As we approach the 2024 US presidential election, the stakes are high — not only for traditional financial markets but also for the rapidly evolving crypto space. The intersection of politics and crypto has never been more critical, with regulatory decisions and economic policies shaping the future of digital assets. At the heart of this political moment lies a question: How will the election outcomes impact crypto regulations and market prices, both in the US and globally?

A Turning Point For Crypto Regulation

The US plays a central role in shaping global crypto regulation. Historically, the regulatory environment for digital assets in the US has been uneven, with various state and federal agencies taking different approaches. As the crypto industry matures, there is an increasing demand for clear, consistent guidelines to govern this new asset class.

Earlier this year, the SEC approved Bitcoin Spot ETFs attracting institutional investors who were previously cautious due to regulatory concerns. This led to increased institutional interest creating higher liquidity and bringing more stability to the market. Positive developments in the US crypto space often have a ripple effect on global market sentiment too impacting the Asian and Indian markets to bring in a regulatory framework.

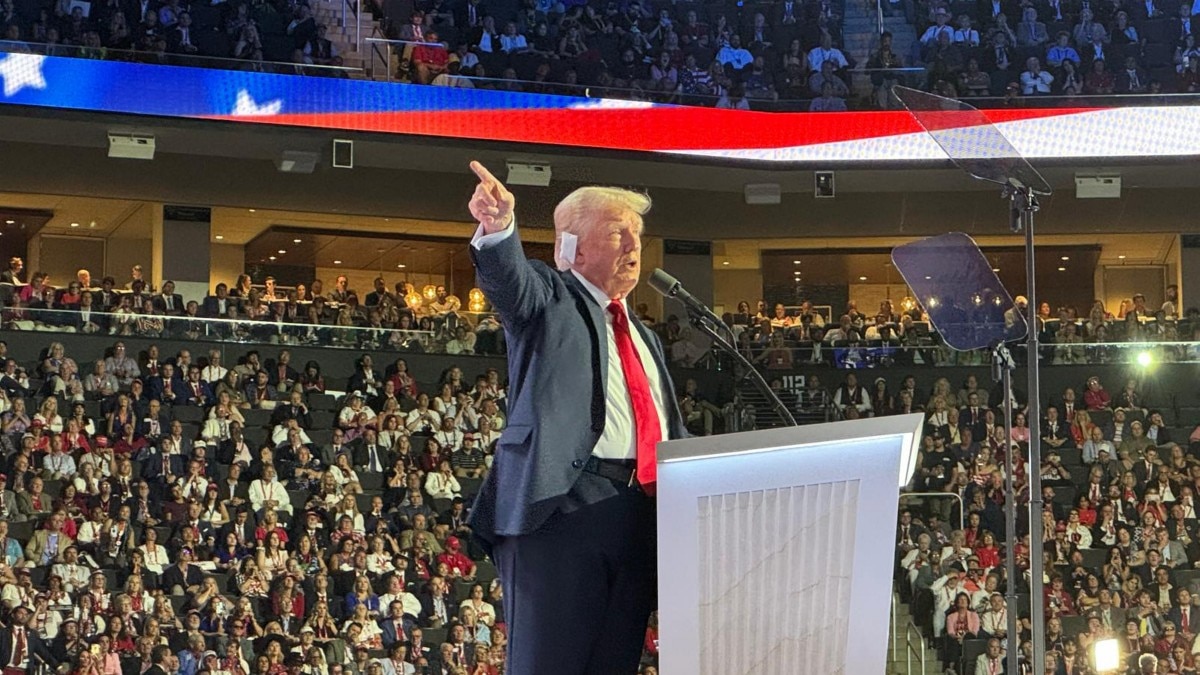

In the 2024 election, for the first time, there have been open discussions about the crypto regulations in the country stating that this election could serve as a turning point. If a pro-crypto administration comes to power, the industry could benefit from more progressive policies aimed at fostering innovation. Donald Trump has expressed support for making the US a leader in the crypto space. This could include pushing for friendlier regulations and encouraging the adoption of cryptos in mainstream financial systems. Such a shift would signal to investors that the US is committed to building a supportive environment for blockchain technology, boosting market confidence and, potentially, prices.

On the other hand, Kamala Harris, representing the Democratic party has also taken a positive stance towards crypto. By accepting donations for her campaign in crypto, she has given a clear message that there are going to be steps to foster the growth of crypto even in the Democratic administration. This way, the upcoming election would turn out to be a win-win situation for the crypto community.

Market Price Implications

Political outcomes and regulatory changes will undoubtedly influence the price trajectory of the crypto market. A pro-crypto administration that enacts favourable regulations may lead to a surge in market optimism. Investors often respond positively to regulatory clarity, and the removal of legal ambiguities could lead to greater institutional investment in digital assets. Large-scale investors, including corporations and asset managers, would feel more confident allocating capital to crypto if they knew the rules of the game.

Bitcoin, often seen as a hedge against inflation, could especially benefit from such an environment. Historically, Bitcoin and other digital assets have performed well during periods of regulatory clarity and economic instability. The approval of Bitcoin and Ether exchange-traded funds (ETFs) in the US earlier this year triggered a notable price rally, underscoring the impact of favourable developments on the market.

That said, the election outcome is not the only factor at play. The Federal Reserve’s monetary policy, particularly interest rate decisions, will also influence crypto prices. A rate cut by the Fed would inject more liquidity into the market, potentially driving up demand for cryptos as investors seek higher returns than those offered by traditional assets. The interplay between political leadership, economic policies, and investor sentiment will be critical in shaping the market’s future direction.

Global Ramifications

While the US is a significant player, the ripple effects of its policies will be felt worldwide. Many countries look to the US for guidance on crypto regulations, and changes in American policy could set global precedents. A more welcoming stance from the US could encourage other nations to follow suit, creating a more favourable environment for digital assets globally. This would further cement the role of cryptos in the global financial system, encouraging widespread adoption in other countries like Canada, the EU, and more importantly, India.

The 2024 US election represents a pivotal moment for the future of crypto. The combination of political outcomes and macroeconomic factors will shape both the regulatory landscape and market prices in the coming years. A supportive administration could unlock new growth opportunities for the crypto sector.

(The author is the CEO and Co-founder of Mudrex, a global crypto investment platform)

Disclaimer: The opinions, beliefs, and views expressed by the various authors and forum participants on this website are personal and do not reflect the opinions, beliefs, and views of ABP Network Pvt. Ltd. Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.