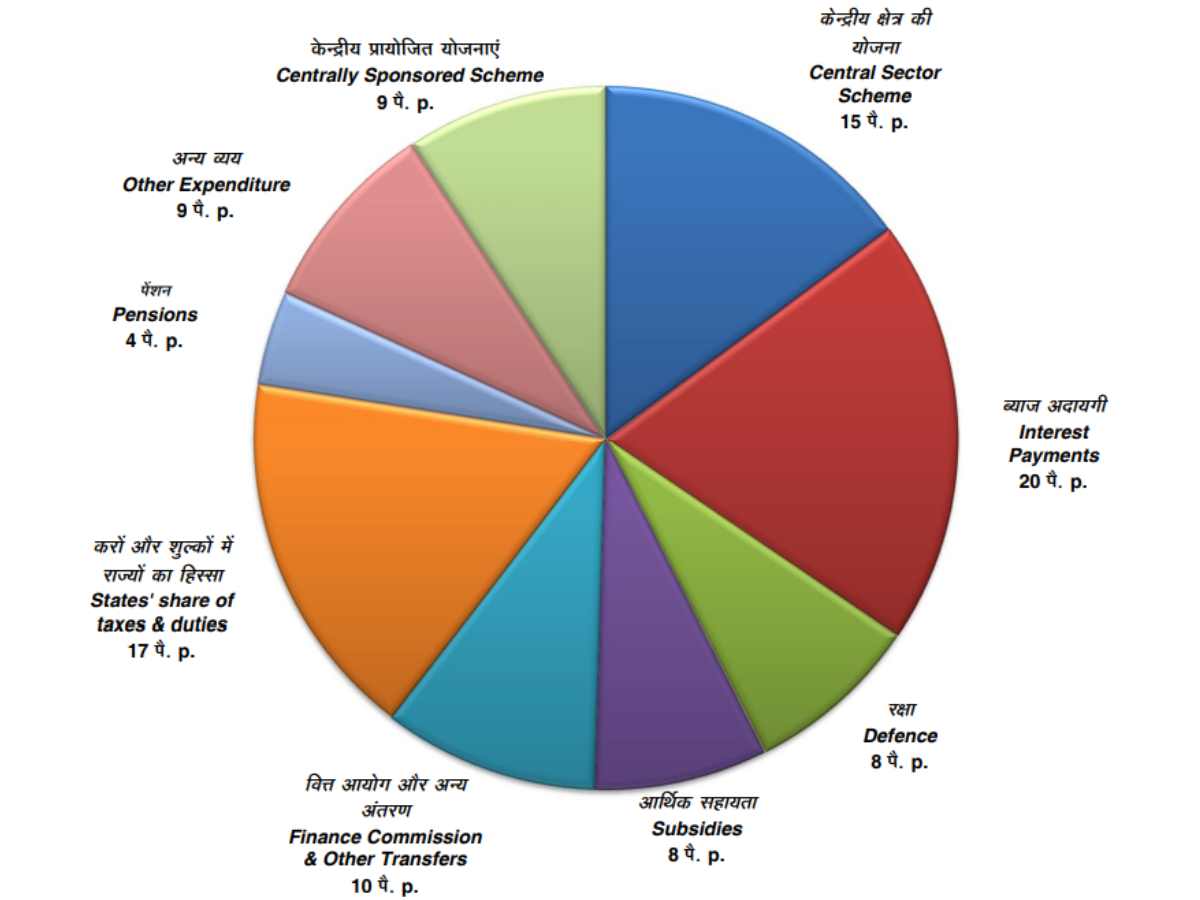

For Revenue Expenditure, interest payments on market loans, external loans, and various reserve funds make up the single largest component of non-plan revenue expenditure. In 2022, the government allocated 20 per cent of the total Budget expenditure for interest payments. Defence expenditure, dedicated to national security, took 8 per cent of the total Budget expenditure in 2022. Subsidies are an important policy instrument that aims at increasing welfare. Aside from offering implicit subsidies through underpricing of public goods and services like education and health, the government also provides explicit subsidies on products such as exports, loan interest, food, and fertilisers. In 2022, the government allocated 8 per cent of Budget expenditure for subsidies.

