CBI Raids Telangana Minister Gangula Kamalakar's Residence In Karimnagar

Earlier on November 9, the federal agency launched the searches, under sections of the Foreign Exchange Management Act (FEMA), at the offices and residential premises of several granite companies

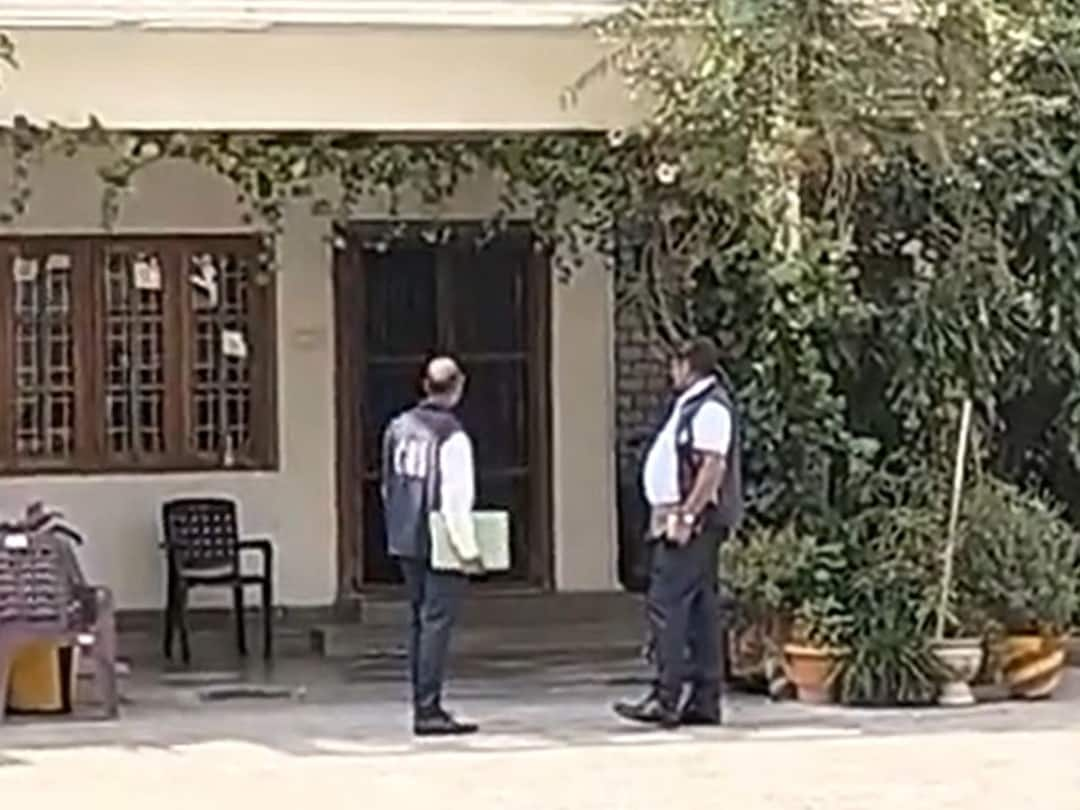

The Central Bureau of Investigation (CBI) Wednesday conducted searches at the residence of Telangana Minister Gangula Kamalakar in Karimnagar.

The CBI raided the minister's residence 20 days after Enforcement Directorate (ED) sleuths along with I-T officials conducted searches and broke open Kamalakar's residence when he was out of the station.

After ED Now CBI carried out searches at the premises related to #TRS senior leader and minister Gangula Kamalakar. Raids in his residence in Karimnagar. #Telangana https://t.co/B8JMe9oUq1 pic.twitter.com/qSEiNukK6i

— Ashish (@KP_Aashish) November 30, 2022

Also read | Telangana ED Raids: Dubious Funds From Chinese Entities Sent To Granite Entities

Earlier on November 9, the federal agency launched the searches, under sections of the Foreign Exchange Management Act (FEMA), at the offices and residential premises of Swetha Granites, Swetha Agencies, Sri Venkateshwara Granites Private Limited, PSR Granites Private Limited, Arvind Granites, Giriraj Shipping Agencies Private Limited and their related entities in Karimnagar and Hyderabad. ED on Monday (November 28) reportedly interrogated the minister's brother and Swetha Granites Director Gangula Venkanna. The ED recorded Venakanna's statement on FEMA violation.

It was reported that illegal funds sent from a Chinese entity, owned by a man named in the leaked Panama Papers, to Telangana-based granite businesses have been found after premises of a number of granite exporters, including that of minister Gangula Kamalakar, were raided, the ED claimed.

The premises of Kamalakar, allegedly linked to some of these companies, were also searched.

"The above entities are exporting rough granite blocks to China, Hong Kong and other countries. During the course of enquiry, it was found that the exported quantity was more than the quantity on which royalty was paid and there was under-reporting of the quantity while exporting," the ED statement said.

"In many instances, the export proceeds are not realised in the declared bank accounts, thereby indicating that the export proceeds are received through other than banking channels," it said.

Related Video

Uttar Pradesh News : ED raids at 15 places, medical colleges to submit student data in 10 days