Explorer

Advertisement

EPFO reduces interest rate, declares 8.55% in FY18

EPFO reduces interest rate, declares 8.55% in FY18

Retirement fund body EPFO is expected to keep interest rate unchanged at 8.65 per cent on provident funds for its about 5 crore members for 2017-18 at its trustees' meet on February 21, 2018, sources said.

The Employees Provident Fund Organisation (EPFO) has already sold exchange traded funds (ETF) worth Rs 2,886 crore earlier this month to bridge the gap to maintain 8.65 per cent for this fiscal, they said.

The EPFO had announced 8.65 per cent rate of interest on deposits for 2016-17, a tad lower than 8.8 per cent in 2015- 16.

It has earned a return of around 16 per cent at Rs 1,054 crore which would be sufficient to provide 8.65 per cent rate of interest this fiscal, said sources.

The income projections for the current fiscal have not been circulated along the agenda to the trustees and it would be tabled during the meeting, they said, adding the decision to sell the ETFs was taken after factoring in the income projections for the current fiscal by the EPFO.

The EPFO has been investing in ETF since August 2015 and it has so far not monetised the ETF investments. The EPFO has invested around Rs 44,000 crore in the ETFs till date.

The agenda listed for the meeting of the trustees includes the proposal for rate of interest on the EPF deposits for the current fiscal.

The trustees may also review the proposal to credit the ETFs into the members' EPF account because a large number of members do not have that level of financial literacy.

It is proposed that the members should be given option to have ETF credits in their EPF account.

Retirement fund body EPFO is expected to keep interest rate unchanged at 8.65 per cent on provident funds for its about 5 crore members for 2017-18 at its trustees' meet on February 21, 2018, sources said.

The Employees Provident Fund Organisation (EPFO) has already sold exchange traded funds (ETF) worth Rs 2,886 crore earlier this month to bridge the gap to maintain 8.65 per cent for this fiscal, they said.

The EPFO had announced 8.65 per cent rate of interest on deposits for 2016-17, a tad lower than 8.8 per cent in 2015- 16.

It has earned a return of around 16 per cent at Rs 1,054 crore which would be sufficient to provide 8.65 per cent rate of interest this fiscal, said sources.

The income projections for the current fiscal have not been circulated along the agenda to the trustees and it would be tabled during the meeting, they said, adding the decision to sell the ETFs was taken after factoring in the income projections for the current fiscal by the EPFO.

The EPFO has been investing in ETF since August 2015 and it has so far not monetised the ETF investments. The EPFO has invested around Rs 44,000 crore in the ETFs till date.

The agenda listed for the meeting of the trustees includes the proposal for rate of interest on the EPF deposits for the current fiscal.

The trustees may also review the proposal to credit the ETFs into the members' EPF account because a large number of members do not have that level of financial literacy.

It is proposed that the members should be given option to have ETF credits in their EPF account.

India

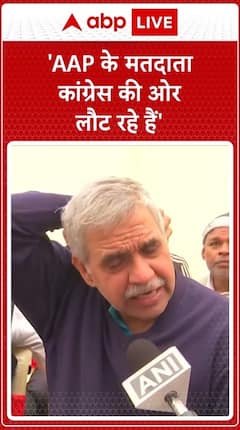

Delhi Elections 2025: Political Debate Intensifies Over PM Modi's Development Announcements

PM Modi to Unveil Major Infrastructure Projects for Delhi Ahead of 2025 Elections

BPSC Protest: Prashant Kishor Reacts to Re-Exam, Criticizes Government's Handling

PM Modi to Unveil Over ₹12,000 Crore Worth of Development Projects Ahead of Delhi Elections 2025

BJP's Big Move Before Delhi Elections 2025: PM Modi to Launch Multi-Crore Development Projects

View More

Advertisement

Advertisement

Advertisement

Top Headlines

Cities

India

Cricket

Cities

Advertisement

Trending News

Sayantan Ghosh

Opinion