(Image Credit: Budget at a glance, Budget 2022, Minister of Finance)

Aside from these the central government also allocates a large portion of the Budgetary expenditure for centrally sponsored schemes, central sector schemes, finance commissions and other transfers, pensions, and states' share of taxes and duties.

Capital expenditure and effective capital expenditure

When you go through Budget documents you see another term called Effective Capital Expenditure. While capital expenditure is something the central government spends on its own, it also provides grants-in-aid to the state governments, constitutional authorities or bodies, autonomous bodies, and other scheme-implementing agencies for the creation of capital assets that are owned by the said entities. So, the total expenditure which includes Capital Expenditure and grants-in-aid for the creation of capital assets is called Effective Capital Expenditure. This provides a clear picture of government expenditure in Capital Budgeting.

The Constitution recognises two types of expenditure: expenditure on revenue account and other expenditure (or capital expenditure) and these must be separately shown in the Budget for approval of the Parliament. This constitutional requirement limits capital expenditure and prevents it from being shifted to meet revenue expenditures by executive orders. In other words, the Budget provision for capital expenditure must be used only for that purpose, or it would be left alone.

However, the central government can utilise the money allocated for grants for the creation of capital assets to meet other revenue expenditures by executive orders. This diminishes the financial supremacy of the legislature over the executive. The Budget documents contain relatively little information about the assets that are expected to be developed via grants in aid. Some critics say this diminishes transparency of government expenditure.

How Budgetary Expenditure Impacts Economy And Common People

Since Independence, the Budget has been reflecting and shaping the country’s economic life. It also vastly affects nations' fiscal state. As different governments tend to follow separate sets of economic ideologies, the annual Union Budget also reflects the same. This can be seen especially at a time of elections. It has been observed by experts that the central government spending increases in the last Budget before the general elections. An analysis by LiveMint shows that most Union governments have resorted to fiscal expansion in the year ahead of general elections.

But this extra spending can’t always be financed through revenues accumulated by Budgetary resources. One of the most notable and intriguing aspects of the government budget is the borrowings made by government entities to fund various government programmes. These borrowings are not included in the budget. These borrowings could be done by government-owned organisations such as the FCI to support some of the planned initiatives such as food subsidies.

If these items are also included in the government accounts, the fiscal deficit of the government shoots up. These borrowings made by government-owned entities that effectively become the debt of the government are known as extra-budget borrowings (EBR). For instance, In 2018-19, 61.4 per cent of all capital expenditure outlined in the Budget was expected to be financed through EBR. This can have a negative impact on economic health in long run.

However, in the short term public benefits from such spending. Like in Budget 2022, the Modi government allocated increased spending on many sectors including, transport, agriculture and allied activities, education, rural development, urban development, health, and social welfare. Outlays on Major Schemes were also raised in Budget 2022. This included spending on 130 schemes (including Core Schemes and Core of the Core Schemes).

Expectations And Predictions

The Centre may not expand its capital expenditure for FY24 to as large as it did in the previous two Budgets as it believes that private-sector capital expenditure is recovering strongly from the pandemic era. In FY23, the Budgetary capital expenditure was Rs 7.5 lakh crore, which is 35.4 per cent higher than the FY22 Budget Estimate (BE) of Rs 5.54 lakh crore.

According to a Business Standard report, capital expenditure could increase by around 25 per cent in the Union Budget 2023. A senior government official told Business Standard, “the data tracked by the government and independent agencies shows private-sector Capex is recovering strongly. There are discussions on how much to increase the Centre’s Capex in the coming year.”

In the Winter Session, Sitharaman had said, "Private-Capex announcements are up by 35 per cent year over year and 53 per cent above pre-Covid levels." Adding that the Centre had seen a robust response to its Production-Linked Incentive (PLI) scheme in 14 sectors as well.

In early December, Chief Economic Advisor V Anantha Nageswaran said, "It may not be necessary or healthy for the public sector to keep expanding capital investment at the same pace. Capital expenditure has to increase but not at the same pace because not only should we not be crowding out the private sector, we should be ensuring that the combined investment spending by the public and private sectors should not drive up the cost of capital too much."