The Importance Of The Three-Day Window In Payment Fraud And Zero Loss. Find Out

This rule essentially shields consumers from financial loss if they report fraudulent activity on their account within three working days

The Reserve Bank of India (RBI) has clear guidelines to safeguard consumers from unauthorised electronic banking transactions. One of the most important aspects of this protection is the three-day zero liability rule. This rule essentially shields consumers from financial loss if they report fraudulent activity on their account within three working days. But why is this 72-hour window so critical, and what happens if you miss it? Let’s look at what the rules say.

ZERO LIABILITY

Under RBI's guidelines, if an unauthorised transaction occurs due to third-party fraud or system errors, you can walk away with zero liability if you report the incident within three working days of being notified. This is a protective measure for consumers who promptly flag issues, giving them peace of mind. For example, imagine you receive a fraudulent transaction alert on a Monday and report it by Wednesday. No matter the amount, the bank must restore your balance. This rule is vital for protecting consumers from losing significant sums in digital fraud cases.

WHY 3 DAYS?

The three-day window might seem stringent. But it's based on practical considerations. In the age of digital alerts — SMS, email, or app notifications — fraudulent activity can be detected almost immediately. The faster a fraudulent transaction is flagged, the less opportunity fraudsters have to drain funds or continue unauthorised activity. For instance, if you spot a Rs 50,000 debit that you didn’t authorise, the earlier you report it, the quicker the bank can act to stop further fraud, limiting potential damage.

WHAT HAPPENS AFTER 3 DAYS?

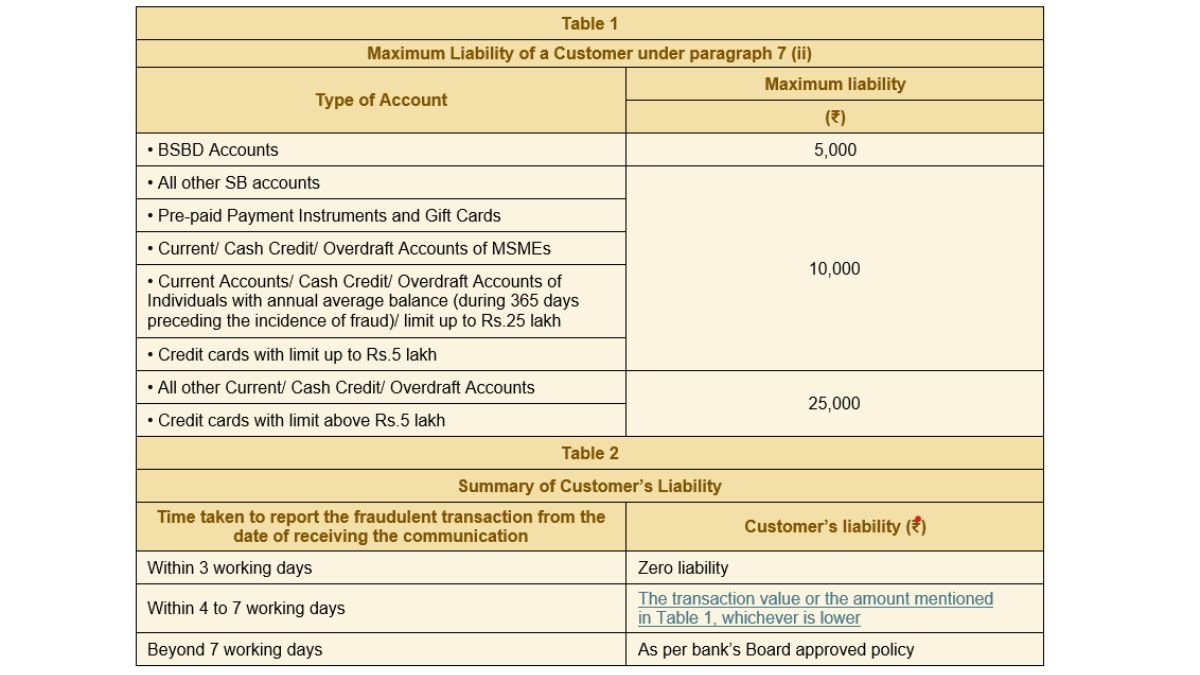

If you fail to notify the bank within three working days but manage to report the transaction within four to seven working days, your liability is capped. For savings accounts, this cap is Rs 10,000, meaning even if the fraud involves a larger sum, you'll only bear the smaller amount. Take a scenario where a scammer withdraws Rs 30,000 from your account. If you report it on the fourth day, your maximum loss would still be just Rs 10,000, thanks to this cap. However, miss the seven-day mark, and the bank’s policies determine your liability — potentially leading to greater financial loss.

BURDEN OF PROOF AND CUSTOMER NEGLIGENCE

The RBI places the burden of proof squarely on banks when it comes to unauthorised transactions. This means that if fraud occurs, the bank is responsible for proving whether you, the customer, were negligent. However, if it is found that you shared sensitive details such as your PIN or OTP, the liability shifts to you. For instance, if a scammer gains access to your account because you shared your OTP over the phone, you bear the full financial loss until you report it. The lesson here is simple: never share your payment credentials, and always take immediate action when something seems amiss.

SHADOW REVERSALS

If you report a fraudulent transaction within the stipulated period, the bank must reverse the amount within 10 working days. This is known as a “shadow reversal.” This credit is temporary but ensures that you don’t lose access to your funds while the bank investigates. For instance, if Rs 20,000 is fraudulently debited and you report it within two days, the bank will credit that amount back to your account while the issue is being resolved.

The RBI's 3-day zero liability rule empowers consumers. But the onus is on consumers to practice safe digital habits, and act quickly after being defrauded. The faster you report a fraudulent transaction, the better your chances of walking away from financial loss.

The author is AVP, Head of Communications, BankBazaar. This article has been published as part of a special arrangement with BankBazaar.