49th GST Council Decision: Entire GST compensation Cess Dues Of Rs 16,982 Crores Will Be Cleared, Says Finance Minister Nirmala Sitharaman

"The entire due on the pending balance of the GST compensation will be cleared as of today...a total of Rs 16,982 crores for June - will be cleared," Union FM Nirmala Sitharaman said.

Finance Minister Nirmala Sitharaman said that the entire due on the pending balance of the GST compensation will be cleared as of today. She said that a total of Rs 16,982 crores for June will be cleared.

"We have announced today that the entire due on the pending balance of the GST compensation will be cleared as of today...In other words, the entire pending balance of the GST compensation - a total of Rs 16,982 crores for June - will be cleared," Union FM Nirmala Sitharaman.

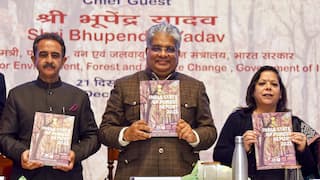

Union Finance Minister Nirmala Sitharaman chaired the 49th meeting of the GST Council. The meeting was also attended by Minister of State Pankaj Chaudhary, Finance Ministers of States and UTs, and senior officers of the government.

Nirmala Sitharaman during the media briefing on the outcomes of the 49th GST Council meeting said, "Although this amount is not really available in the compensation fund as of today, we have decided to release this amount from our own resources and the same amount will be recouped from the future compensation cess collection."

With this release, the Centre would clear the entire provisionally admissible compensation cess dues for 5 years as envisaged in the GST (Compensation to States) Act, 2017, Nirmala Sitharaman said.

Revenue Secretary Sanjay Malhotra said, "For June 2022, 50 per cent of the provisional GST compensation cess amount was released earlier. Now, we are releasing 50 per cent amounting to Rs 16,982 crore. This will be from the funds of the Centre, which will be recouped later from the cess."

We also released Rs 16,524 crore to six states based on the AG certificates we have received, Finance Minister said.

Finance Minister also said that two GoM reports have been accepted. One with slight modifications and the other with the understanding that some small amendments will be needed in the language of the relevant bill. GoM report on capacity-based taxation for pan masala has been accepted. GoM on appellate tribunals approved with certain modifications has been accepted.

A final draft of GoM on the appellate tribunal will be sent to members in a few days, Sitharaman added.

GST Council decided to reduce GST on liquid jaggery, pencil sharpeners, and certain tracking devices, Sitharaman said.

"GST on a type of liquid jaggery reduced to nil from 18 per cent if it's loose. If it's pre-packaged and labeled, the tax rate on this will be 5 per cent, FM said.

GST Council also decided to tax services supplied by courts and tribunals under the reverse charge mechanism, FM added.

The council recommended rationalisation of penalties for late filing of annual GST Returns.

Tamil Nadu Finance Minister Palanivel Thiagarajan said that the GST council is close to consensus on the formation of GST Appellate Tribunal, reported MoneyControl. Tamil Nadu Finance Minister said he is expecting a written document later on the formation of the GST Appellate Tribunal.

He added, "Council discussed Clarification on selection committee for Appellate Tribunal, state tribunals, structural issues. Some states including Tamil Nadu raised issues on formation on state appellate tribunals."

Tamil Nadu Finance Minister also said that states raised the issue of wrong calculation of GST compensation for 2021-22.

Trending News

Top Headlines