Fact Check: No, Govt Of India Has Not Announced Any Income Tax Exemption For Senior Citizens Above 75

The claim that senior citizens over 75 are exempt from income tax and filing IT returns is false. However, those with only pension and interest income are exempt from filing ITRs.

A post (here & here) is being widely shared on social media claiming that the central government has announced that senior citizens above 75 years, who rely on pensions and other welfare programs, are exempt from paying income taxes and filing IT returns. Let’s verify the claim made in the post.

Claim: Senior citizens above 75, reliant on pensions and welfare programs, are exempt from income taxes and IT returns.

Fact: The Government of India has not made any decision to exempt senior citizens above 75 years from paying taxes. However, effective from 01 April 2021, senior citizens above 75 years, with only pension and interest income, are exempt from filing ITR. Taxes, if applicable, are deducted by the specified bank after computing the income and eligible deductions. Hence the claim made in the post is FALSE.

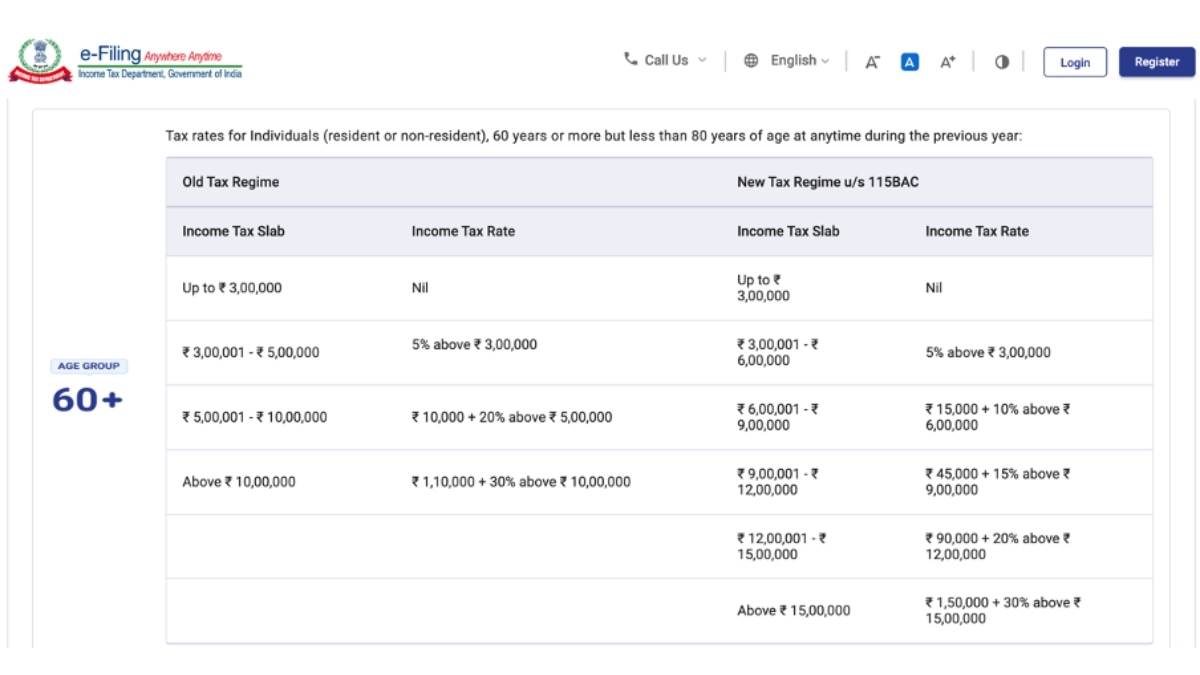

Firstly, we referred to the Income Tax website to understand the tax slabs for senior and super senior citizens. According to the latest information, senior citizens (aged 60 years or more but less than 80 years) with an annual income of up to ₹3 lakhs, including income from pensions, are exempt from paying income tax under both the new and old tax regimes. However, senior citizens earning more than ₹3 lakhs must pay taxes based on their applicable income tax slab and regime. A detailed tax breakdown is provided in the table below.

