Explorer

Advertisement

The Significance of No Claim Bonus in Insurance

With the increase in competition in the insurance market, insurance companies are competing to stay ahead of the game by offering perks and value-addition on their products. The discounts offered during the festive seasons are noteworthy, so are the benefits offered to long-term customers in the form of loyalty discounts and No Claim Bonuses.

A No Claim Bonus (NCB) is an attractive discount available under motor and health insurance plans. It helps in shaving off a significant amount from your insurance premium. Let us take a look at how it works and how you can build yours.

How can I get a No Claim Bonus?

No Claim Bonus is offered by car insurance companies to customers who refrain from raising any claims in a policy year. This benefit can translate into a significant reduction in the renewal of premium. It is possible to accumulate the NCB under the insurance policy over a period of time so that premium discounts are amplified.

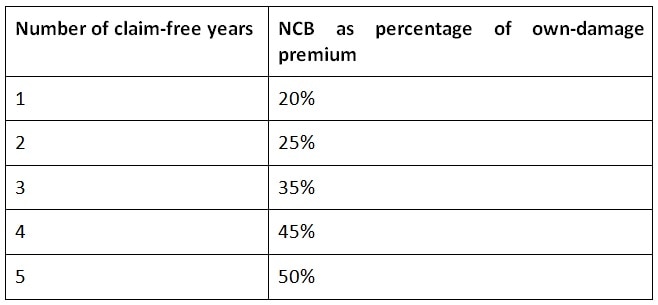

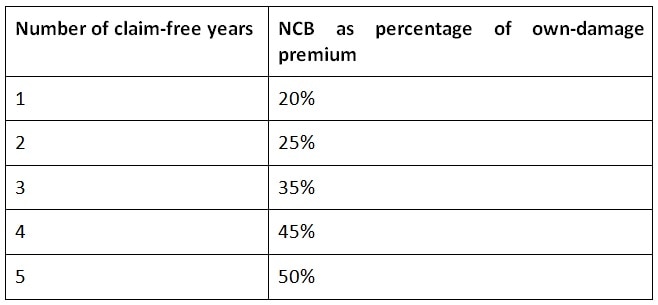

In car insurance, diligent drivers who do not get involved in accidents get rewarded through a No Claim Bonus. Most insurance companies allow you to accumulate the NCB for up to 5 years when working out a discount. The rate at which one accrues the bonus is as shown below:

A No Claim Bonus (NCB) is an attractive discount available under motor and health insurance plans. It helps in shaving off a significant amount from your insurance premium. Let us take a look at how it works and how you can build yours.

How can I get a No Claim Bonus?

No Claim Bonus is offered by car insurance companies to customers who refrain from raising any claims in a policy year. This benefit can translate into a significant reduction in the renewal of premium. It is possible to accumulate the NCB under the insurance policy over a period of time so that premium discounts are amplified.

In car insurance, diligent drivers who do not get involved in accidents get rewarded through a No Claim Bonus. Most insurance companies allow you to accumulate the NCB for up to 5 years when working out a discount. The rate at which one accrues the bonus is as shown below:

The above table indicates that if a car owner does not raise any claims after 1 policy year, he/she is eligible to receive an NCB that can bring down the car insurance renewal premium by 20%. It should be noted that this is applicable only to the own-damage part of the premium, not the third-party liability premium.

In the health insurance domain, NCB is also referred to as cumulative bonus. It is offered under indemnity-based health insurance policies. This is how it works:

The above table indicates that if a car owner does not raise any claims after 1 policy year, he/she is eligible to receive an NCB that can bring down the car insurance renewal premium by 20%. It should be noted that this is applicable only to the own-damage part of the premium, not the third-party liability premium.

In the health insurance domain, NCB is also referred to as cumulative bonus. It is offered under indemnity-based health insurance policies. This is how it works:

A No Claim Bonus (NCB) is an attractive discount available under motor and health insurance plans. It helps in shaving off a significant amount from your insurance premium. Let us take a look at how it works and how you can build yours.

How can I get a No Claim Bonus?

No Claim Bonus is offered by car insurance companies to customers who refrain from raising any claims in a policy year. This benefit can translate into a significant reduction in the renewal of premium. It is possible to accumulate the NCB under the insurance policy over a period of time so that premium discounts are amplified.

In car insurance, diligent drivers who do not get involved in accidents get rewarded through a No Claim Bonus. Most insurance companies allow you to accumulate the NCB for up to 5 years when working out a discount. The rate at which one accrues the bonus is as shown below:

A No Claim Bonus (NCB) is an attractive discount available under motor and health insurance plans. It helps in shaving off a significant amount from your insurance premium. Let us take a look at how it works and how you can build yours.

How can I get a No Claim Bonus?

No Claim Bonus is offered by car insurance companies to customers who refrain from raising any claims in a policy year. This benefit can translate into a significant reduction in the renewal of premium. It is possible to accumulate the NCB under the insurance policy over a period of time so that premium discounts are amplified.

In car insurance, diligent drivers who do not get involved in accidents get rewarded through a No Claim Bonus. Most insurance companies allow you to accumulate the NCB for up to 5 years when working out a discount. The rate at which one accrues the bonus is as shown below:

The above table indicates that if a car owner does not raise any claims after 1 policy year, he/she is eligible to receive an NCB that can bring down the car insurance renewal premium by 20%. It should be noted that this is applicable only to the own-damage part of the premium, not the third-party liability premium.

In the health insurance domain, NCB is also referred to as cumulative bonus. It is offered under indemnity-based health insurance policies. This is how it works:

The above table indicates that if a car owner does not raise any claims after 1 policy year, he/she is eligible to receive an NCB that can bring down the car insurance renewal premium by 20%. It should be noted that this is applicable only to the own-damage part of the premium, not the third-party liability premium.

In the health insurance domain, NCB is also referred to as cumulative bonus. It is offered under indemnity-based health insurance policies. This is how it works:

- If the policyholder does not raise any claims in a policy year, there is an increase in the sum assured by at least 5%. This bonus increases progressively for each claim-free year. The cumulative bonus can be accumulated under the policy for up to 10 years.

- Some insurance companies offer this benefit in the form of a discount on the renewal premium. It is also found that certain insurers offer the NCB as a combination of premium discount and extended cover.

- The actual amount of cumulative bonus that the policyholder will be liable to receive is listed in the fine print of the health insurance policy. There are no year-wise bonus slabs in health insurance as seen under motor insurance. However, the maximum amount offered can go up to 50%.

- In case the policyholder does not renew the policy, he/she is liable to lose the accrued NCB.

- The rate of increase in the NCB each year varies from insurer to insurer. This value is usually 10% for most insurers.

Follow Breaking News on ABP Live for more latest stories and trending topics. Watch breaking news and top headlines online on ABP News LIVE TV

View More

Advertisement

Trending News

Advertisement

Advertisement

Top Headlines

World

India

Election 2024

World

Advertisement