Gold Rush: RBI Brings Over 100 Tonnes Of Yellow Metal Home From UK, Marking First Such Move Since 1991

Gold Rush: Currently, over half of the RBI's gold reserves are stored overseas with the Bank of England and the Bank of International Settlements, while about a third is held domestically

Gold Rush: The Reserve Bank of India (RBI) has shifted over 100 tonnes or 1 lakh kilograms of gold from the United Kingdom (UK) to its vaults within the country, a move that can bolster India’s domestic gold reserves, according to a TOI report. This repatriation marks the first addition of precious metal to India's domestic stockpile since 1991.

As per government sources, the RBI is considering further repatriations, with decisions to be made annually. Currently, over half of the RBI’s gold reserves are stored overseas with the Bank of England and the Bank of International Settlements, while about a third is held domestically. By bringing more gold back to India, the RBI aims to reduce the storage costs paid to the Bank of England.

According to the RBI's annual data, the central bank's gold holdings as part of its foreign exchange reserves stood at 822.10 tonnes as of March 31, 2024, an increase from 794.63 tonnes the previous year.

Historically, in 1991, the Indian government pledged 46.91 tonnes of gold with the Bank of England and the Bank of Japan to manage a balance of payments crisis, raising $400 million. Additionally, about 15 years ago, the RBI acquired 200 tonnes of gold from the International Monetary Fund (IMF).

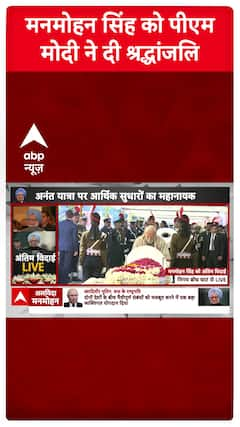

In 2009, under Prime Minister Manmohan Singh, India purchased 200 tonnes of gold worth $6.7 billion to diversify its asset base. Since December 2017, the RBI has been steadily increasing its gold reserves to diversify its foreign currency assets and hedge against inflation and foreign currency risks.

As of April 2024, the share of gold in India's total foreign exchange reserves has risen from 7.75 per cent at the end of December 2023 to nearly 8.7 per cent.

Within India, the repatriated gold is stored in vaults located at the RBI's headquarters on Mumbai’s Mint Road and in Nagpur.

A World Gold Council report highlights that global central banks own about 17 per cent of all the gold ever mined, with reserves totalling 36,699 metric tonnes as of the end of 2023. The majority of this accumulation has occurred over the last 14 years, as central banks have become net buyers of gold since 2010.

ALSO READ | RBI's Balance Sheet Expands By 11% To Reach Rs 70.47 Lakh Crore In FY24

Trending News

Top Headlines