India's Economic Activities Reviving To Pre-Pandemic Levels: Principal Economic Advisor Sanjeev Sanyal

India’s inflation still within tolerance threshold. The global situation is facing pressure from supply side shocks due to higher oil prices and transportation charges, chip shortages, said the PEA

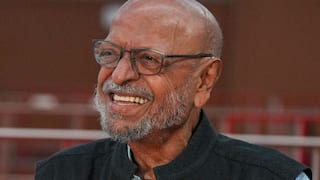

New Delhi: India’s Principal Economic Advisor (PEA) Sanjeev Sanyal, while presenting the Economic Survey, highlighted that the growth in 2022-23 will be driven by widespread vaccinations, gains from supply-side reforms, easing of regulation, robust export growth, and availability of fiscal space to ramp up capital spending.

India's Chief Economic Advisor (CEA) V Anantha Nageswaran was also present at the press conference presenting the Economic Survey 2021-22. Sanyal said there has been a revival in economic activities to pre-pandemic levels in the year 2021-22.

“Even though the health cost of the second Covid wave was much more severe, the economic cost of it was much milder,” he said. He said that the crypto currency issue has not been considered in the survey as the government still not having taken a final stand on the issue.

India’s inflation still within tolerance threshold, he said. The international situation is facing pressure from supply side shocks due to higher oil prices and transportation charges, chip shortages.

Sanyal said that there is a dearth of good official real-time unemployment data. “We know there was a significant decline in employment during the lockdown and a significant revival till March, 2021.” Adding more he said MNREGA data shows many source states for migrants like Bihar, are doing better in generating jobs, than many destination states for migrants, like Maharashtra and Punjab.

He said EPFO data shows recovering job numbers in formal sector jobs which are at the bottom of the pyramid.

Revival in service sector to be largely dependent on subsequent waves of the pandemic, the PEA told the media. He added that India is well placed with the amount of reserves to buffer any tapering by the US Federal reserve.

The CEA said that $70-75 per barrel of oil estimate made for next financial year by the economic survey is an average price. He added that thanks to the tightening of monetary policy globally and lowering of growth forecast in the developed world, the demand for oil will moderate.

Nageswaran made it clear that assumption of oil prices in range of $70-75 for 2022-23 is reasonable despite the current oil price standing at $90 at the moment as IMF predicts a slowdown in the growth of global economies.

Sanyal added, “India does need to be wary of imported inflation, especially from elevated global energy prices. India is 85 per cent dependent on imports to meet its oil needs.”

Trending News

Top Headlines