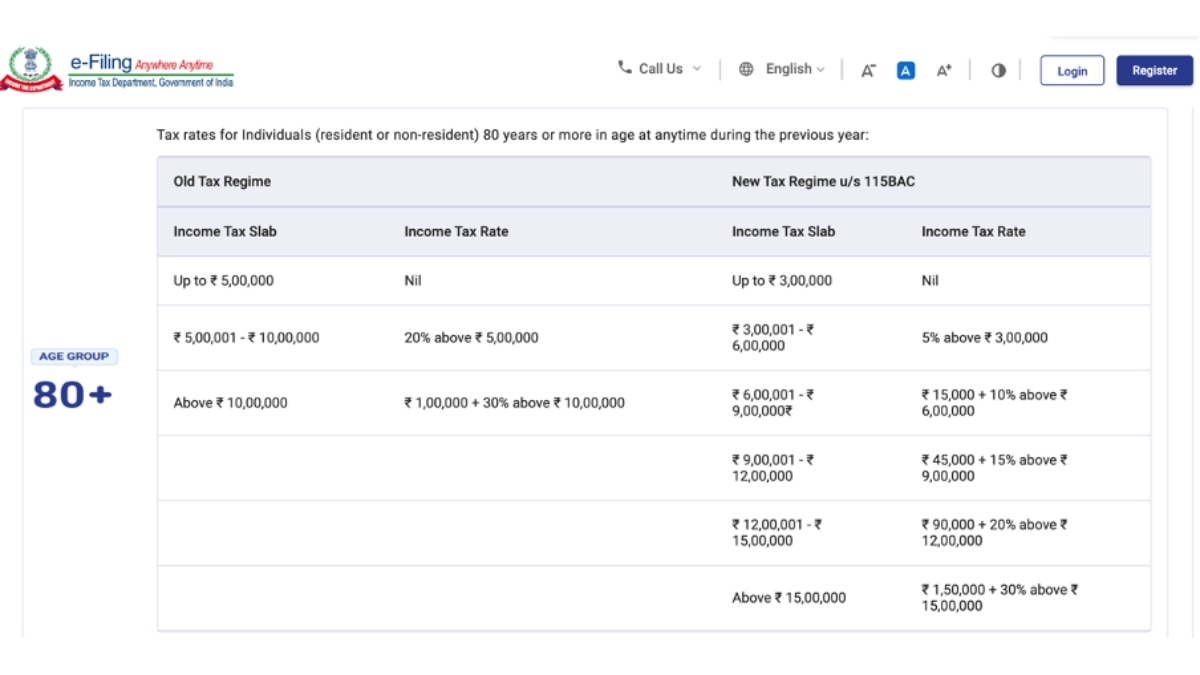

Similarly, super senior citizens (aged 80 years or above) are exempted from paying tax if their annual income, including income from pensions, is less than ₹5 lakhs and ₹3 lakhs under old and new tax regimes respectively. However, super senior citizens earning more than these amounts are required to pay taxes based on their applicable income tax slab and regime. A detailed tax breakdown is provided in the table below. More detailed information about the deductions and benefits applicable for senior and super senior citizens can be seen here and here.

However, effective 01 April 2021, Section 194P of the Income Tax Act, 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above. Conditions for exemption are:

- Senior Citizen should be of age 75 years or above

- Senior Citizen should be ‘Resident’ in the previous year

- Senior Citizen has pension income and interest income only & interest income accrued/earned from the same specified bank in which he is receiving his pension

- The senior citizen will submit a declaration to the specified bank.

- The bank is a ‘specified bank’ as notified by the Central Government. Such banks will be responsible for the TDS deduction of senior citizens after considering the deductions under Chapter VI-A and rebate under 87A.

- Once the specified bank, as mentioned above, deducts tax for senior citizens above 75 years of age, there will be no requirement to furnish income tax returns by senior citizens.

Moreover, on 28 November 2024, the PIB Fact Check Unit clarified that the Central Government had not made any decision to exempt senior citizens above 75 years from paying taxes. However, it mentioned that senior citizens above 75 years, with only pension and interest income, are exempt from filing ITR (as per Section 194P). Taxes, if applicable, are deducted by the specified bank after computing the income and eligible deductions.

A message circulating on social media claims that as India commemorates 75 years of its Independence, senior citizens above 75 years of age will no longer have to pay taxes.#PIBFactCheck

— PIB Fact Check (@PIBFactCheck) November 28, 2024

✔️This message is #fake pic.twitter.com/VAqRPEid2E

To sum up, the Indian government has not announced any tax exemption for senior & super-senior citizens.

Disclaimer: This story was originally published by Factly, as part of the Shakti Collective. Except for the headline and excerpt, this story has not been edited by ABP LIVE staff.

Related Video

Exclusive: Akhilesh Jumps Barricades, Leads Opposition March To EC Amid Vote Looting Allegations