AU Small Finance Bank gets RBI nod for Scheduled Commercial Bank

New Delhi [India], Nov 2 (ANI): AU Small Finance Bank today received approval from Reserved Bank of India (RBI) to operate as Scheduled Commercial Bank. AU Small Finance Bank's name has now been included in the Second Schedule of Reserve Bank of India Act, 1934.

Post acquiring scheduled commercial bank status, AU Small Finance Bank will be able to do borrowing and lending with RBI under Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF).

Additionally, it will help AU Small Finance Bank to acquire business from Public Sector Undertakings (PSU)s, Corporates, Banks, Mutual Funds, Insurance companies and other market participants which can transact with schedule banks only to comply either regulatory or internal guidelines. It will also enable AU Small Finance Bank to issue Certificate of Deposits (CDs) on competitive interest rates in market to get liquidity.

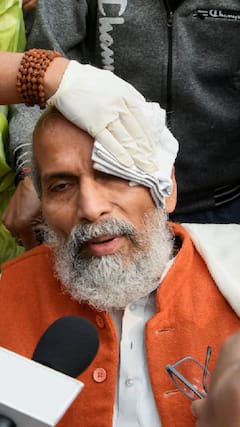

"We are extremely thankful to the central bank for extending Schedule Commercial Bank status to us. It will significantly help us to broaden our liabilities and treasury operations and shall provide more liquidity avenues. It will also help AU to widen its market perspective in terms of government business and acquire liability business at relatively lower costs," said MD and CEO AU Small Finance Bank, Sanjay Agarwal.

AU Small Finance Bank, started its banking operation from 19th April this year, has gained the status of a scheduled commercial bank within seven months of its banking operations.

The development will not only widen the reach for AU Bank's services and liability capabilities but also influence its growth prospects in future.

Prior to becoming a bank, as Au Financiers (India) Limited (an Asset Finance NBFC), the company has gained over 20 years of experience in financing the unbanked and under banked segment in rural and semi urban areas.

In fact, its in-depth understanding of financial needs and its consistent growth has attracted various domestic and international marquee investors including Warburg Pincus, Kedara Capital, , IFC Washington (World Bank), Chris Capital and Motilal Oswal in the past. (ANI)

This story has not been edited. It has been published as provided by ANI

Trending News

Top Headlines