Stock Market Snaps 3-Day Losing Run: Sensex Gains 300 Points, Nifty Closes Above 17,600. PSBs Lead

Stock update: Mahindra & Mahindra was the top gainer in the Sensex pack, climbing 3.05 per cent, followed by Bajaj Finance, SBI, Nestle India, HUL, Bajaj Finserv, and HDFC on the Sensex platform

Sensex and Nifty, the two key equity benchmarks, on Monday found firmer ground after a three-session losing streak, propped up by buying in banking, finance, FMCG, and auto counters despite negative global trend.

After starting in the red, the BSE Sensex recovered the lost ground and ended 300 points higher at 59,141, while the broader NSE Nify jumped 91 points to close at 17,622

On the 30-share Sensex platform, Mahindra & Mahindra was the top gainer in the Sensex pack, climbing 3.05 per cent, followed by Bajaj Finance, SBI, Nestle India, HUL, Bajaj Finserv, and HDFC. On the flip side, Tata Steel, ICICI Bank, PowerGrid, NTPC, Asian Paints, L&T, and UltraTech Cement were among the laggards, shedding up to 2.50 per cent.

The market breadth was positive, with 22 of the 30 Sensex constituents closing in the green.

In the broader market, the BSE Midcap gauge declined 0.16 per cent and the Smallcap index dipped 0.17 per cent.

Sectorally, the Nifty Metal, and Realty indices closed in the red, falling in the range of 0.5 per cent to 0.9 per cent. On the contrary, the Nifty PSU Bank index advanced 2 per cent, and the Nifty FMCG and Auto indices surged 1 per cent each.

In the previous session on Friday, the 30-share BSE benchmark had tanked 1,093 points (1.82 per cent) to settle at 58,840, while the Nifty declined 346 points (1.94 per cent) to 17,530.

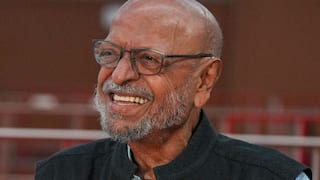

"The global market was expected to battle volatility as we approach the Fed policy announcement, while the latest inflation data remained above the estimates. The policy tone indicates hawkish measures, suggesting elevated hikes, leading to the pull-out of FIIs money from the Indian equities. However, this trend is expected to be short-lived, as future inflation trend forecasts a clampdown, bringing stability in policy stance by the end of this year," said Vinod Nair, Head of Research at Geojit Financial Services.

Elsewhere in Asia, markets in Seoul, Shanghai and Hong Kong ended lower. European equity markets were also quoting in the negative territory in the afternoon session. Wall Street had ended lower on Friday.

Meanwhile, the international oil benchmark Brent crude declined 1.37 per cent to $90.10 per barrel.

The rupee pared its initial gains and settled 2 paise lower at 79.80 (provisional) against the US dollar on Monday, weighed down by the strength of the greenback in the overseas market.

Foreign institutional investors (FIIs) offloaded shares worth a net Rs 3,260.05 crore on Friday, according to data available with the BSE.

Trending News

Top Headlines