Explorer

Advertisement

Rs 50,000 crore debt: Cabinet gives in-principle nod for divestment in bleeding Air India

"In-principle approval for Air India divestment has been given," Finance Minister Arun Jaitley told a press briefing after the cabinet meeting chaired by Prime Minister Narendra Modi.

New Delhi: Moving ahead on the proposal for privatisation, the Union cabinet gave its in-principle approval for divestment of Air India, whose debt has mounted to Rs 50,000 crore besides huge losses.

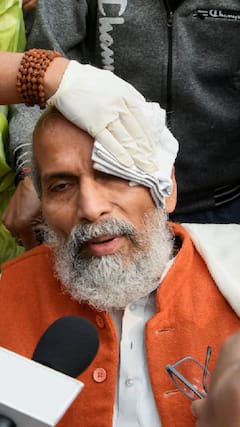

"In-principle approval for Air India divestment has been given," Finance Minister Arun Jaitley told a press briefing after the cabinet meeting chaired by Prime Minister Narendra Modi on Wednesday.

"The Civil Aviation Ministry's proposal for formation of a group under the chairmanship of the Finance Minister to decide the modalities of divestment process has also been accepted," he said.

Apart from Jaitley, the group will include Civil Aviation Minister Ashok Gajapathi Raju and some other ministers to be decided by the Prime Minister.

The group will guide the process on strategic divestment and decide that the treatment of unsustainable debt of Air India and hiving-off of certain assets to a shell company, officials said.

The demerger and strategic divestment of three profit making subsidiaries, the quantum of disinvestment and the universe of bidders will also be taken up by the ministerial group to be headed by Jaitley.

Jaitley has in the recent past expressed strong views on the need to divest Air India considering that it had acquired heavy losses over a long period.

"There are many private airlines like Jet Airways, IndiGo, GoAir. If 86 per cent of the aviation market can be handled by private sector, then 100 per cent can also be handled by the private sector," Jaitley had said.

National passenger carrier Air India currently has a market share of 14 per cent and a debt of Rs 50,000 crore. The private airlines enjoy 86 per cent of the market share.

"Air India has a debt of Rs 50,000 crore. Its valuation of aircrafts will be at Rs 20,000-25,000 crore. The civil aviation ministry is exploring all possibilities," Jaitley had said.

In a recent report to the Civil Aviation Ministry, the NITI Aayog recommended strategic disinvestment in the loss-making Air India, by which government control would be transferred to a private owner.

The airline in 2015-16 had posted an operating profit of Rs 105 crore. For the last fiscal 2016-17 the company is expected to report an improved operating profit margin.

The flag carrier had got a new lease of life on April 12, 2012, when the previous central government under the UPA regime had approved a Rs 30,000 crore turnaround (TAP) and financial restructuring plans (FRP) package spanning up to the year 2021.

The mega financial package came with stringent riders like maintaining high on-time performance and healthy load factors.

The central government under the TRP had allocated to infuse an additional equity of Rs 1,800 crore in the cash-strapped airline for 2017-18 fiscal.

Currently, Air India's portfolio of subsidiaries include Air India Engineering Services, Air India Transport Services, Alliance Air, Air India Express and the Hotel Corporation of India. It also has a ground handling joint venture AISATS.

Apart from its subsidiaries, the national passenger carrier owns several properties in India and abroad, operational slots at international airport and priceless art work, besides a well trained manpower.

According to the company's website, Air India operates 118 different kinds of aircraft. Its international network consists of 41 destinations across the US, Europe, Australia, Far East and South East Asia and the Gulf.

The airline's domestic network covers 72 destinations, including far-flung areas of the North-East, Ladakh, Andaman and Nicobar Islands.

Follow Breaking News on ABP Live for more latest stories and trending topics. Watch breaking news and top headlines online on ABP News LIVE TV

View More

Advertisement

Trending News

Advertisement

Advertisement

Top Headlines

Cities

India

India

Science

Advertisement

Amitabh Tiwari

Opinion