Explorer

5 Reasons Why Women Need Life Insurance

No matter whether you earn income or do not earn income, taking life insurance is extremely significant for life safety.

Life insurance is taken to receive benefits in the future through the lumpsum payment of the sum insured on the death of assured to the family. (Representative photo: Getty images)

New Delhi: Are you a married or an unmarried woman? Are you a mother? Single, homemaker or employed? These are the questions that will surround you whenever you plan to buy life insurance. The main objective of enquiring such questions is to get an idea about the kind of coverage you need and to calculate how many financial responsibilities you have in the near future. No matter whether you earn income or do not earn income, taking life insurance is extremely significant for life safety. Before proceeding to know why we need insurance, let’s first understand ‘What Is Life Insurance’. What is life insurance? Life insurance is taken to receive benefits in the future through the lump sum payment of the sum insured on the death of assured to the family. If no death occurs, the assured will receive a maturity benefit i.e. payment of premiums. What else? The assured person also gets the benefit from investment in equity, debt, and other financial instruments(present in some plans). It is a contract between the insurer and the assured where you have to provide some basic information. It helps in creating a wealth of resources/ income for the future to financially assist the dependents in absence. The premiums are paid till the policy attains maturity or life assured meets his/her death. The premiums are calculated based on factors like age of insured, annual income, medical history, personal risk propensity, and occupation. Both men and women are eligible to take life insurance. However, most of the women ignore buying life insurance. If you have the same thinking, then carefully read the points to know how beneficial it is. Why Women Need Life Insurance? So here to get a clear picture of why life insurance is important for women, let’s have a quick glance at the top five reasons behind this-  It is clearly visible from the chart that most of the women population prefer insuring themselves between 20 years to 30 years. Whereas the percentage reduces in the age group which is less than 20 years and above 50 years i.e. 2% & 15%. The research also published an intensive study on the purchase trend adopted by women in buying types of life insurance plans. As per our analysis, we have gathered the data shown in a bar graph.

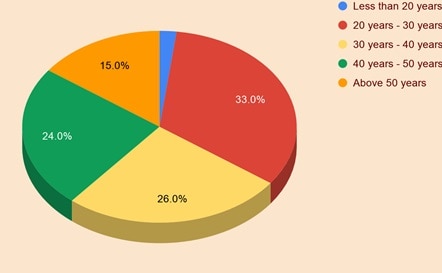

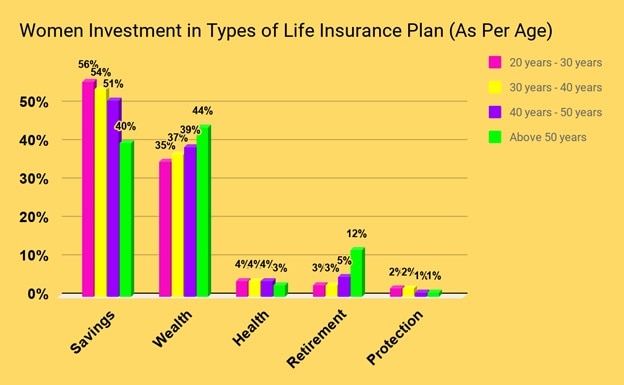

It is clearly visible from the chart that most of the women population prefer insuring themselves between 20 years to 30 years. Whereas the percentage reduces in the age group which is less than 20 years and above 50 years i.e. 2% & 15%. The research also published an intensive study on the purchase trend adopted by women in buying types of life insurance plans. As per our analysis, we have gathered the data shown in a bar graph.  As visible in the column chart, a good percentage of young women showed interest in saving plans. Wealth plans are most preferred by females above 40 years. The reason is increased responsibility like child education, home expenses, etc. Coming to Retirement plans, women above 50 years have shown maximum interest to settle the concern about ensuring future income. However, health and protection receive less attention from women. From this, we can evaluate that women focus on saving money and creating wealth for their family's future needs. Types of Life Insurance Plans Life insurance is a vast term and includes 6 types of plans under it. This include-

As visible in the column chart, a good percentage of young women showed interest in saving plans. Wealth plans are most preferred by females above 40 years. The reason is increased responsibility like child education, home expenses, etc. Coming to Retirement plans, women above 50 years have shown maximum interest to settle the concern about ensuring future income. However, health and protection receive less attention from women. From this, we can evaluate that women focus on saving money and creating wealth for their family's future needs. Types of Life Insurance Plans Life insurance is a vast term and includes 6 types of plans under it. This include-

- Wealth Development for Future: Life insurance policies help women in creating a reserve of income for her family. The income generated is paid in a lump sum to the dependents after the death of the mother. This way you can protect the future of your children even if you are no more.

- Enjoy Tax Benefits: Life insurance is loaded with tax benefits. Any payment of death benefit or any loan is taken against the policy is tax-free. The premium submitted by the assured will receive tax deductions on the annual income tax under section 10, section 80C and 80 CCC of Income Tax Act.

- Security From Unnatural Events: Unnatural events such as death or permanent disability often regarded as a stumbling block in your life. Life insurance supports you and your family by offering complete payment of sum assured on such events. This gradually helps to stand by financial emergencies.

- Retirement Benefits: India is a country where inflation fluctuates every year. So, to ensure you are protected from these risks, the life insurance plan gives monthly pension once you retire. A woman can use this money to meet future expenses. This feature is available in annuity plans or pension plans.

- Lesser Premium Rates: Women often get cheaper premium rates in comparison to the male counterpart. The premium is discounted to entice female participation in buying a life insurance plan. Usually, 10% to 20% of the premium is waived off when a woman takes a policy.

It is clearly visible from the chart that most of the women population prefer insuring themselves between 20 years to 30 years. Whereas the percentage reduces in the age group which is less than 20 years and above 50 years i.e. 2% & 15%. The research also published an intensive study on the purchase trend adopted by women in buying types of life insurance plans. As per our analysis, we have gathered the data shown in a bar graph.

It is clearly visible from the chart that most of the women population prefer insuring themselves between 20 years to 30 years. Whereas the percentage reduces in the age group which is less than 20 years and above 50 years i.e. 2% & 15%. The research also published an intensive study on the purchase trend adopted by women in buying types of life insurance plans. As per our analysis, we have gathered the data shown in a bar graph.  As visible in the column chart, a good percentage of young women showed interest in saving plans. Wealth plans are most preferred by females above 40 years. The reason is increased responsibility like child education, home expenses, etc. Coming to Retirement plans, women above 50 years have shown maximum interest to settle the concern about ensuring future income. However, health and protection receive less attention from women. From this, we can evaluate that women focus on saving money and creating wealth for their family's future needs. Types of Life Insurance Plans Life insurance is a vast term and includes 6 types of plans under it. This include-

As visible in the column chart, a good percentage of young women showed interest in saving plans. Wealth plans are most preferred by females above 40 years. The reason is increased responsibility like child education, home expenses, etc. Coming to Retirement plans, women above 50 years have shown maximum interest to settle the concern about ensuring future income. However, health and protection receive less attention from women. From this, we can evaluate that women focus on saving money and creating wealth for their family's future needs. Types of Life Insurance Plans Life insurance is a vast term and includes 6 types of plans under it. This include- - Endowment policy

- Money Back Policy

- Unit Linked Insurance Plan

- Whole Life Policy

- Term Insurance Plan

- Pension Plan

Related Video

Breaking News: India Budget 2026-27 Sparks Market Volatility, Long-Term Reforms Highlighted

Dr Prosenjit NathThe writer is a technocrat, political analyst, and author.

Opinion