Why Equity Investment Is Gaining Traction Among Novice Investors

For beginners, large-cap stocks with long-term growth are suggested because large-cap firms are less volatile and more stable than smaller companies

Want to generate wealth? Investing in the stock market could be the best option for you. However, for a beginner, investing in the stock market is not an easy task. It requires a sound understanding of the equity market and stocks apart from many other things. Foraying into the stock market can be thrilling and equally challenging. For a novice investor, knowledge about stocks, equity market, regulatory guidelines, and patience are required before investing.

Of late, equity investment is gaining traction among beginners, and data collected by the two major depositories, the Central Depository Service (CDSL) and the National Securities Depository (NSDL), only proves the point. The total number of active dematerialised (Demat) accounts in India surpassed 120 million for the first time in June. Data collected that month saw an addition of 2.36 million new accounts, marking the highest monthly increase since May 2022. The total demat tally crossed 120.51 million, up 2 per cent from a month ago and 24.41 per cent from a year ago.

Why Invest In Stock Market?

The two most common options to invest in equities are equity shares and equity mutual funds. So, why should one invest in the stock market?

According to Kranthi Bathini, director, equity strategy, at WealthMills Securities Pvt Ltd, increasing awareness among the masses, especially among the beginners, is leading them towards investing in equities. "People looking for an alternative income invest in stocks. By investing in the stock market, one can create wealth. But this is a long-term procedure. And, it may take time, at least around 5 years to reap benefits," he told ABP Live.

Bathini pointed out that stock investment is also much more effective than investing in gold or real estate. The push in digitisation is helping novice investors to access knowledge regarding equity investments. Like any investment, equity investments also come with their own set of risks. Seasoned investors, too, make mistakes and lose money sometimes. So, relevant knowledge on stocks and markets is necessary before one starts investing. He said the visibility on stock investment has gone up rapidly, which in turn is pushing newcomers to invest in stocks.

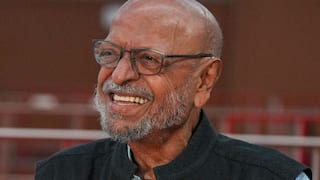

Deven Choksey, promoter of KRChoksey Group and managing director of KRChoksey Shares and Securities Pvt. Ltd, said stock investment is a wealth-creating instrument. This encourages small investors to invest in equities. "Investing in equities can help beat inflation and also allows small investors to physically build wealth over a period of time," Choksey said.

A strong stock market can drive more investments, encouraging more newcomers to invest in equities.

Regarding the current nature of the stock market, Choksey said that markets will continue to rise as long as liquidity in the system. "Liquidity continues to be there in the system; strong fundamentals which are there in the economy and in the corporate sector are also driving the market," he said. According to Choksey, these two are the main reasons which are driving the market up.

Bathini said that consistent FPI inflows are helping the markets to gain considerably. However, markets mostly depend on geopolitical events, so rise and fall are natural occurrences. It is presumed that the stock market and economic performance of a country are usually aligned. Thus, if a stock market is performing well, it hints that the economy is functioning well.

Vittal Ramakrishna, CEO and founder of POD World, a start-up investment firm, said equity investments serve as an additional income source, allowing individuals to build substantial wealth for their future, which grows over time and appreciates in value.

"The recent surge in equity investments can be attributed to the rise of new-age retail investors, who now have the opportunity to purchase partial shares in companies, granting them ownership privileges and nudging them to explore this new asset class. Nevertheless, it is crucial to diversify equity investments. Given the constantly evolving market, maintaining an updated and expanding portfolio is the most effective way to mitigate risks," he said.

Advice For New Investors

Novice investors are always advised to go for long-term investments instead of betting on an intra-day basis. Intra-day trading carries a higher risk in comparison to long-term investments or even short-term deals. The other major decision is buying the right stock. For beginners, large-cap stocks with long-term growth are suggested because large-cap firms are less volatile and more stable than smaller companies. Large-cap firms or blue chip companies are regarded safer for investments than mid-cap or small-cap companies.

According to Ramakrishna, by embracing equity investments with a diversified approach, investors open the door to increased chances of higher returns in the long run. "Diversification spreads investments across various sectors, industries, and asset classes, reducing vulnerability to market fluctuations and specific risks associated with individual companies. Moreover, for those seeking optimal returns, long-term investments are highly recommended. Choosing to invest in long-term equity options significantly increases the likelihood of achieving higher returns," he added.

Trending News

Top Headlines