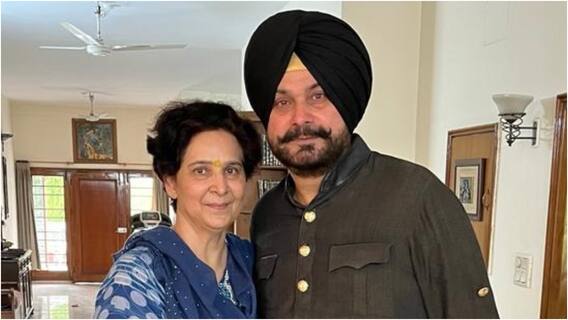

(Source: ECI/ABP News/ABP Majha)

US-Based Baron Capital Hikes Swiggy Valuation To $12.1 Billion Ahead Of IPO

The fund, managed by Baron Capital Group, raised the value of its share in the Indian start-up, up by 13 per cent against the $10.7 billion valuation of the firm during its last fundraising in 2022

A US-based fund hiked the valuation of food delivery start-up Swiggy to $12.1 billion. The fund, managed by asset management entity, Baron Capital Group, raised the value of its share in the Indian start-up, up by 13 per cent against the $10.7 billion valuation of the firm during its last fundraising in 2022.

Baron Capital reportedly increased the fair value of its holding in Swiggy for the third consecutive time. Earlier, it participated in the 2022 funding round worth $700 million. The recent valuation reflected the value of the Indian start-up as of December end, 2023. The valuation was revealed in the official filings with the US Securities and Exchange Commission, reported Business Standard.

Previously, the fund raised the value of its share in Swiggy to $87.2 million from the original investment of $76.7 million in the food delivery platform. Notably, Swiggy’s valuation was revised down by US investment firm Invesco last year.

Invesco, which led Swiggy’s earlier funding round, decreased the company’s valuation by 33 per cent from $8.2 billion to nearly $5.5 billion. This was followed by Invesco raising Swiggy’s valuation to $7.85 billion after cutting it twice in a span of four months in 2023.

Earlier in January 2022, Swiggy garnered $700 million in the funding round, led by Invesco, and increased its valuation by almost double to touch $10.7 billion. The recent valuation by Baron comes ahead of the initial public offering (IPO) the Indian start-up is planning.

Swiggy is targeting a valuation of $11 billion for its maiden issue and is also planning to submit a draft red herring prospectus (DRHP) with the capital markets regulator, the Securities and Exchange Board of India (SEBI) soon.

The food delivery giant plans to raise nearly $1 billion via the IPO this year. It currently has nearly $800 million in cash from the earlier funding round, the report stated citing sources. In the preceding fiscal year, the firm clocked a 45 per cent rise in revenue, touching Rs 8,625 crore, at the same time, its net loss also expanded to Rs 4,179 crore.

Also Read : LPG Subsidy Extension Applicable For FY25, Says Union Minister Hardeep Singh Puri

Top Headlines

Trending News