Budget 2024: ICC Calls For Customs Duty Rationalisation To Aid Domestic Mfg

ICC President Ameya Prabhu emphasised the necessity of protective measures to foster the growth of domestic industries, particularly in sectors like steel, solar batteries, aluminium, & lithium cells

The Indian Chamber of Commerce (ICC) has recommended that the government streamline customs duties across several sectors, including steel, solar batteries, aluminium, and lithium cells, with the aim of enhancing domestic manufacturing. Union Finance Minister Nirmala Sitharaman is all set to unveil the Union Budget for the fiscal year 2024-25 on July 23rd.

ICC President Ameya Prabhu emphasised the necessity of protective measures to foster the growth of domestic industries, particularly in sectors such as steel, solar batteries, aluminium, and lithium cells. "There is a need for rationalisation of customs duty in these specific sectors in a holistic manner. Huge potential is there to boost domestic manufacturing and make India a global hub for manufacturing," opined Prabhu.

He further noted that tariffs on raw materials disproportionately affect domestic players, especially downstream firms. Additionally, he called for rectifying the inverted duty structure by reducing the duty on mixed petroleum gas from 5 per cent to 2.5 per cent.

"To boost domestic manufacturing, there is a need to increase duty on polymers - polyvinyl chloride, polyethylene terephthalate, polypropylene and polyesters to 10 per cent. This will help in reducing import dependency and will drive India towards self-sufficiency in the petrochemical manufacturing segment," he said.

Discussing the significance of the aluminium foil sector, Prabhu highlighted that the domestic industry has been experiencing significant losses due to anti-dumping duties on raw materials, while finished goods imported from China face no import duties. "This dual effect has resulted in extensive net losses to the companies that have made significant investments into this industry," Prabhu noted.

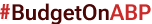

Regarding taxation, the chamber has proposed establishing a commission to comprehensively review and simplify the provisions of the Income Tax Act of 1961. "This is an old Act. Every year in the Budget, amendments are made, which has made this Act complex to understand. These amendments have resulted in many anomalies, which in turn have given rise to a large number of legal cases," said the chamber.

Also Read: Union Budget 2024: Nirmala Sitharaman Leads Halwa Ceremony, Signaling Final Stage Of Preparations

Trending News

Top Headlines