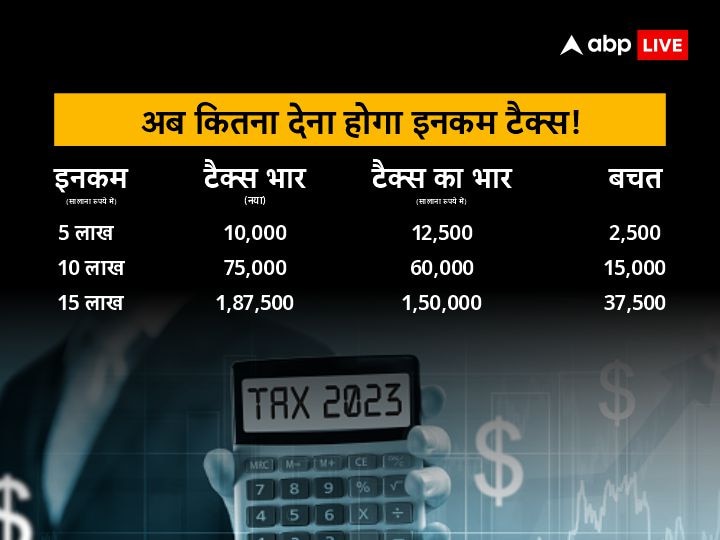

New Tax Regime: How Much Tax You Will Pay If You Earn Rs 5 lakh, 10 Lakh Or Rs 15 Lakh/PA

Budget 2023: Finance Minister Nirmala Sitharaman announced changes in the tax slabs under the new income tax regime. Know how much tax one has to pay if they earn Rs 5 Lakh, Rs 10 Lakh or Rs 15 Lakh.

New Tax Regime: Under the new income tax regime, those who have an annual income of up to 7 lakh rupees will not have to pay any tax. To make the new income tax regime attractive, Finance Minister Nirmala Sitharaman introduced major changes in the tax slab under the new tax regime.

Individuals earning between 3-7 lakh rupees were earlier taxed 25,000 rupees under the new tax regime. Those falling under this category no will receive a tax rebate under Section 87A of the Income Tax Act, meaning they do not have to pay taxes anymore. However, those earning more than 7 lakh rupees will not receive this rebate benefit.

Similarly, if your salary income is 9 lakh rupees per annum, you will not be eligible for the rebate benefit and will have to pay a total income tax of 45,000 rupees. Nevertheless, this amount is 25% lower than the 60,000 rupees required under the previous tax slab of the new tax regime.

Tax On Income Of 5 lakh Rupees

For individuals earning 5 lakh rupees, the new tax regime previously levied a tax of 12,500 rupees, which was waived with a government rebate. However, under the new provisions, a tax of 10,000 rupees will be imposed for this income range, but with the government rebate, no tax payment will be required.

Tax On Income Of 10 Lakh Rupees

Under the previous tax slab of the new tax regime, individuals earning 10 lakh rupees were required to pay a total income tax of 75,000 rupees. However, with changes in the tax slab, individuals with this income range will now only have to pay 60,000 rupees in income tax, resulting in a savings of 15,000 rupees.

Tax On Income Of 15 Lakh Rupees

Under the previous tax slab of the new tax regime, individuals earning a salary income of 15 lakh rupees were required to pay an income tax of 1,87,500 rupees. However, with the new provisions, such taxpayers will now only have to pay 1,50,000 rupees, resulting in a savings of 37,500 rupees in income tax.

If Deduction, Exemption Claims Less Than Rs 3.75 Lakh, Opt New Tax Regime: Official

A taxpayer whose deductions and exemption claims are less than Rs 3.75 lakh annually would be advised to opt for the new income tax regime and pay less tax than they gave in the old regime, a senior finance ministry official informed news agency PTI. The Income Tax Department has arrived at the figure after making due calculations for ensuring a "hassle-free and less tax rate" filing regime for the assessees, he said.

"So, a taxpayer who claims deductions less than Rs 3.75 lakh while filing the annual I-T returns will be advised to opt for the new tax regime as declared in the Budget. They will stand to benefit by enjoying the reduced tax slab as stated in the Budget," the officer said.

The figures have been arrived at after an analysis of the tax filing data, he said.

Trending News

Top Headlines